Yale Endowment – a Levered 60/40?

2017 Yale endowment report rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found...

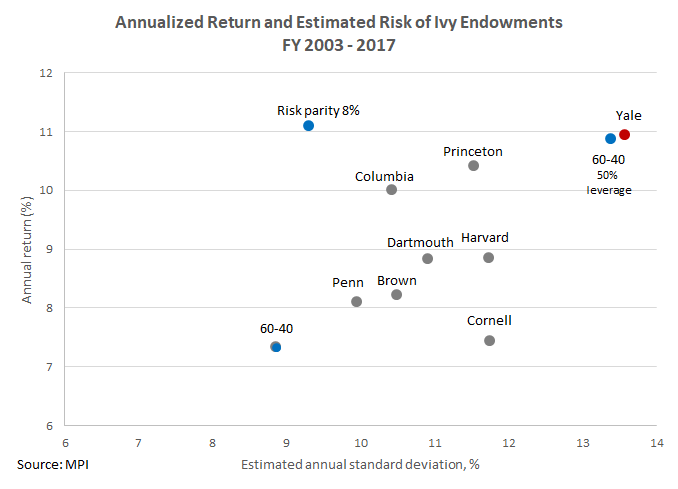

In Yale’s 2017 annual endowment report released last week, CIO David Swensen and his team give a lot of credit to the role of active management for Yale and other top performing endowments’ superior returns relative to the market and a balanced 60/40 portfolio over the past 20 years (along with portfolio diversification, equity orientation and a heavy allocation to alternatives). For the second consecutive year, the Yale report also rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found1.

In Yale’s 2017 annual endowment report released last week, CIO David Swensen and his team give a lot of credit to the role of active management for Yale and other top performing endowments’ superior returns relative to the market and a balanced 60/40 portfolio over the past 20 years (along with portfolio diversification, equity orientation and a heavy allocation to alternatives). For the second consecutive year, the Yale report also rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found1.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.