How will each party tax proposals impact the wealth of Middle Class and High Net Worth households?

How will each party tax proposals impact the wealth of Middle Class and High Net Worth households?

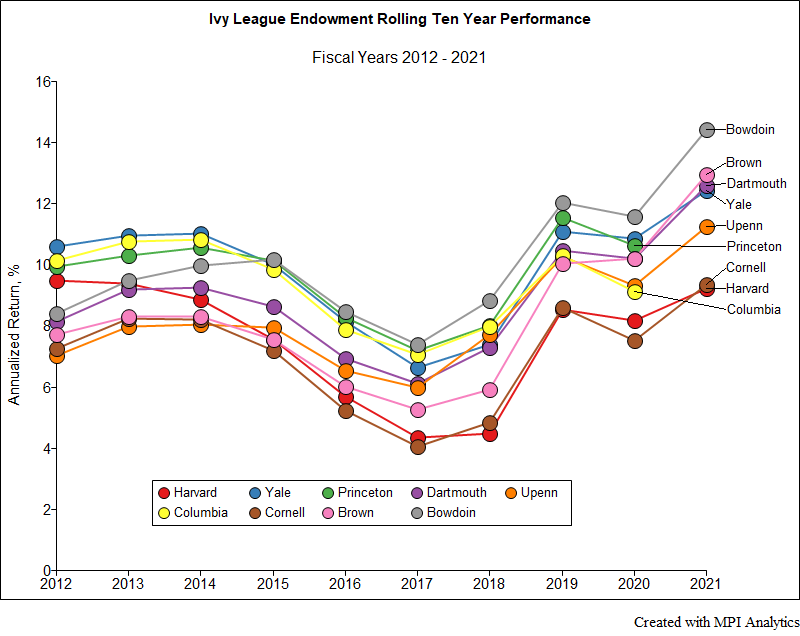

Bowdoin College Endowment has been outperforming all Ivies on a 10-year basis since 2015 with its latest FY2021 result bringing it to 14.4%, an almost impossible number to beat.

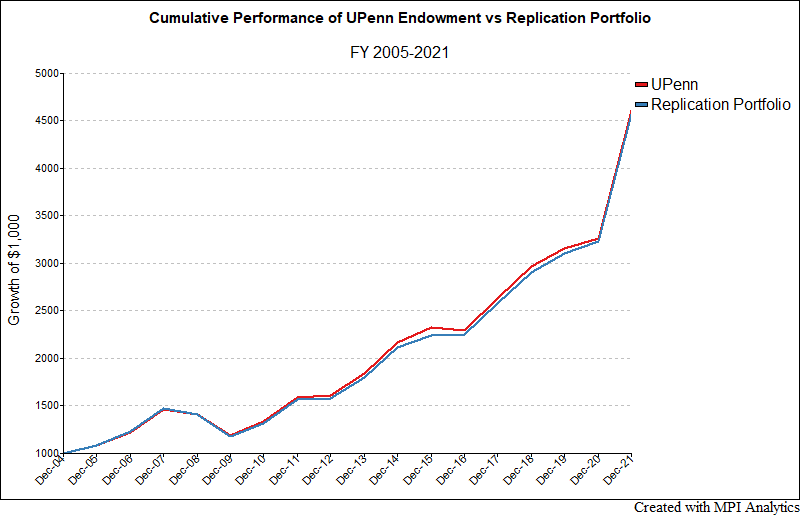

UPenn’s $20.5 Billion endowment posted a return of 41.1% for FY 2021, driven by strong returns in private equity and venture capital.

The endowment model, and active management in general, has come under increased scrutiny, while indexed, or passive, products have grown in popularity and number. Regardless of where you stand on that debate, it’s hard to deny that the Ivies approach to asset allocation has been very good.

