How Brown and Columbia Landed at the Top of the FY2024 Class

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

Fiscal year 2024 Ivy League and elite endowment reporting season is officially underway. Dartmouth kicked things off with an 8.4% return. Then Columbia posted their 11.5% figure, and Brown followed with an 11.3% return, reported Friday.

Based on our estimates of asset allocation modeled with MPI Stylus using reported annual performance[1], we estimate Columbia’s 11.5% return from July 2023 through June 2024 will be at the top of the class of elite endowments (Ivy League plus Stanford and MIT). There is a chance it is salutatorian though, as the competition for valedictorian looks solid[2]. We expect an average return for the elite endowments between 9% and 10.5% for fiscal 2024.

After another strong year for public equity, specifically the so-called Magnificent 7 powering U.S. stocks, and a muted year for private markets, including another negative year for venture capital—a staple in Ivy endowments—we don’t expect any elite school following the alternatives-heavy “Yale model” to beat the robust 14.20% return of a global 70/30 portfolio[3] for the second consecutive year. Simpler, more vanilla endowment portfolios allocated primarily to stocks and bonds found at smaller, less-resourced schools, could again prove hard to beat. Those that do will likely have overweighted domestic stocks, particularly technology.

The largest, storied endowments—Harvard, Yale, Princeton—could see returns lower than Dartmouth. As for Columbia sitting at the top, we look forward to seeing if there are any surprises who surpass their return.

Longer-Term View: For institutions managing assets for perpetuity, we recognize a fixation on annual performance isn’t entirely constructive, especially when compared to peer schools with their own set of unique circumstances and goals.

So far, with a 10.8% annualized 10-year return, Brown’s lock on the stop spot amongst the Ivy league over the recent decade window remains intact. We anticipate the $7.2bn system helmed by Jane Dietze, the smallest school in the group, to continue pulling away from Princeton and Yale in the recent decade window (through FY 2023, respectively, $34.1bn AUM with a 10.8% annualized 10-yr return and $40.7bn returning 10.9%). In the expanded “elite” grouping, MIT’s 11.5% was ahead of Brown (11.3% through FY 2023).

While Dartmouth’s FY 2024 return is anticipated to be closer to the bottom of the class, as mentioned we could see some of the largest systems with the highest exposure to private markets assets—especially venture capital—struggling to beat Dartmouth. Over 10-yrs, Dartmouth should continue to best the Ivy average with its 9.5% return through June 2024 (10.5% to 9.8% as of FY2023).

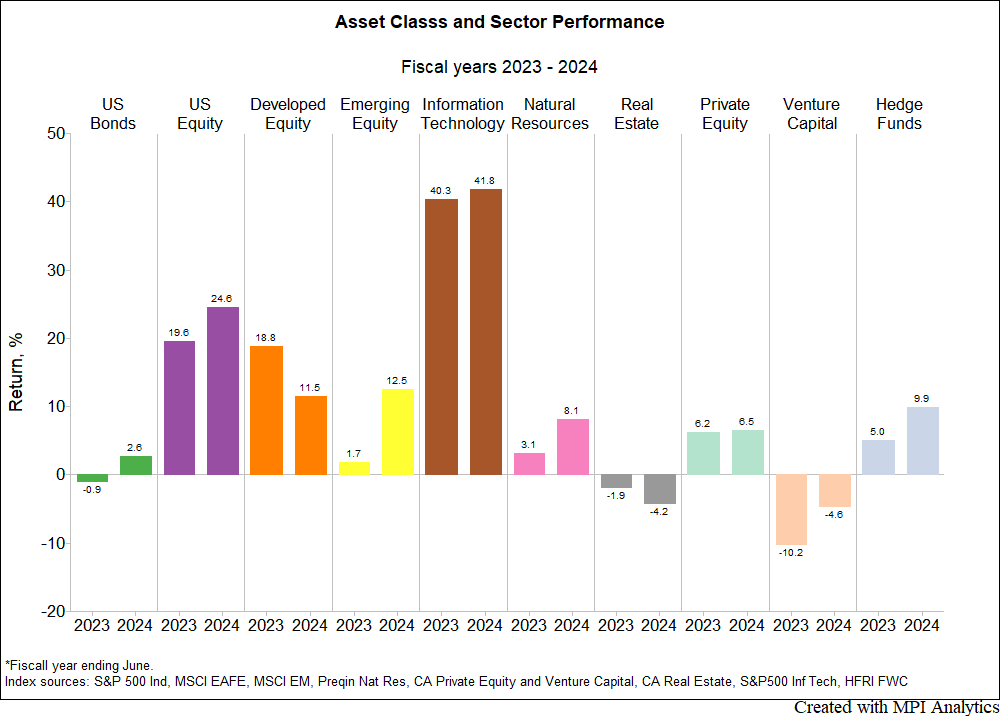

Asset Class Returns FY2024

As we covered in our pensions return projections, FY 2024 was defined by the outperformance of U.S. stocks. Domestic public equities again led broad asset classes in FY2024, with mega-cap technology companies once more powering the S&P 500’s 24.6% return. The S&P 500’s Information Technology sector was up 41.8%, following an already remarkable turnaround in FY 2023. Endowments’ modelled exposure to stocks can come directly from equity allocations but also from placements with hedge funds that hold equities.

Saves time and money with MPI’s comprehensive software platform that provides both historical and forward-looking analysis capabilities

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.