UPenn’s Endowment Wins Big… with Asset Allocation

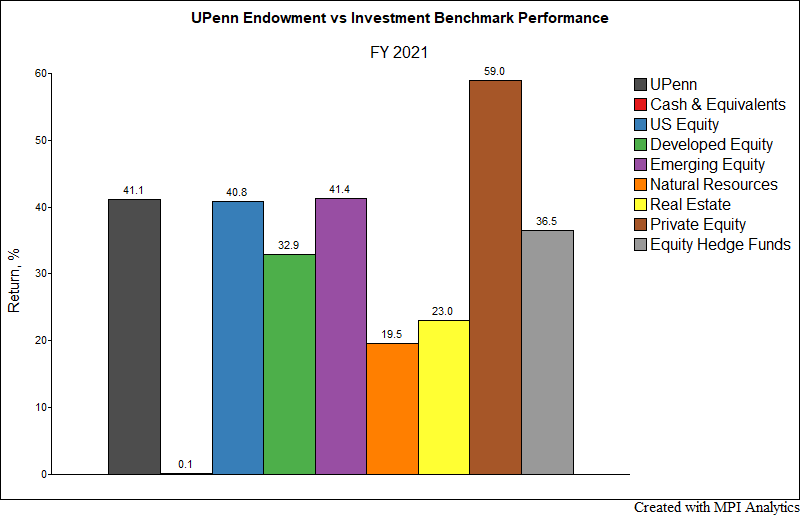

UPenn's $20.5 Billion endowment posted a return of 41.1% for FY 2021, driven by strong returns in private equity and venture capital.

Endowment performance reports are streaming in, so it’s time for MPI to continue our long tradition of analyzing some of the largest and most important university endowments.

First up is the University of Pennsylvania, the first ivy league school to report its performance. The $20.5 Billion endowment posted a return of 41.1% for FY 2021, driven by strong returns in private equity and venture capital. This represents a 3.1% outperformance of their blended composite benchmark (composition undisclosed).

Research teams that want to explore the drivers of performance and risk at these endowments face a number of challenges. First, only annual returns are made public, leaving analysts with far too few observations for traditional static and rolling window regression methods to produce meaningful results. Secondly, definitions of asset classes and their proxies varies wildly between schools, especially when it comes to alternatives – the focal point of most Ivy endowments’ portfolios. This makes it difficult to establish a common framework for analyzing and comparing results based on reported allocations alone.

This is where factor modeling plays crucial role

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.