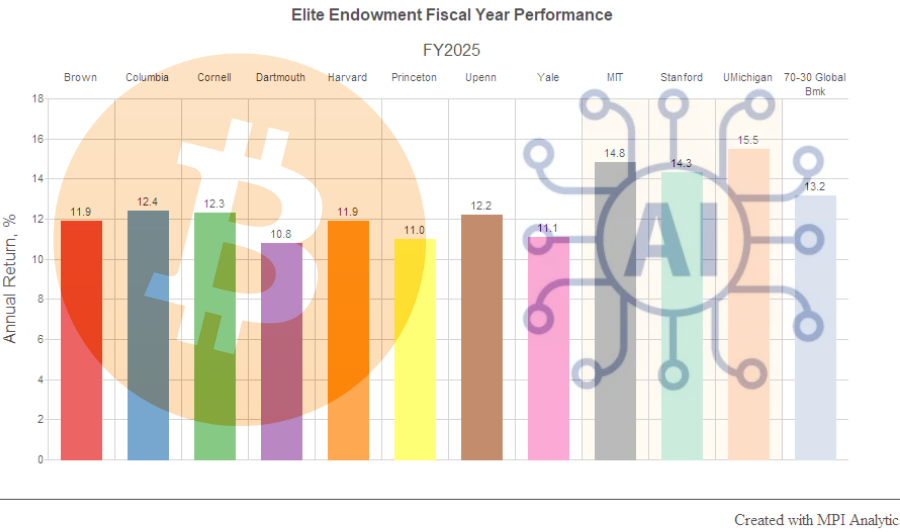

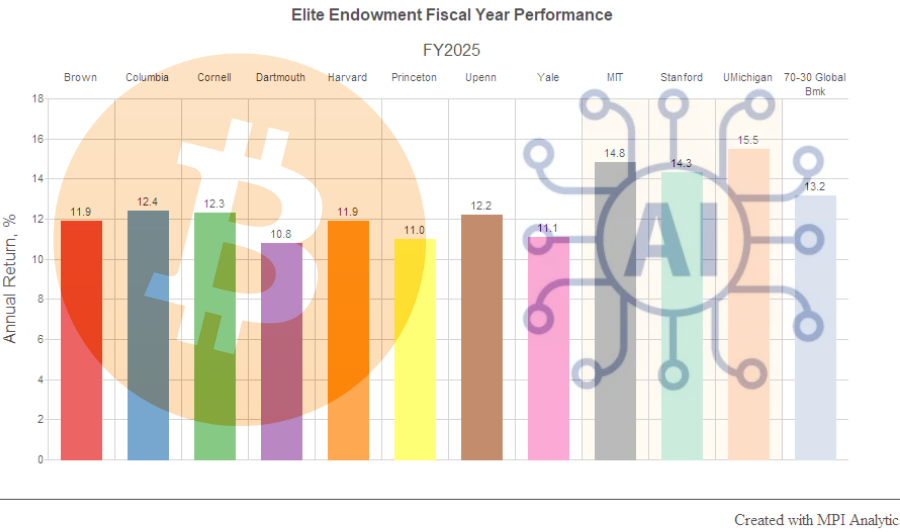

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

We analyze annual endowment returns to offer a plausible explanation for MIT, Stanford, and Michigan’s spectacular FY25 results. The evidence points to AI and digital-asset themes.

