Beyond Correlation: Using Active Style® to Understand and Display Fund Performance

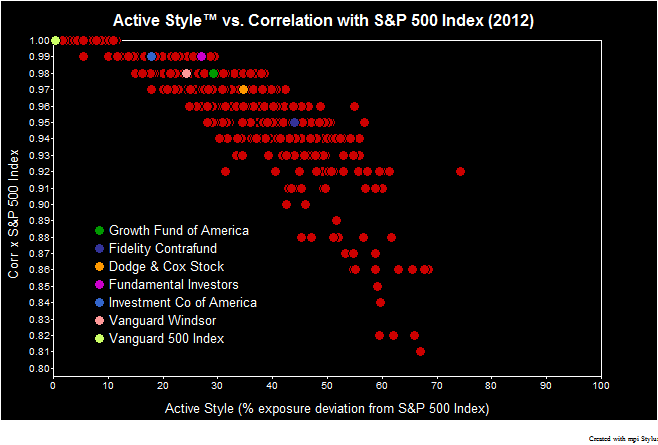

To say that the post-Financial Crisis, Fed-fueled investing climate is one of markedly high correlations has become platitudinous. Managers of U.S. equity mutual funds know this all too well; the ability of the S&P 500 to explain their returns has risen to very high historical levels, with the average large blend fund exhibiting an R2 […]

To say that the post-Financial Crisis, Fed-fueled investing climate is one of markedly high correlations has become platitudinous. Managers of U.S. equity mutual funds know this all too well; the ability of the S&P 500 to explain their returns has risen to very high historical levels, with the average large blend fund exhibiting an R2 of over 99% recently.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.