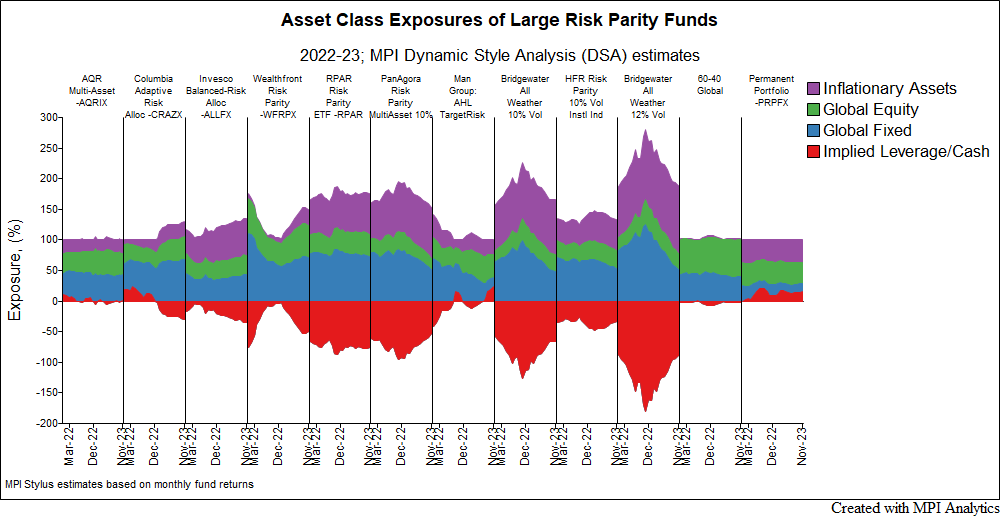

Many high profile funds with set risk targets exhibit levels of volatility last seen only during the Global Financial Crisis. This and the disparity of results between funds in the category is the subject of this post.

Many high profile funds with set risk targets exhibit levels of volatility last seen only during the Global Financial Crisis. This and the disparity of results between funds in the category is the subject of this post.

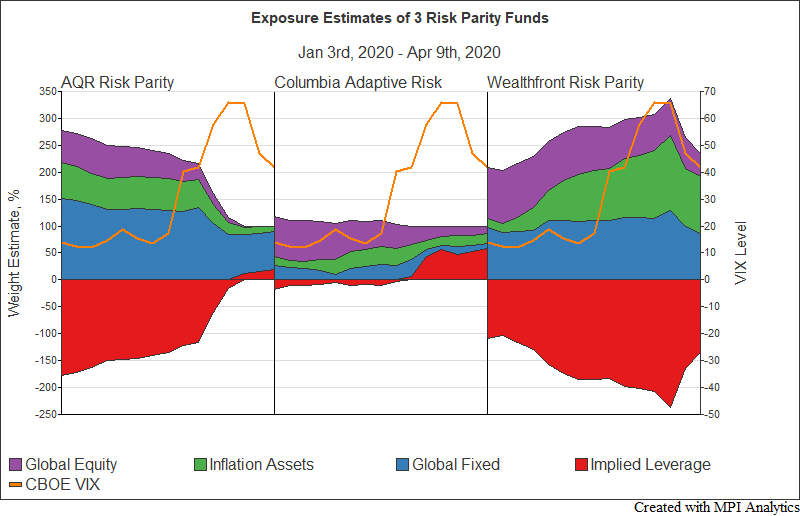

How have risk parity funds actually acted (or reacted) during the current crisis? We use our Stylus Pro system to estimate changes in allocations and leverage levels.

Webcast: March 23, 2020 & March 26, 2020

A returns-based factor framework provides an elegant way to understand the drivers of complex strategies and assessing their behavior in times of market stress. Using Bridgewater’s All Weather and Pure Alpha as examples, MPI will demonstrate how factor analysis can be used to monitor daily market swings of investments in the current chaotic environment.

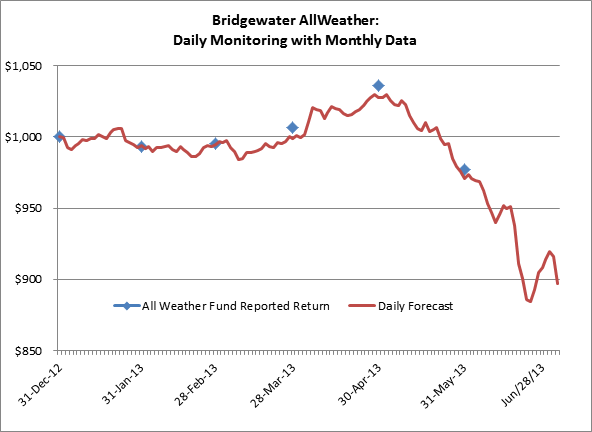

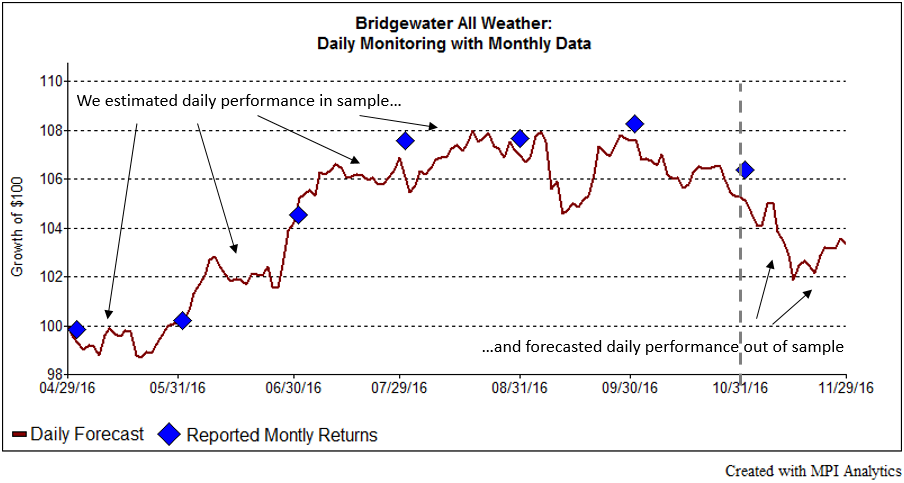

We use Bridgewater All Weather, one of the largest hedge funds, to illustrate how to quantitative techniques could provide investors with a more dynamic understanding of the potential fund behavior intra-month using only monthly fund data.