Asset Allocation

A comprehensive asset allocation and portfolio optimization solution used by the world’s leading institutions and financial services firms

MPI’s asset allocation tools enable smarter investment research, portfolio construction and optimization and provide greater insight into portfolio dynamics.

Key Benefits

- Save time and money with one comprehensive software platform that provides both historical and forward-looking analysis capabilities

- Construct custom portfolios

- Create asset allocations

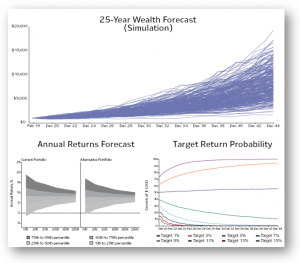

- Project future portfolio values leveraging one or more of several quantitative models

- Includes benchmark tracking capabilities for users who want to optimize their portfolios relative to a benchmark or implement an allocation across funds

- Run multiple portfolio optimization models, including MVO, Black-Litterman, CVaR, downside risk and mean-benchmark tracking

- Design your own charts, tables and reports, or select from a number of “out-of-the-box” templates

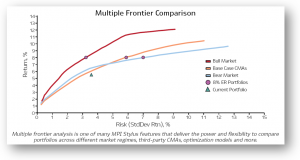

- Analyze efficient portfolios along frontiers

- Utilize MPI’s Patented Resampling Model

Powerful Insights

Whether you are a wealth manager seeking to build better client portfolios, or you are an institutional investor or consultant looking to improve strategic and tactical allocation models, MPI Stylus solutions can help.

Flexible Analysis

Our technology delivers analytics that are as flexible as they are powerful to help you better visualize your asset allocation decision making process.

Contact us

Take advantage of detailed portfolio comparisons — contact us today for a demo.

Email: info@markovprocesses.com

Phone: +1 908 608 1558

Or fill the form below: