An analysis of the third mystery fund linked to both Archegos and the Allianz Structured Alpha funds’ meltdowns hints at the need for efficient and scalable top-down counterparty risk surveillance and monitoring for banks and investors.

An analysis of the third mystery fund linked to both Archegos and the Allianz Structured Alpha funds’ meltdowns hints at the need for efficient and scalable top-down counterparty risk surveillance and monitoring for banks and investors.

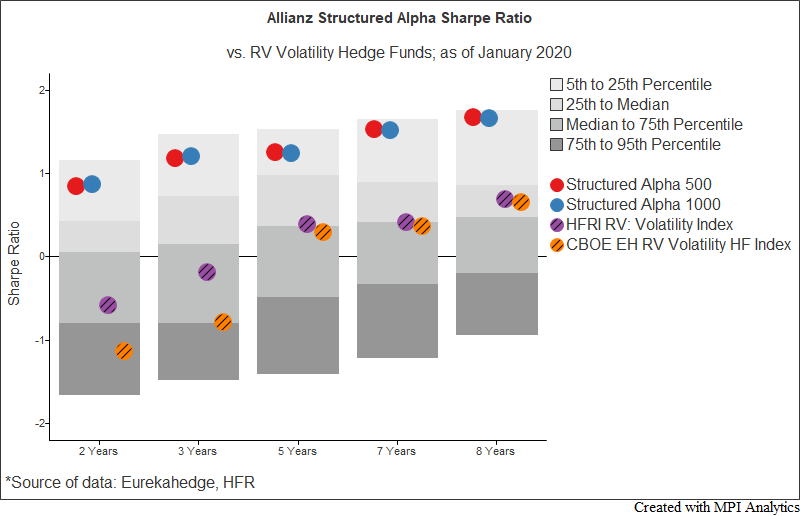

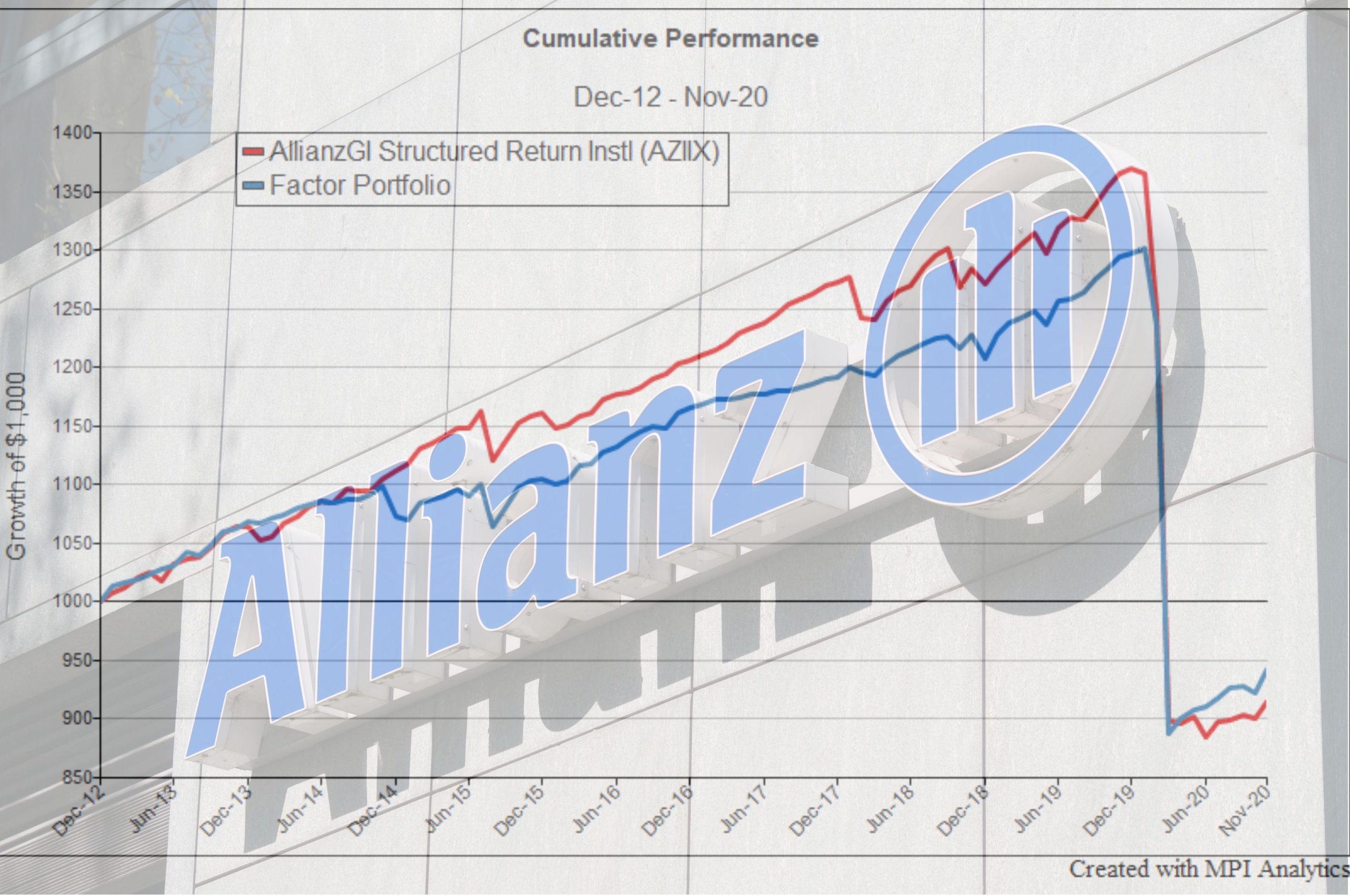

MPI’s September 2021 analysis of the Structured Alpha fund has again been at the forefront of investment reporting this week after Allianz’s recent admission of fraud and the sale of its U.S. asset management business to Voya. Illuminated sources of risk and alpha for investors.