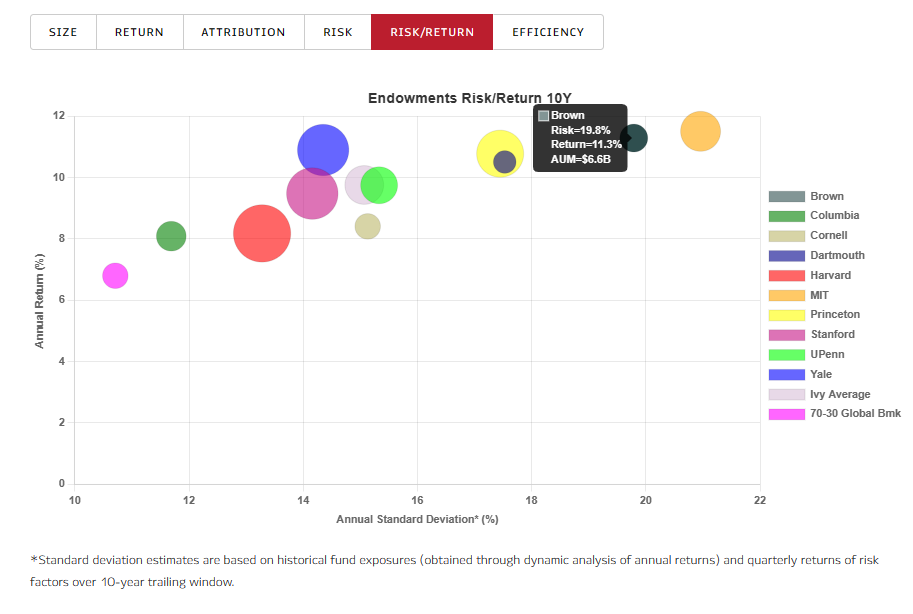

Our analysis shows how portfolio construction, pacing, and governance created a resilient “Switzerland” profile – and what others can emulate.

