Chart of the Week: Reversal of Fortunes – Fairholme Fund

Fairholme (FAIRX), managed by Morningstar’s Domestic Equity Fund Manager of the Decade, Bruce Berkowitz, has been the top performing large-cap U.S. equity fund YTD 2012 (through June 22nd). After being at the bottom of the large-value category in 2011 with a 32% loss, investors are being rewarded so far in 2012. The below chart shows […]

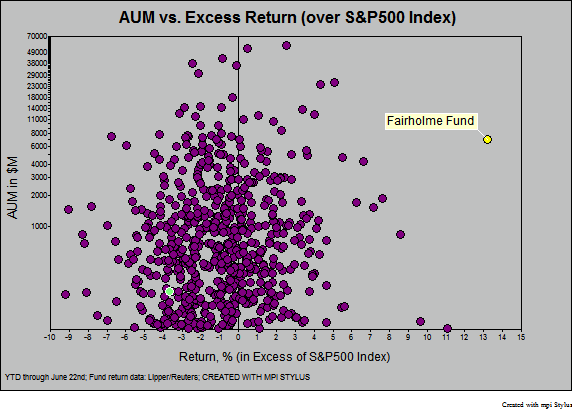

Fairholme (FAIRX), managed by Morningstar’s Domestic Equity Fund Manager of the Decade, Bruce Berkowitz, has been the top performing large-cap U.S. equity fund YTD 2012 (through June 22nd). After being at the bottom of the large-value category in 2011 with a 32% loss, investors are being rewarded so far in 2012. The below chart shows YTD return against total net assets:

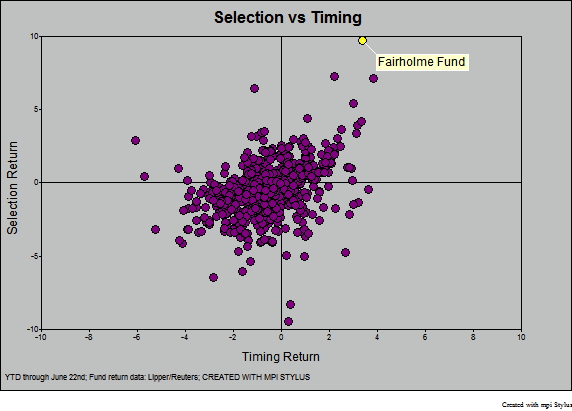

With its attendant high profile, FAIRX’s portfolio – and its high-conviction, highly concentrated nature – is a topic of much discussion in the markets and the media. From a strictly performance perspective though, it is important to look at the fund’s performance attribution in terms of selection and timing. Returns-based analysis using daily NAV data for 2012 provides unique insight into the fund’s performance drivers (the analysis is done using MPI Stylus). In this regard, FAIRX has been equally impressive YTD; it has absolutely the best selection and the second best timing amongst the large US equity fund universe.

When considering public information on the portfolio, selection return would seem to be driven in large part by the performance of holdings within the Financials sector, which recently comprised 77% of FAIRX’s portfolio, including AIG and BofA – up 33% and 40% YTD, respectively. In terms of timing, investor outflows and the fund’s cash levels are interesting to note. FAIRX, currently at about $7billion, saw outflows of $9 billion over the last 15 months, as reported by Morningstar. At the same time, its cash position has fallen below its typical average. This means that investors have benefitted from FAIRX being largely in the market during the broadly rising tide YTD, and particularly so with Financials.

1Footnotes

- 1MPI conducts performance-based analyses and, beyond any public information, does not claim to know or insinuate what the actual strategy, positions or holdings of the funds discussed are, nor are we commenting on the quality or merits of the strategies. This analysis is purely returns-based and does not reflect actual holdings. Deviations between our analysis and the actual holdings and/or management decisions made by funds are expected and inherent in any quantitative analysis. MPI makes no warranties or guarantees as to the accuracy of this statistical analysis, nor does it take any responsibility for investment decisions made by any parties based on this analysis.