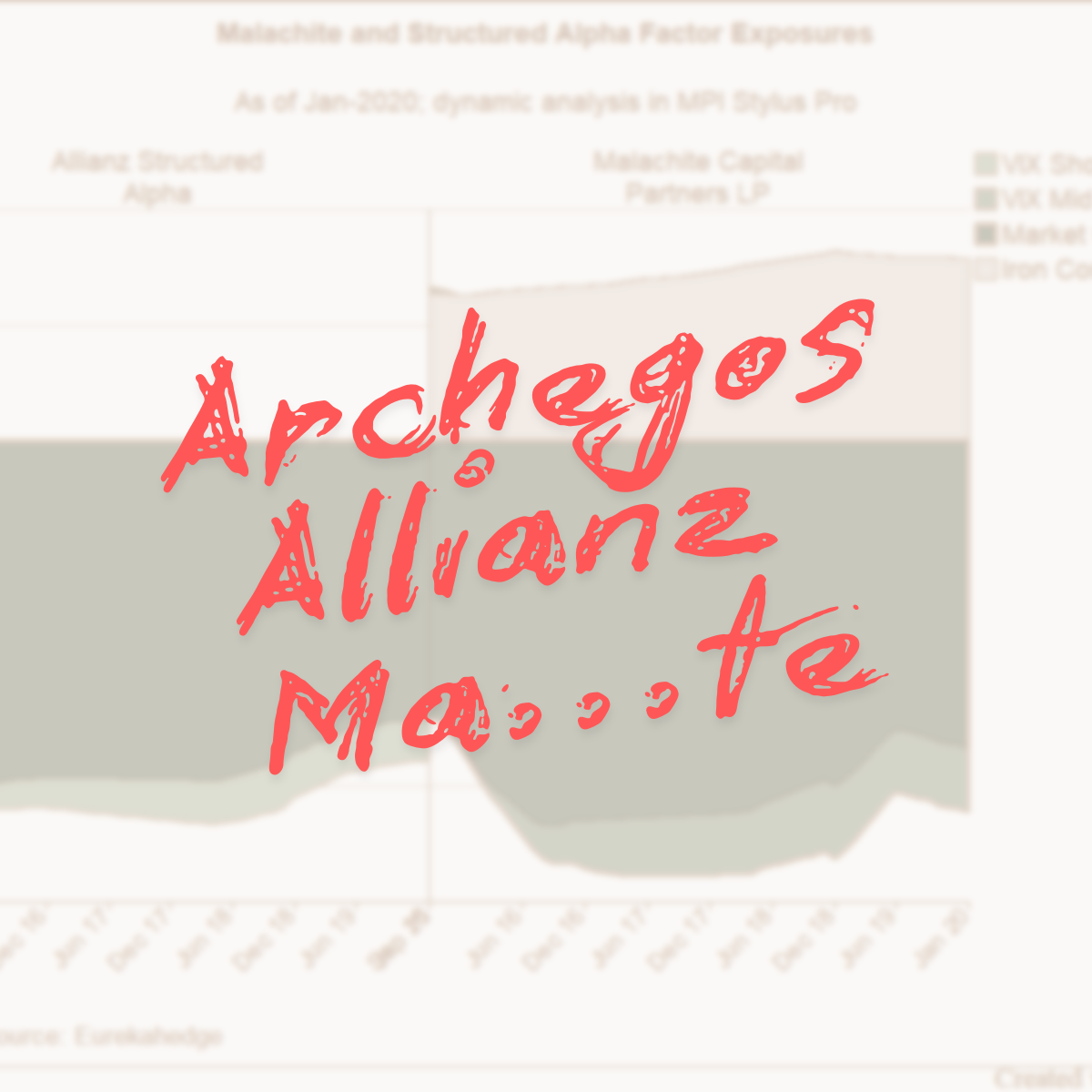

We argue that Sharpe Ratios could be hugely deceiving for derivative strategies – especially if they are in an outlier category as it was the case for the Allianz Structured Alpha funds.

“MPI deconstructs complex volatility strategies to find that many investors might have been doing the opposite of what they thought,” writes Julie Segal from Institutional Investor in her article about MPI’s analysis of the Structured Alpha hedge fund.

We use Allianz Structured Alpha hedge fund as an illustration to demonstrate how investors could apply quantitative techniques to assess potential risks of complex volatility strategies.