An analysis of the third mystery fund linked to both Archegos and the Allianz Structured Alpha funds’ meltdowns hints at the need for efficient and scalable top-down counterparty risk surveillance and monitoring for banks and investors.

An analysis of the third mystery fund linked to both Archegos and the Allianz Structured Alpha funds’ meltdowns hints at the need for efficient and scalable top-down counterparty risk surveillance and monitoring for banks and investors.

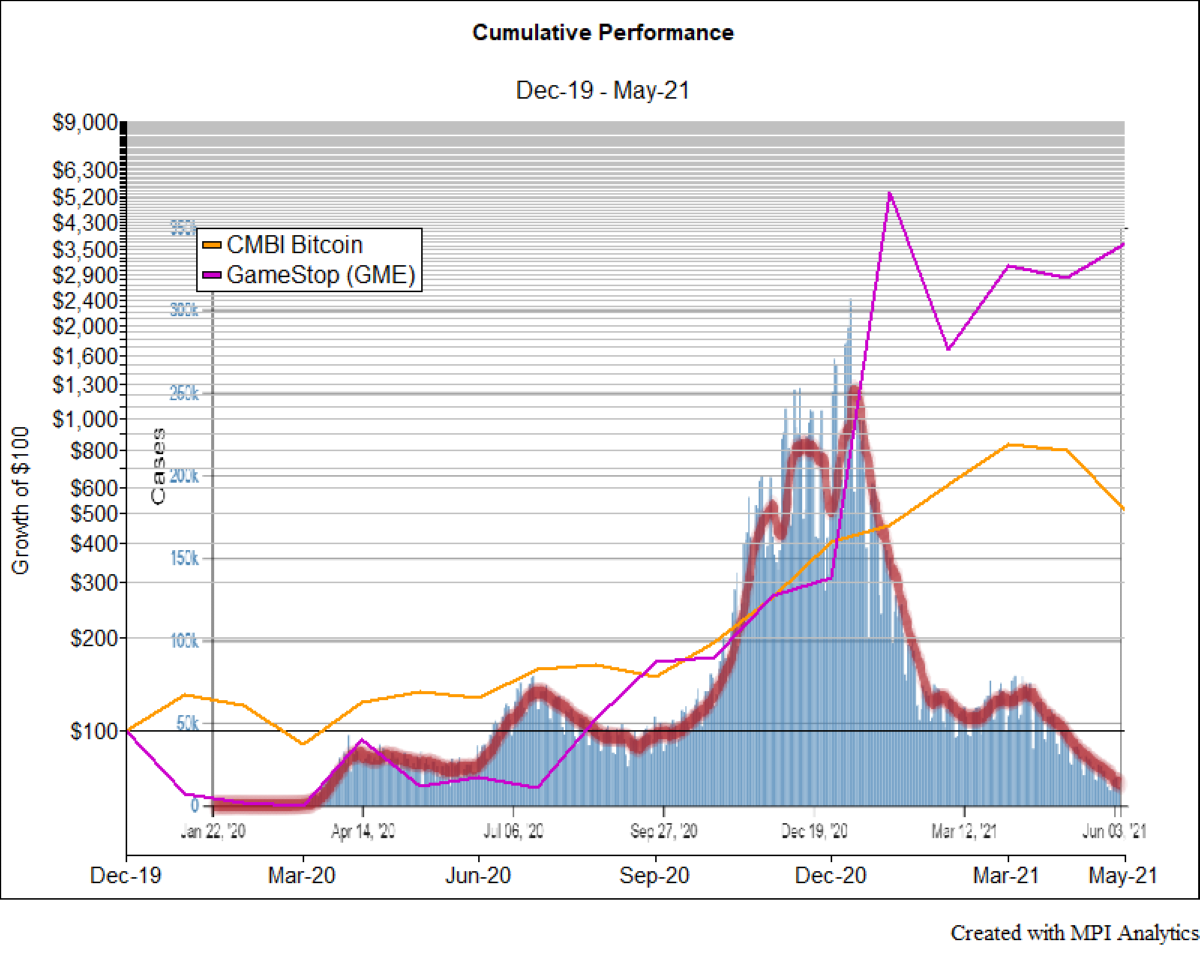

It’s been a wild rollercoaster ride these days for Bitcoin investors. The cryptocurrency hit an all-time high of $64k in April only to plummet nearly 50% a month later. Last year, as the entire world shut down access to mountain peaks and surfing spots, people started to look for stay-at-home ways to supply their adrenaline fix – and speculative trading fit the bill.