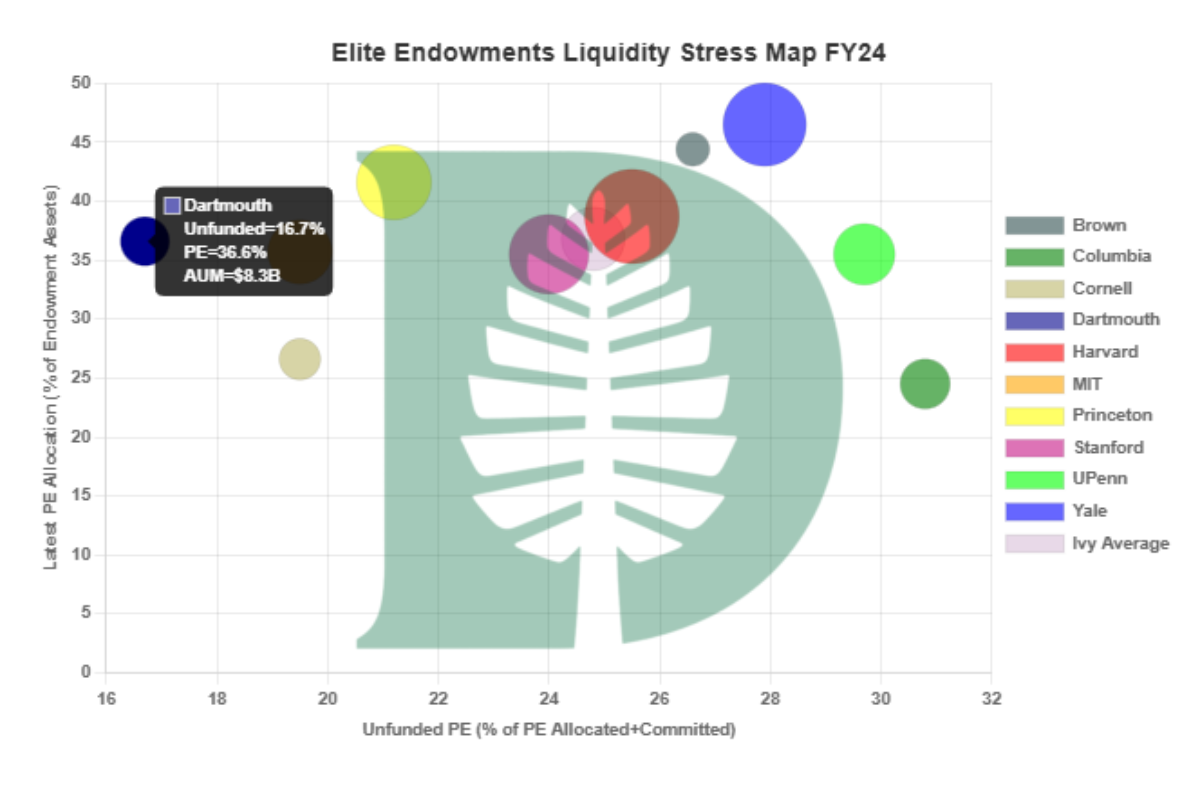

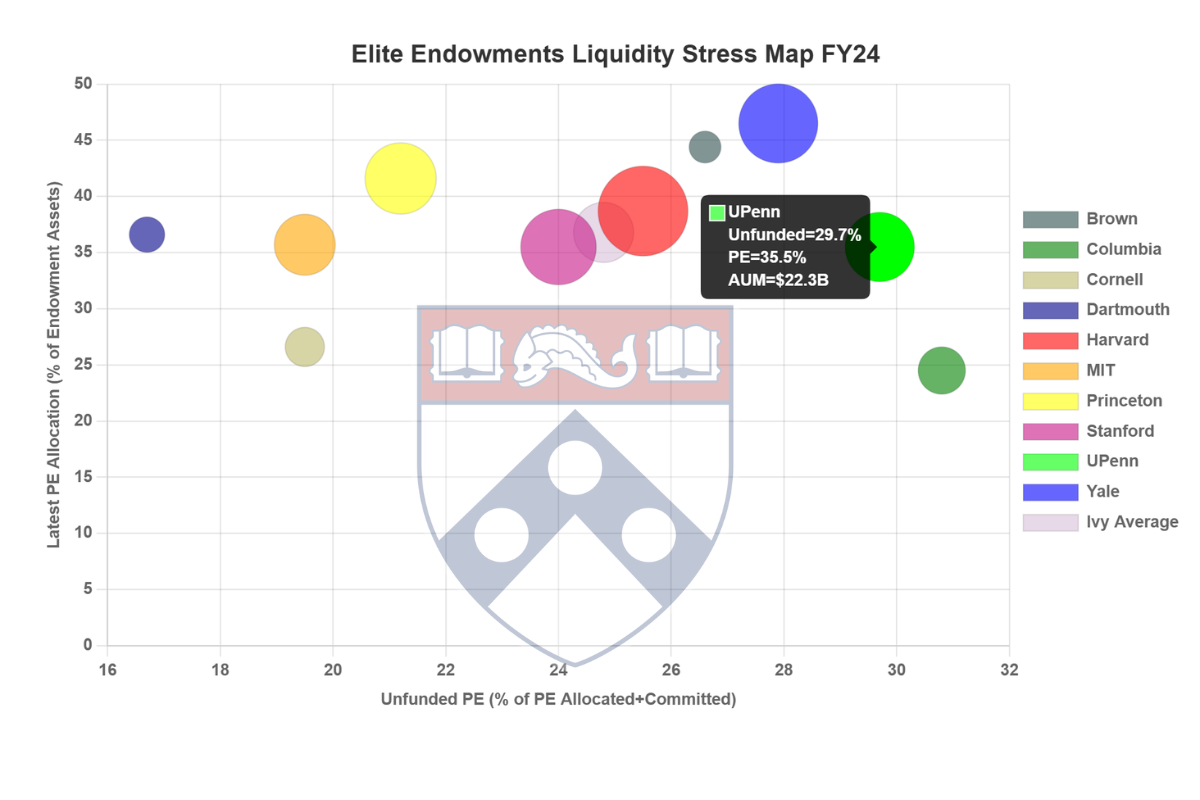

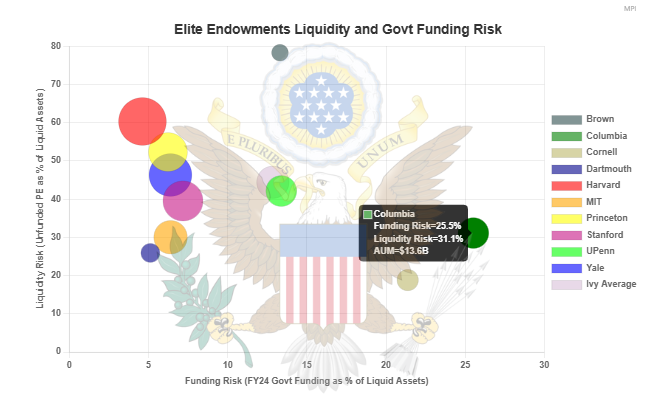

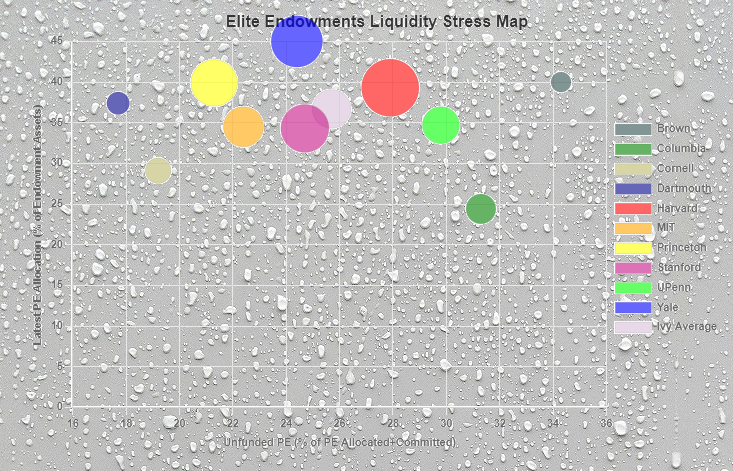

According to our analysis, UPenn’s liquidity problem is real—but somewhat different from those faced by other elite schools. Dartmouth emerges as the most resilient to cash flow pressures.

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

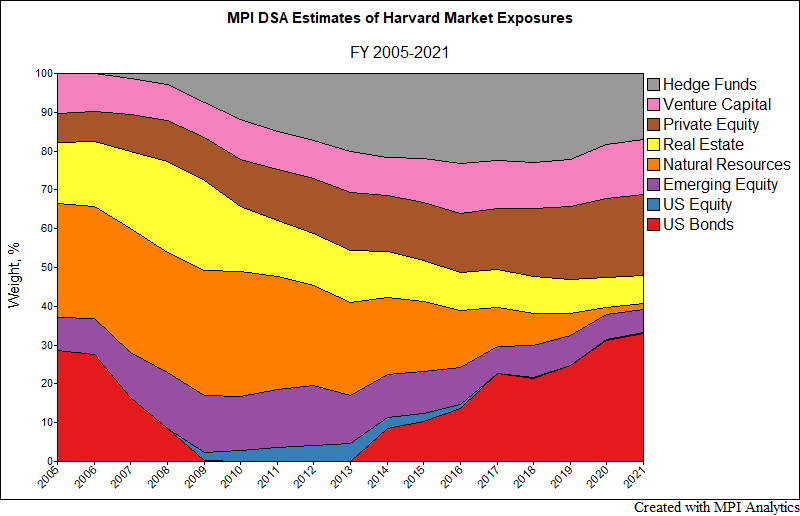

“Overweighting IT and the Mag 7 relative to the broad S&P 500″ may have helped boost returns… “Harvard seems to have overcome the drag of their significant private markets exposure to outperform our estimates—based on our models of their portfolio behavior through FY2023—by a surprising margin.” MPI CEO Michael Markov parsed Harvard University endowment’s solid return for fiscal year 2024 with Institutional Investor for James Comtois‘ story What Drove Harvard’s Returns? The article dissects the Harvard Management Company’s CEO N.P. “Narv” Narvekar annual letter to investors and the Harvard community through the lens of MPI’s quantitative prism.

