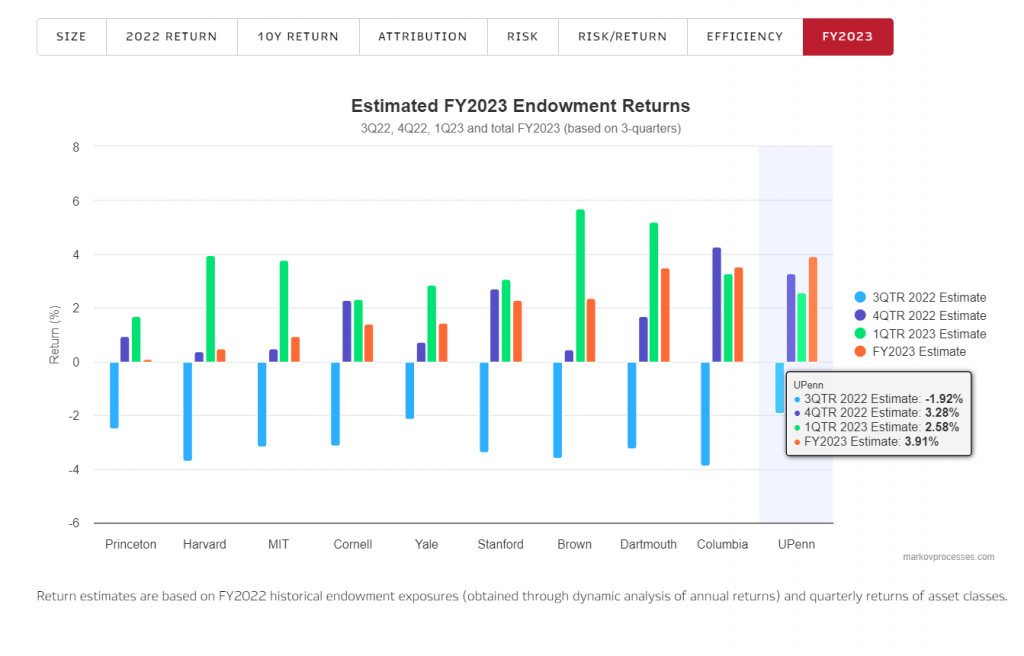

UPenn and Columbia Endowments Take the Lead In 2023 Fiscal Year

Endowments and pensions continue to post gains, but exposure to private markets pushes many below benchmarks

Three quarters into the 2023 fiscal year, MPI Transparency Lab estimates that University of Pennsylvania is leading the pack with 3.91%, with Columbia University close second with 3.55% estimated return. Princeton University and Harvard University are expected to trail other Ivy League universities with returns close to zero.

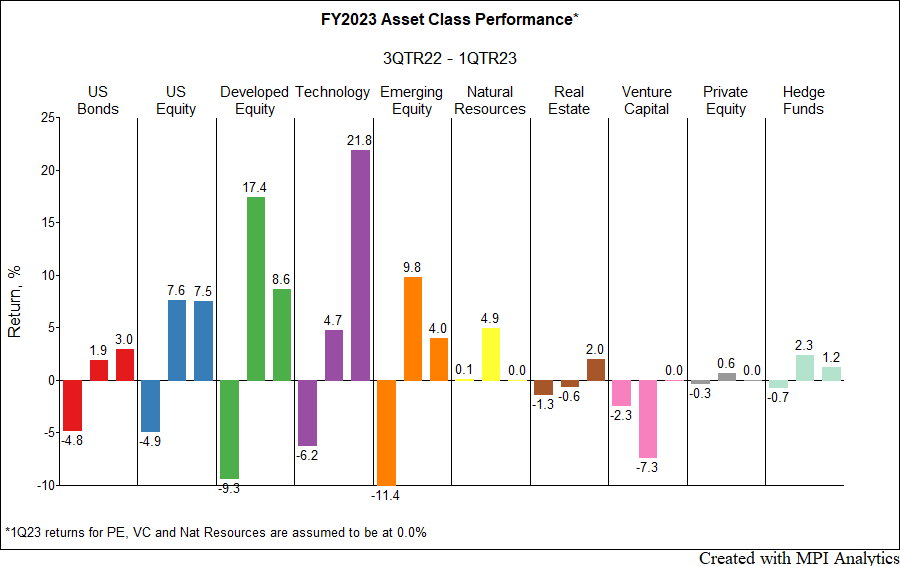

As equities rebounded in the fourth quarter of 2022 and the first quarter of 2023, endowments with the most exposure to global public equities (UPenn and Columbia) and technology sector in particular (Brown University and Dartmouth University), most likely saw their returns lifted up after losses in the third quarter of 2022.

We compiled our projections for fourth quarter of 2022 based on the recently released Cambridge Associates’ Private Benchmarks preliminary estimates. The CA Venture Capital index was down -7.31% for the fourth quarter (67% reporting) and CA Private Equity Index is up 0.62% (63% of funds reporting). CA Real Estate index return is -0.56% for the quarter, with 60% of funds reporting. Even though we’re a couple of months away to get preliminary estimates on private benchmarks’ returns for the first quarter of 2023, we don’t expect any breakthroughs for private equity and venture capital given rising interest rates, depressed valuations, and the increased bankruptcy rates in early 2023. Therefore, for our estimates we conservatively assumed fourth quarter returns for PE and VC at zero and expect the gap between the best and the worst Ivies widen as we start getting private benchmark estimates.[1]

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.