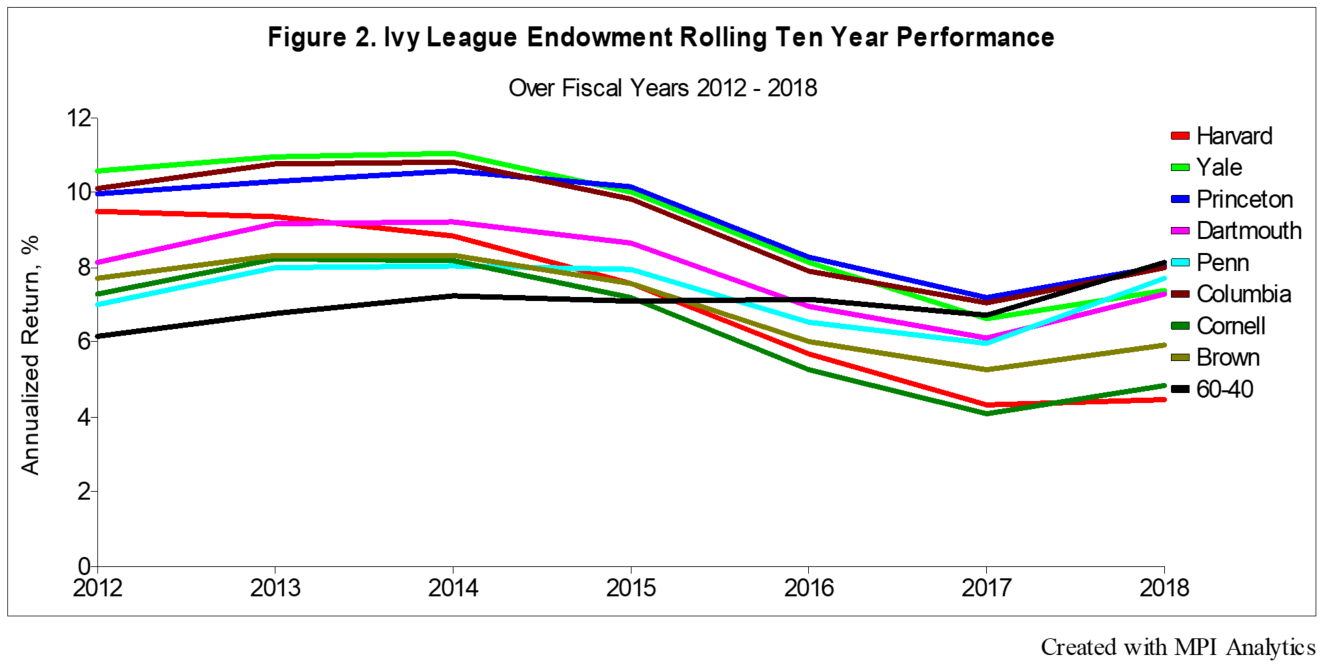

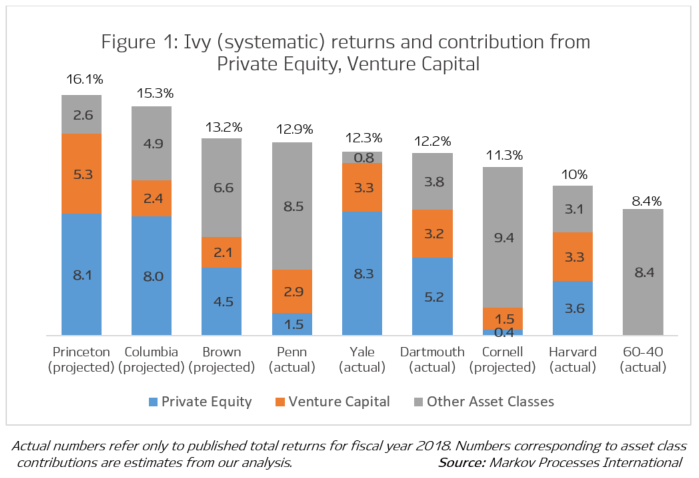

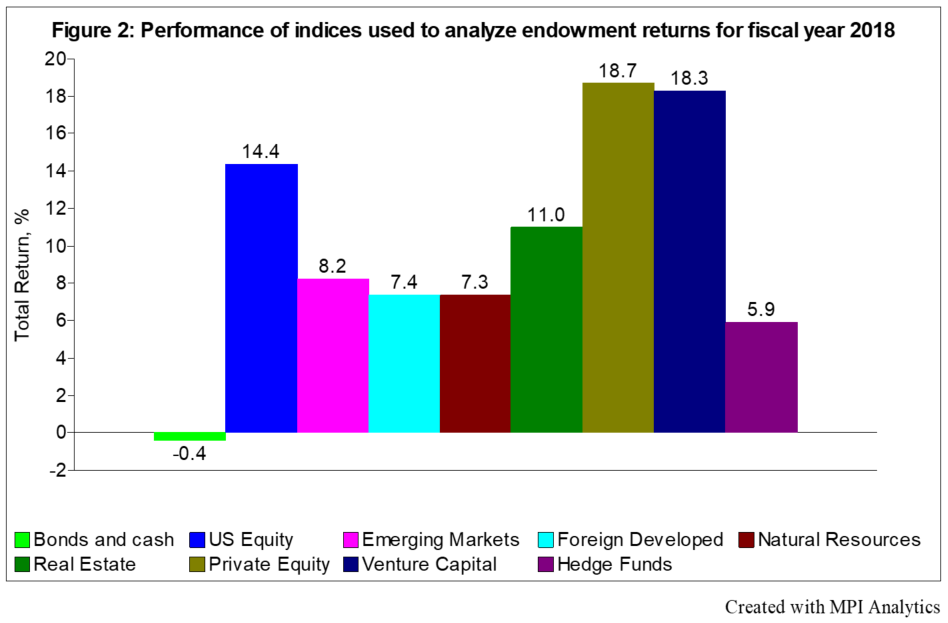

Similar to 2017 performance, this past fiscal year was a strong one for most Ivy League endowments. Fiscal year 2018 is noteworthy, however, for being the first year that long horizon (10-year) returns from all Ivy endowments lagged behind the 60-40 portfolio.

Returns across the Ivy League are largely seen as being driven by exposure to private equity and venture capital.

