Sharpe Ratio: a Blessing, a Curse or Both?

We argue that Sharpe Ratios could be hugely deceiving for derivative strategies - especially if they are in an outlier category as it was the case for the Allianz Structured Alpha funds.

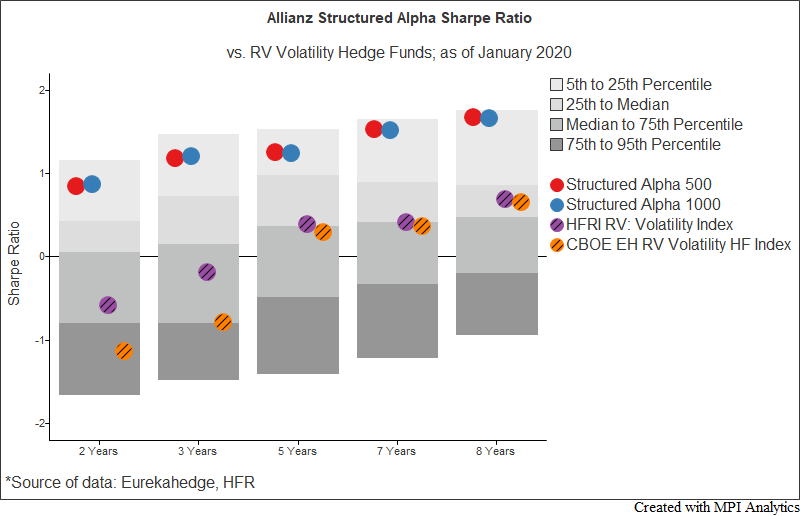

“How Did Investors End Up on the Other Side of This Trade?” – asks Julie Segal from Institutional Investor in her article about MPI deciphering the now defunct Allianz’ Structured Alpha fund in the latest research Should Institutional Investors be Selling Market Crash Insurance? Do they Know They Are? One possible explanation is hinted in the following chart showing that through January 2020 – right before its collapse – the Structured Alpha funds consistently had one of the highest Sharpe Ratios of all Relative Value Volatility funds in the category for any period of the past 8 years.

Over the following two months, Structured Alpha funds collapsed and lost over $4B in client assets. Yet another reminder that the Sharpe Ratio for derivative and highly dynamic strategies has to be taken with a grain of salt. And as we frequently mention on these pages, Sharpe Ratios should be considered only after the dynamics of factor exposures is totally transparent: Chasing Top-Rated Funds: Are We Investing In Outliers?