Is Columbia’s Endowment Performance at the Top or the Bottom of the Ivies? It Depends.

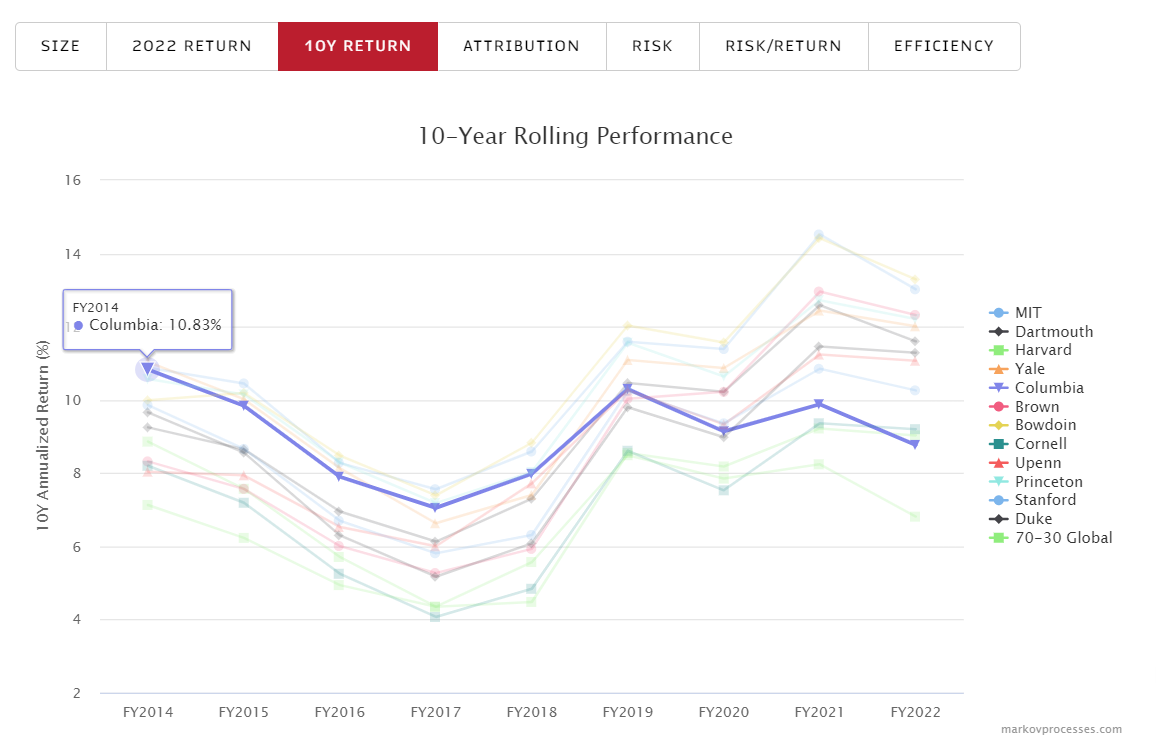

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

This past year, Columbia found itself at the very bottom, with a trailing 10-year return of just 8.8%.

That put the focus on whether Columbia’s Investment Management Company, run by CEO Kim Lew, need a change in focus or strategy.

It is easy to criticize endowments solely on returns. After all, despite their importance, there is so little data made available about them. What’s more, performance data is only released typically once a fiscal year.

We have already written about the falling endowment angels, but the story of performance in endowments can be far more nuanced. As our recently launched MPI Transparency Lab helped us to discover, Columbia may be at the bottom of 10-year performance, but it is doing far better in other metrics, which is important to all of its stakeholders.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.