At the midway point of fiscal year reporting for the Ivy League endowments, our research team analyzes what we know so far to identify the key drivers of returns.

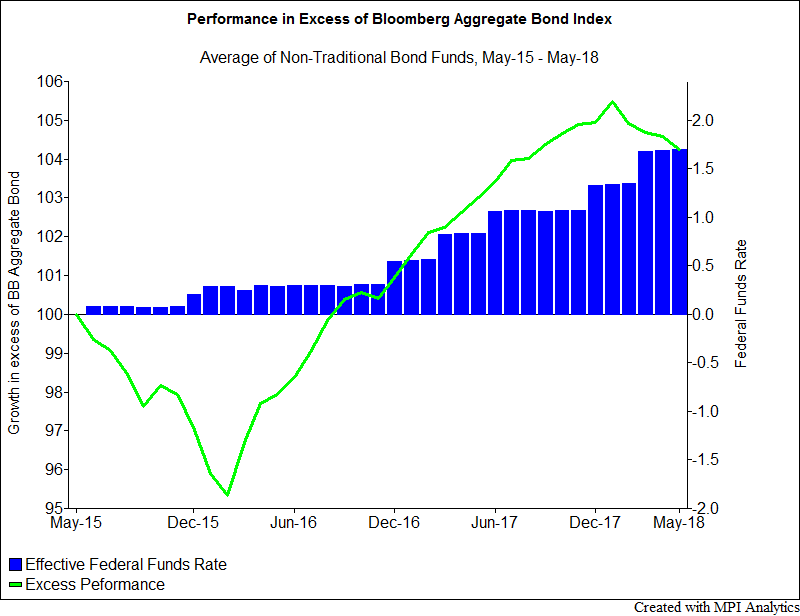

After years of underperformance following the financial crisis, the non-traditional bond fund segment is beginning to shine, outperforming the broader market index in the face of rising rates.

