Risk Parity Not Performing? Blame The Weather.

Many high profile funds with set risk targets exhibit levels of volatility last seen only during the Global Financial Crisis. This and the disparity of results between funds in the category is the subject of this post.

The increased correlations of bonds and equities have caused significant losses in traditional passive balanced stock/bond strategies that have become gospel to investors, as the WSJ reported in a prominent October story “The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations”. A less highlighted casualty of the changing stock/bond relationship, however, has been risk parity – and the pension funds that adopted such institutional-oriented strategies and products en masse.

The risk parity or “balanced beta” approach popularized by Ray Dalio’s Bridgewater Associates allocates investor dollars based on the risk contribution of an asset class to a portfolio. Their “All Weather” fund is literally intended to ‘weather’ all economic environments reasonably well – or in the manager’s words to “chug along, providing attractive, relatively stable returns”. The category Dalio pioneered has become very popular with institutional investors, with hundreds of billions of dollars allocated globally[1], where the strategies are often viewed as a distinct asset class[2].

And while Bridgewater’s All Weather fund still manages $32B AUM[3], the fund’s performance has been anything but all-weather recently. Last year, the fund lost -22% – two percent more than its -20% loss in 2008 during the Global Financial Crisis. This year, All Weather is up 4.5% through November, boosted out of negative territory at the end of October (down -1.8% vs 2.9% for a Global 60/40) by the best month for bonds since the 80’s and a top 20 month for large-cap domestic stocks. (The Fed’s pivot at their December meeting will most likely provide a further lift.)

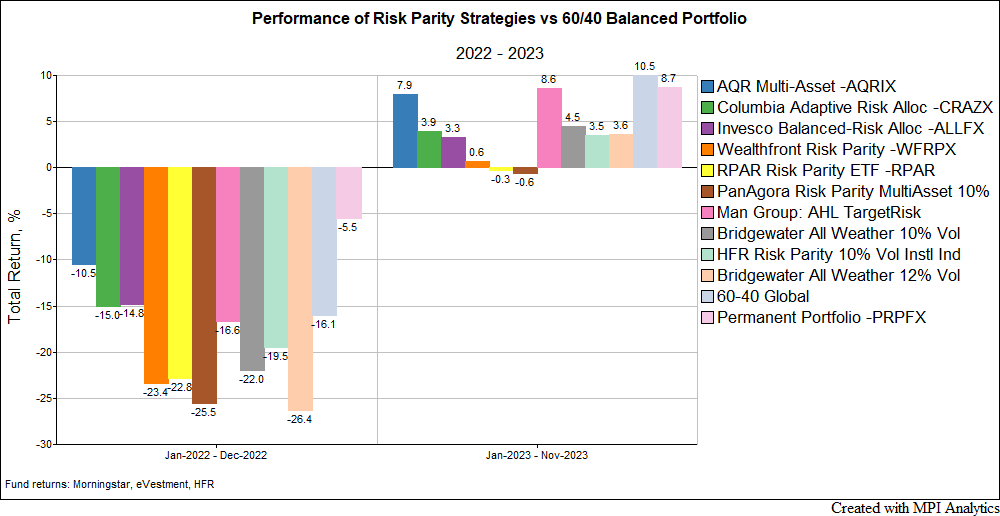

In the bar chart below, we compare 2022 and 2023 year-to-date through November performance of some of the largest and most referenced risk parity mutual funds, ETFs, UCITS, hedge funds and institutional products (SMAs) alongside Bridgewater’s All Weather 10% Volatility Target fund[4]. We also added a Global 60% stocks/40% bonds portfolio[5] as a reference point (after all, the risk parity approach was created to provide a “better 60/40”) and the Permanent Portfolio (PRPFX) mutual fund – a multi-asset portfolio strategy where assets are equally rebalanced between equities, bonds, cash and gold (and other inflationary assets silver, real estate and natural resources).[6]

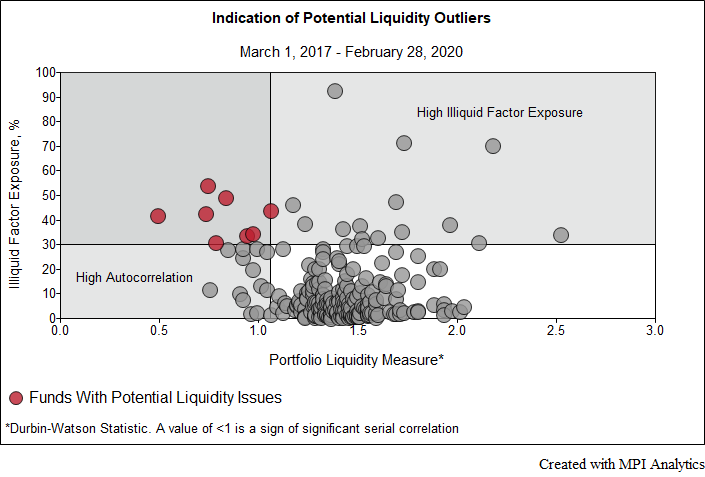

MPI Stylus Pro provides a quantitative framework that enables investment practitioners to screen and monitor liquidity risks in fixed-income products

To be fair, Bridgewater was not alone in 2022; performance was a disaster for the category as a whole. Most risk parity products significantly underperformed the -16.1% return of the Global 60/40 benchmark; the HFR Risk Parity 10% Vol Target Institutional Index, an equal weighted average of hedge funds implementing the strategy, was down -19.5% for the year. AQR’s Multi-Asset Fund (AQRIX) – their rebranded risk parity strategy – stands out for preserving capital, with a peer group-leading return in 2022 (-10.5%). Columbia Adaptive Risk Allocation Fund and Invesco Balanced-Risk Allocation Fund slightly bested a traditional balanced portfolio in 2022, while Man AHL Target Risk UCITS Fund saw a similar drawdown.

This year through November 30th, the dispersion of results is quite wide, from the -0.6% loss for PanAgora Risk Parity Multi Asset to a 8.6% gain for Man AHL Target Risk UCITS, which together with AQR’s AQRIX (7.9%) have the best performance in the group. The best, however, is still shy of the 10.5% return of the Global 60/40, propelled by November’s “everything rally”. The average institutional risk parity fund gained 3.5%, per HFR, rebounding from being in the red -1.6% through October.

The Permanent Portfolio stands out with significant allocations to both equities and gold contributing to its exceptional capital preservation in 2022 (-5.5% loss) and 8.7% return through November this year.

We wrote about 2022 risk parity challenges in detail: the algorithms had nowhere to hide amid unprecedented inflation, with commodities being the only asset providing a real inflation hedge, and a historic, if delayed, rate hiking cycle to combat price increases. Any funds that used TIPS to hedge inflation or significantly levered fixed income suffered massive losses. [7] Blame the weather – or the Fed.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.