Stylus Pro Surveillance

A critical capability for asset owners, asset managers, lenders and prime brokers

MPI Stylus Pro delivers a patented, risk-factor based approach to help in fund investment and lending decisions and fund monitoring and surveillance. Our predictive, dynamic modeling reverse-engineers funds’ P&L or NAVs to flag changes in behavior to help identify areas of high risk, liquidity issues and excessive leverage.

Stylus Pro Surveillance

Key Capability

Fund Risk Monitoring Dashboard

A non-intrusive, scalable monitoring system used by some of the world’s largest investors and government regulators covering both traditional and alternative fund products.

Delivers a risk-based fund surveillance solution ideal for asset owners, manager due diligence professionals, risk analysts and asset managers.

Monitors any number of funds simultaneously (up to thousands) for significant changes in risk, potential excessive leverage and other red flags.

Helps prioritize resources by providing an early warning system for potential “high risk” funds.

Patented analytical models provide the sophistication and flexibility required to analyze the numerous complexities and nuances within the global fund industry.

Created with MPI Analytics

Created with MPI Analytics

Stylus Pro Surveillance

Key Features

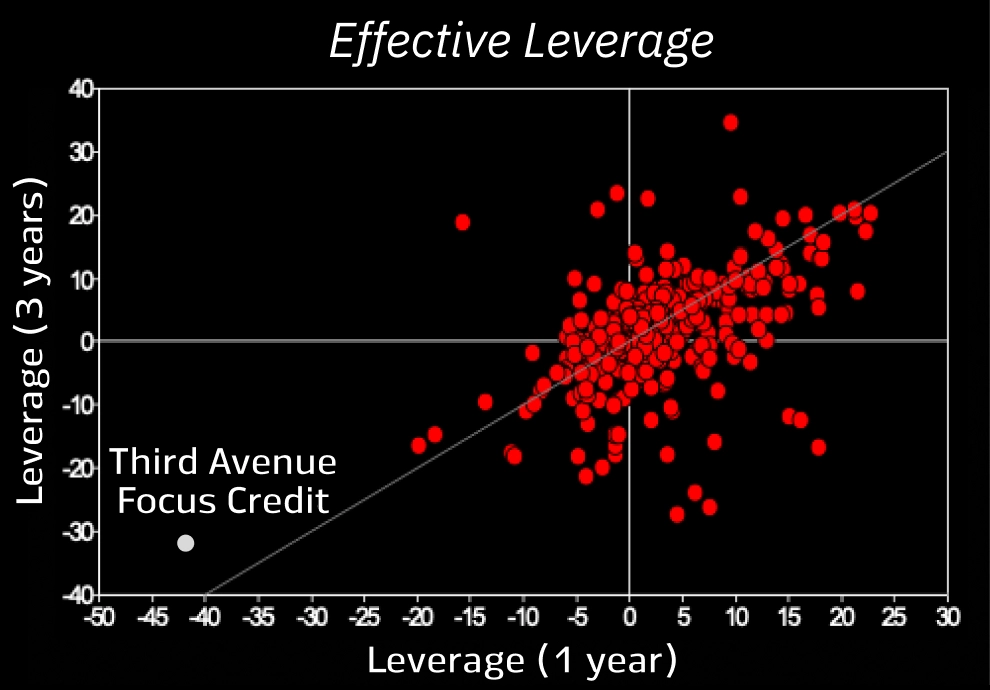

- Provides estimates of risk exposures and leverage using only the return stream of the fund. No position-level information is necessary.

- Identifies abrupt changes in exposures and risks.

- Stress-tests portfolios using historical scenarios and hypothetical shocks.

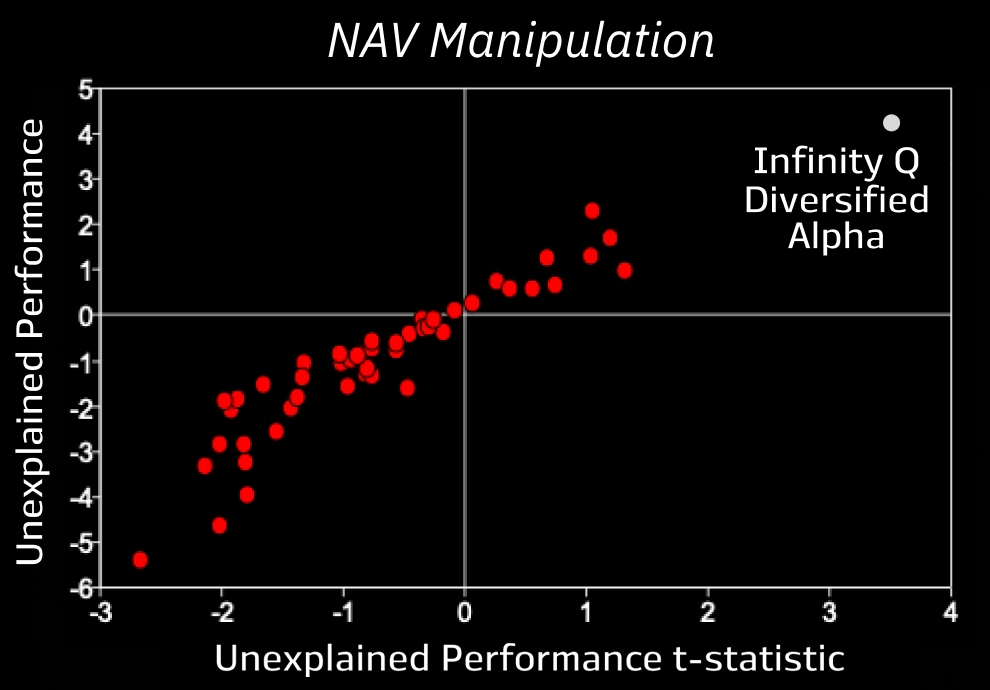

- Identifies inconsistencies in P&L, which could indicate outliers such as hidden fees, NAV manipulation and other red flags.

Key Benefits

- Alerts users to hidden exposures and risks.

- Uses daily, weekly, monthly returns or NAV; uses quarterly cash flows and NAV for private investments.

- Monitors a wide range of strategies including long/short, equity or credit, arbitrage and CTAs.

- Accommodates public and private investment products including liquid and illiquid assets.

- Acts as a cost-efficient and scalable second opinion tool for risk managers.

Stylus Pro Surveillance

Notable Applications and Case Studies

SEC awards a contract to MPI for surveillance of mutual funds

Provided insights into the Bridgewater Pure Alpha fund using its monthly NAVs

MPI showed how to identify outlier behavior that could indicate irregularities, with Galleon hedge fund (insider trading) as an example

MPI demonstrated potential NAV manipulation of the $2 billion Infinity Q Diversified Alpha fund

“This method allows firms to effectively deduce strategies at other firms and avoid potential counterparty risks, without being forced to wade through information.”

“Criminal minds and increased surveillance,” Risk.net