2022 Endowment Saga: How the Mighty Have Fallen

Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

On Wall Street, as the old saying goes, you’re only as good as your last trade.

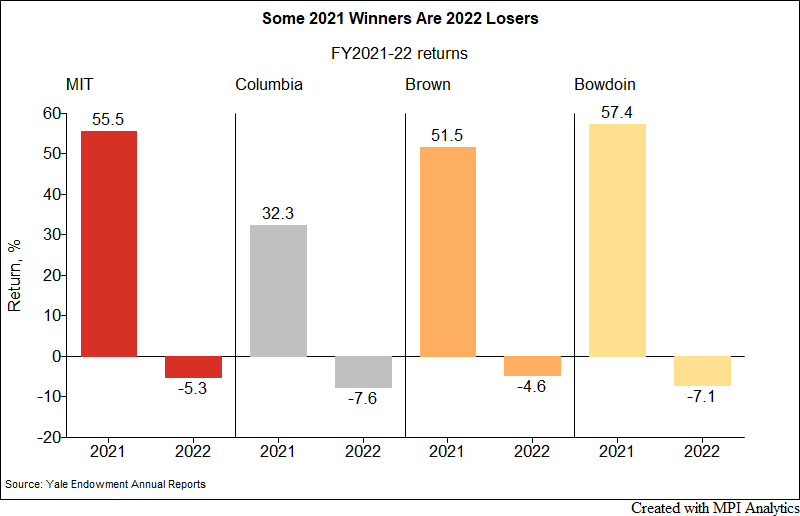

This was a difficult fiscal year for endowments across the board, but performance looks especially worse for the ones that were the standouts from last year, yet yielded poor results compared to their peers in FY2022. Specifically, $24.6B MIT endowment’s return of -5.3%, $13.3b Columbia’s -7.6%, $6.5B Brown University’s -4.6%, and $2.5B Bowdoin’s -7.1%, put them in the bottom of either the Ivy group or large endowments.

Oh, how the mighty have fallen. But how did they fall? That’s where it gets interesting.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.