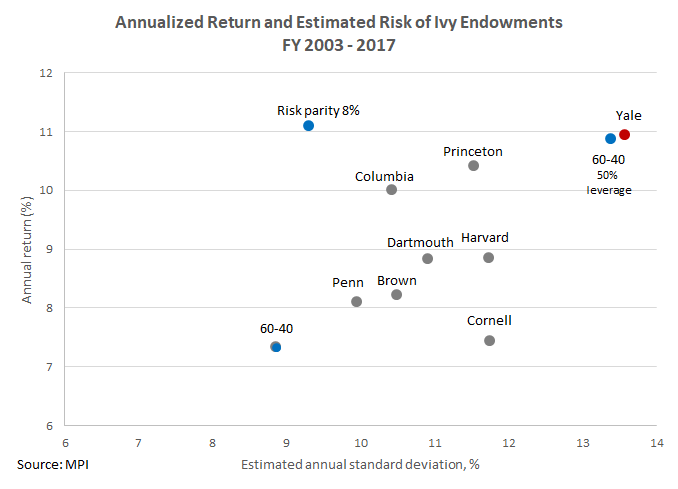

2017 Yale endowment report rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found…

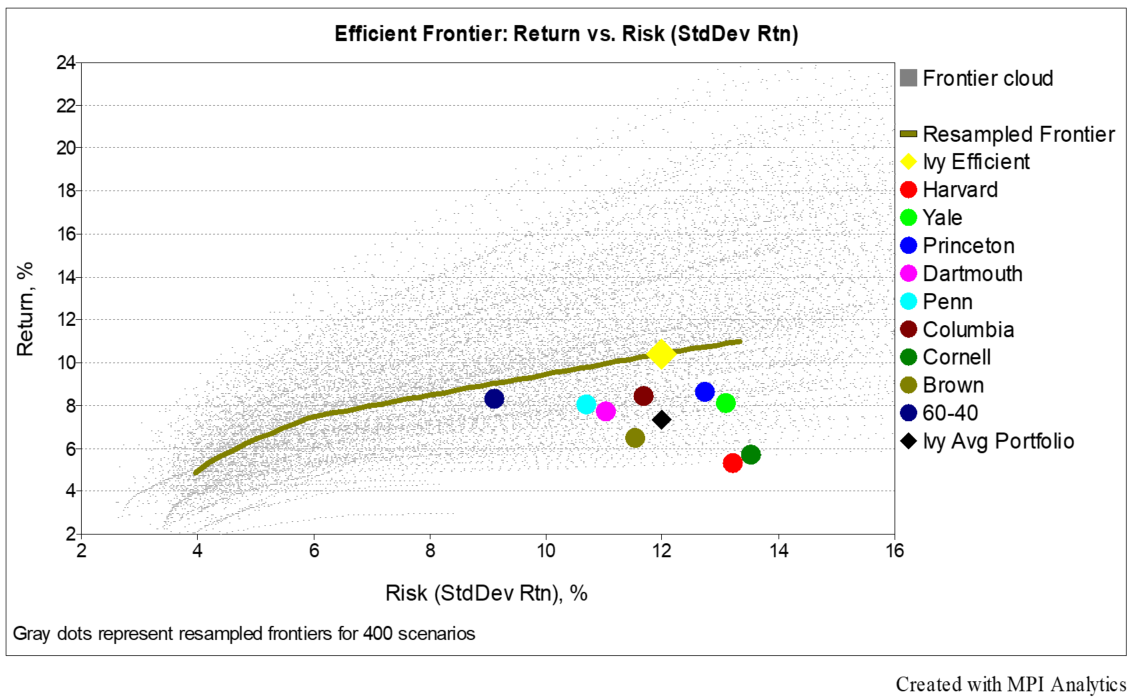

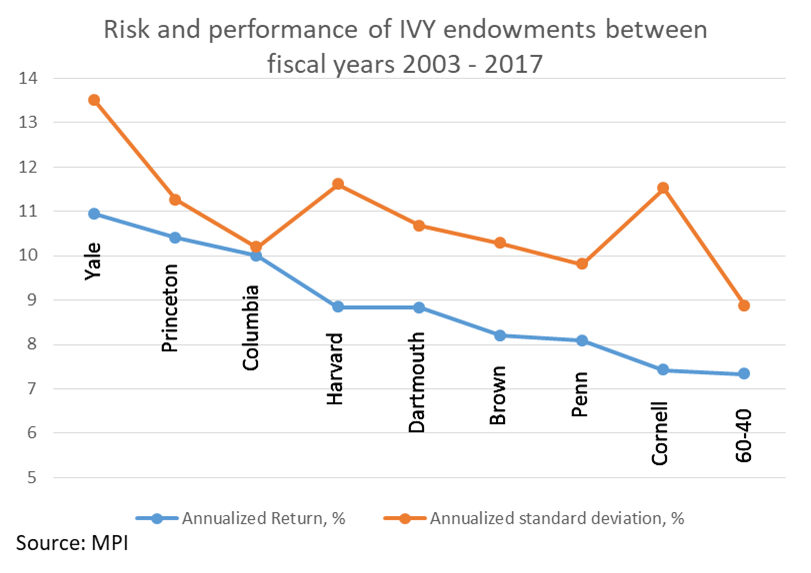

It is generally known that endowments invest in risky assets, but quantifying such risks has remained challenging due to a lack of information about returns. We set out to address this challenge and developed a new basis for estimating endowment risks.