Top Hedge Fund Managers Agree on Something – And It’s Not Risk Parity

Hedge Funds have a place in investor portfolios, they’re just too darn expensive and not easy to pick

Asked his key to a happy life in 2021, the recently deceased investing industry legend Charlie Munger sagely said, “The first rule of a happy life is low expectations. If you have unrealistic expectations, you’re going to be miserable all your life.”

Investors in risk parity would do well to heed this advice. And investors in hedge funds might want to absorb Munger’s wisdom, too[1].

For reasons we’ve recently discussed — including vast dispersion in performance, risk levels exceeding targets and failure to preserve capital during a period of inflation and rising rates — we think it is time for investors to manage their expectations when allocating to risk parity.

The idea pioneered by Bridgewater Associates that allocation of investor dollars based on the risk contribution of an asset class to a portfolio would somehow provide a good hedge in a market downturn hasn’t materialized – especially during the positively correlated, higher inflationary environment as of late, which it was apparently built to handle. Indeed, a standalone allocation to risk parity has likely been a source of misery for many allocators, consultants and advisors lately – though November’s bull market in most asset classes has certainly helped.

But when we consider where risk parity came from, a silver lining emerges. Yes, there’s an approach designed to deliver an all-weather performance which has been in existence for 75 years – a regular hedge fund! The main purpose of a typical hedge fund was to preserve wealth – hence the term “hedge”. And, despite all the perennial criticism, as a group, large and established hedge funds have actually delivered on that promise over market cycles.

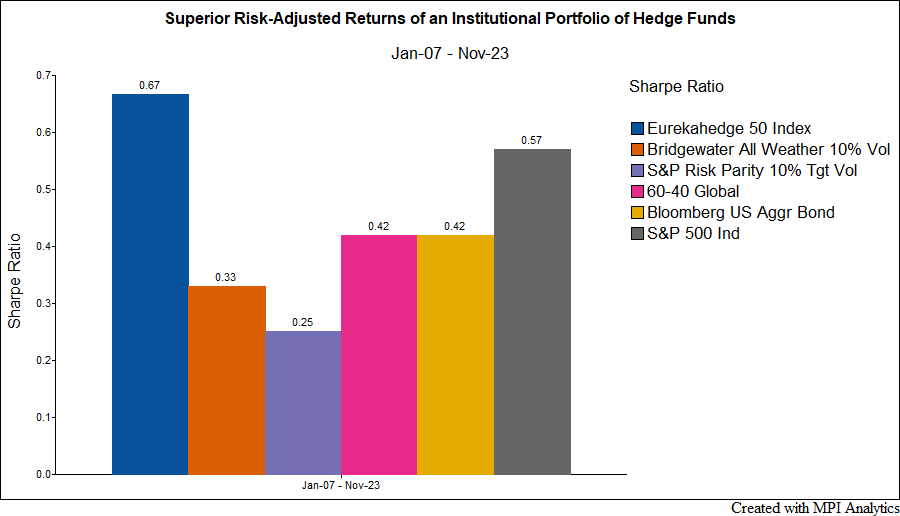

In the chart below, we compare the risk-adjusted returns (Sharpe Ratios) of:

- Bridgewater All Weather 10% Volatility Fund, the flagship risk parity fund;

- S&P Risk Parity Index – 10% Target Volatility, a rules-based risk parity benchmark;

- U.S. stocks (S&P 500 Index);

- Bonds (Bloomberg U.S. Aggregate Bond Index);

- Global 60-40 (MSCI ACWI Index and the Bloomberg U.S. Agg Bond);

- Eurekahedge 50 Index (BLOOMBERG: EHFI400), a benchmark for institutional portfolios of large, established, illiquid, hard-to-access hedge funds diversified across five strategies[2].

This index of the 50 largest institutional quality hedge funds rather significantly tops the others in efficiency over the past 16+ years. The collective wisdom of hedge fund managers can result in better risk-adjusted returns than the mighty 60-40.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.