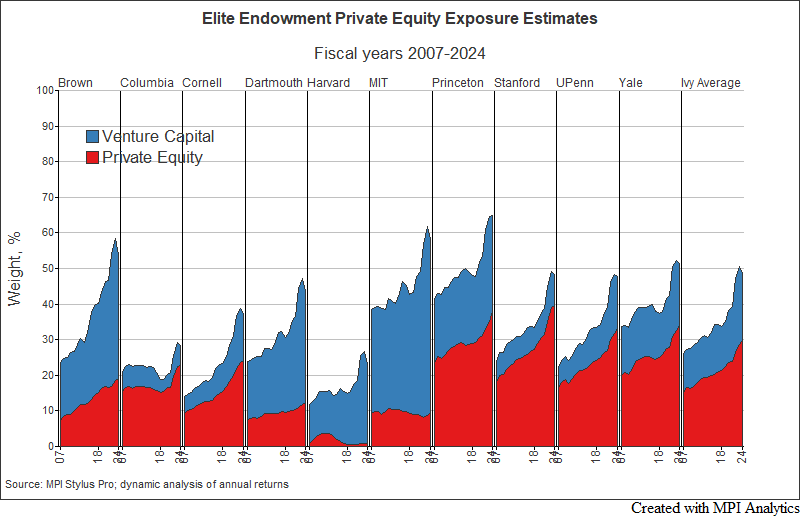

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

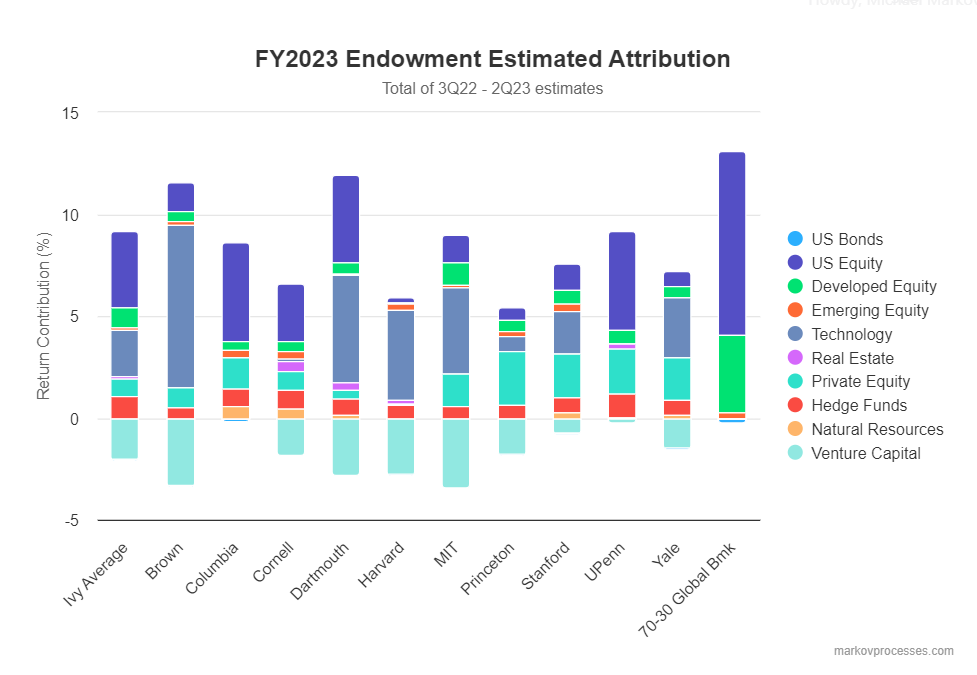

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

Haunted by the ghosts of 2009, Harvard endowment’s lower risk appetite still pays off with a 33.6% return.