Solving 2019 PIMCO Income Fund Puzzle

Since its launch in 2007, PIMCO Income Fund has become one of the top-performing US bond funds. However, in 2019 the fund has underperformed both the benchmark and most of its peers. Using this fund as an example, we will demonstrate how advanced returns-based analysis can be used to analyze complex fixed income products without delving into volumes of complex holdings.

Since its launch in 2007, PIMCO Income Fund has become one of the top-performing US bond funds overall and the only one consistently in the top quartile of its category over the previous nine years. However, in 2019 the fund underperformed both the benchmark and most of its peers. Using this fund as an example, we will demonstrate how advanced returns-based analysis can be used to analyze complex fixed income products without delving into volumes of complex holdings.

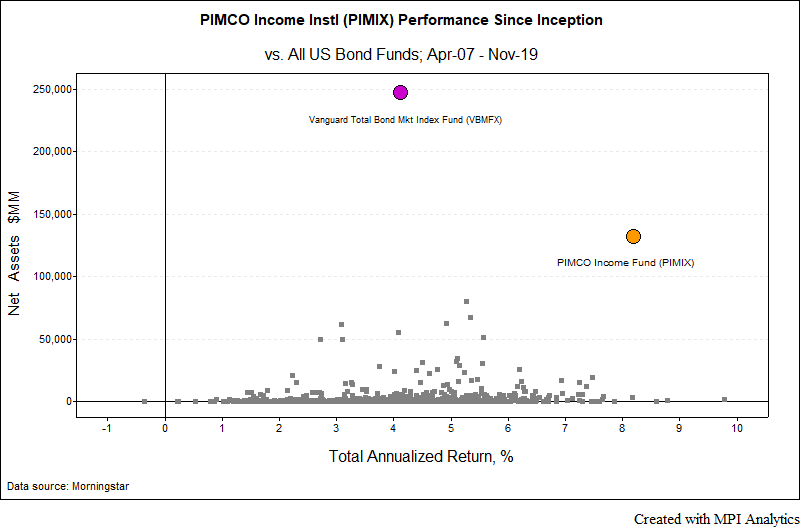

PIMCO Income Fund (ticker: PIMIX for institutional share class) is the largest actively managed bond mutual fund, with assets of more than $130 billion and over $200B globally in the strategy. Since its inception the fund has outperformed all but three U.S. bond funds delivering an average annualized return of 8.2% for the period from April 2007 to November 2019. In Figure 1, below, we show the fund’s performance and AUM vs all U.S. bond funds in the Morningstar database. Only Vanguard Total Bond Market Index Fund (VBMFX) – a passively managed index fund – has more assets than PIMCO Income and only three funds, two of which are managed by PIMCO, have had better performance.

Figure 1: Performance Since Inception and AUM vs. Entire U.S. Bond Fund Universe

Morningstar categorizes PIMCO Income as a multisector bond fund. According to the fund researcher, funds in this category:

“seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high-yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB (considered speculative for taxable bonds) and below.”

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.