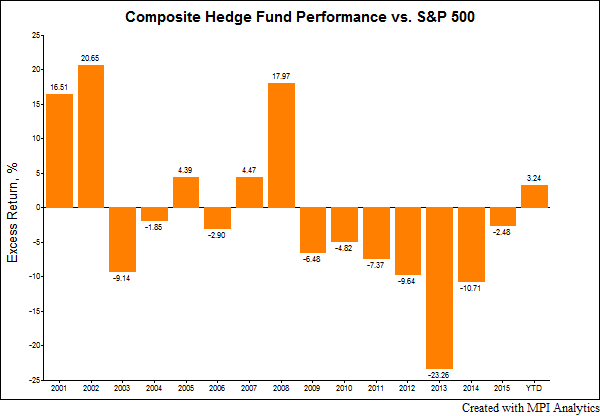

Whether rightly or wrongly1, hedge funds are often compared to market beta as an indicator of their worth, and their (expensive) fee structure. With 2015 figures now in, the average hedge fund, as measured by HFRI Composite, has trailed the S&P 500 for seven straight years in the wake of the Global Financial Crisis.

Source: HFR (HFRI Fund Weighted Composite Index), S&P

This is all well and good, but hedge funds vary widely in their investment mandates and strategies; thus, comparing the average of this still-growing universe to a single equity market isn’t going to be appropriate for some of the funds involved.

Some hedge fund groups show evidence of adding value when compared to an appropriate benchmark using refined analytical tools. We identified hedge funds that focus on making directional bets on global equities and created two groups based on their assets under management (AUM). These two groups have out-performed the MSCI World Index, an equity benchmark that is broader and more consistent with their mandates than the S&P500. The chart below shows the directional global equity hedge managers2 by size3 against this index:

As we see in the above chart, across the past 1-yr, 3-yr and 5-yr periods, the average fund in this segment adds value even after fees are accounted for. While large funds beat their small peers in the past year, over the recent 3-yr and 5-yr period, we see a return premium to funds that remained under a half billion dollars in AUM.

The higher return of both groups, however, isn’t the product of just adding more risk. On a risk-adjusted basis, the average global equity hedge fund, regardless of size, delivers this outperformance with significantly less risk per unit of return. Sharpe ratios for the past 5-yr period appear in the below chart.

Diving deeper, we ask, “What are the sources of these directional funds’ returns? How have these managers, on average, beat the market?” To answer these questions, we conducted a quantitative, returns-based analysis of the average Large and Small funds, regressing each group’s return against global equity sectors4 and cash. This results in portfolios of the most influential exposures with the highest predictive power that best explain each groups’ performance5, shown below.

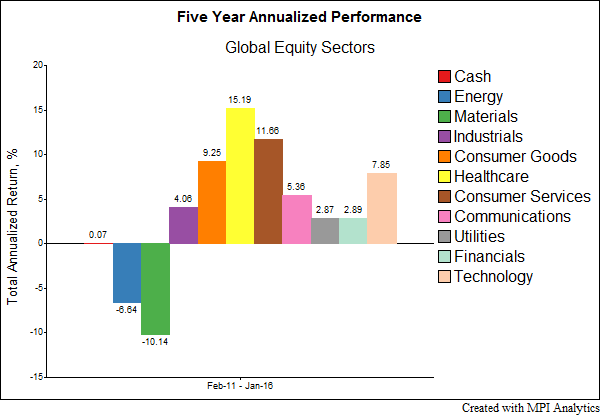

We see that one of the sectors with the highest exposure in the funds in both groups is Healthcare, which has been the highest performing sector in the most recent 5-yr period (see below chart of annualized sector performance). In both groups, we notice spikes in funds’ cash exposures, which suggests managers actively reduced risk during recent market turmoil.

From a returns-based performance attribution standpoint, we see that – with the exception of large funds over the past year – stock selection return delivers the majority of the outperformance over the various time periods relative to market timing return. Selection return is the portion of the groups’ return that we are unable to attribute to market exposures (i.e., sector betas)6, timing (or allocation) return is the difference in return between the groups’ dynamic factor exposures and the dynamic factor exposures of the MSCI World Index.

Performance attribution of the average Large and Small fund’s outperformance is below.

Despite continued criticism, some of which is warranted, we see evidence of both strong stock selection and skillful market timing displayed by the average manager profiled in this study of directional global equity hedge funds.

Hedge funds can expect an unwavering spotlight, with high hurdles for performance and plenty of skepticism along the way.

They can continue to prove their worth to investors by (consistently) delivering risk-adjusted returns with such skillful active management. In a growing (or swollen, depending on your stance) industry with increasing competition for alpha, the fate of thousands of funds rests on their managers’ ability to do so.

Footnotes

- 1The debate and historiography of the objectives for hedge funds, and proper benchmarking techniques, is not something that we are addressing with this post. Uncorrelated and/or lesser-correlated returns, absolute returns, alpha generation and market-like returns with lower volatility are all legitimate reasons for various investors choosing to allocate to hedge funds. We don’t seek to promulgate the practice of comparing the vast universe of hedge funds to broad equity benchmarks, but we cannot ignore the evermore-common practice of doing so.

- 2Funds within the portfolios report to the HFR database, applying the following filters: Active; History greater than 59 months; Strategy of Equity Hedge; All sub strategies except for Market Neutral; Regional Focus of Global; Included in HFRI.

- 3Assets over $500 million indicate Large Funds in the study, while funds with AUM between $100 million and $500 million are defined as Small Funds. Based on the above filters, the Large group holds 22 funds and the Small group contains 25 funds. The funds within the groups are equal weighted, rebalanced monthly.

- 4Using Dow Jones Global Sector Indices

- 5DISCLAIMER: MPI conducts returns-based analyses and, beyond any public information, does not claim to know or insinuate what the actual strategy, positions or holdings of the funds discussed are, nor are we commenting on the quality or merits of the strategies. This analysis is purely returns-based and does not reflect insights into actual holdings. Deviations between our analysis and the actual holdings and/or management decisions made by funds are expected and inherent in any quantitative analysis. MPI makes no warranties or guarantees as to the accuracy of this statistical analysis, nor does it take any responsibility for investment decisions made by any parties based on this analysis.

- 6Selection return is typically thought to come from a few sources: (1) good selection of individual stocks that outperform the global sector index; (2) selective currency hedging; (3) missing market factors, such as to small-cap stocks and/or companies from developing economies/markets not included in MSCI World Index, from our analysis that result in unexplained behavior and/or (4) usage of derivatives and/or other exotic instruments hedge funds may utilize.