Asset Allocation Software

MPI asset allocation software was developed to meet the needs of allocators who require powerful, yet flexible, analytics to help them communicate and differentiate their asset allocation philosophy.

Powerful Insights

Whether you are a wealth manager seeking to build better client portfolios, or you are an institutional investor or consultant looking to improve strategic and tactical allocation models, MPI Stylus solutions can help.

Flexible Analysis

Our technology delivers analytics that are as flexible as they are powerful to help you better visualize your asset allocation decision making process.

Key Benefits

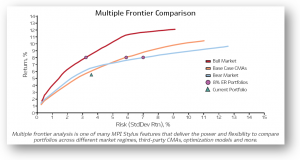

- Flexibility to employ multiple optimization models, including MVO, Black-Litterman, CVaR, downside risk, mean-benchmark tracking, surplus (liability-driven), and more

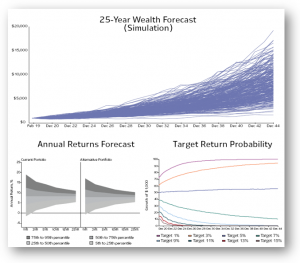

- Simulate future outcomes that include fat-tailed, extreme possibilities that other systems often miss

- Save time and money with one comprehensive software platform that provides both historical and forward-looking analysis capabilities

Key Features

- Demonstrate how individual portfolios might perform using historical regimes and foreword-looking theoretical scenarios

- View the efficient frontier from almost any statistical perspective

- Design your own charts, tables and reports, or select from a number of “out-of-the-box” templates

- Create robust, stress-tested portfolios across thousands of hypothetical outcomes with MPI’s patented Calibrated Frontiers

- Identify results that are generated by asset allocation and portfolio optimizations leveraging MPI’s patented Frontier Map®1 functionality.

MPI Stylus Pro‘s quantitative models and methodology paired with our Advanced Analytics module can improve your firm’s portfolio construction and optimization process. To find out how, contact us at +1 908 608 1558 or via email.

Footnotes

- 1FRONTIER MAP® is a registered trademark of Markov Processes International.