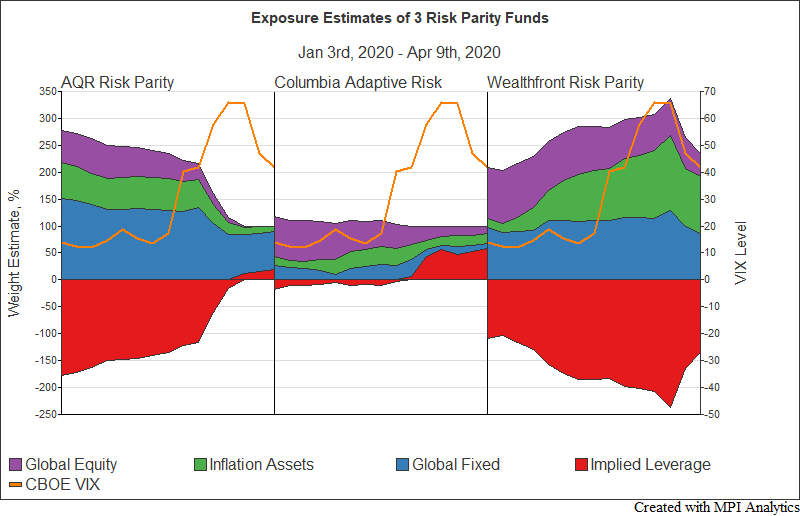

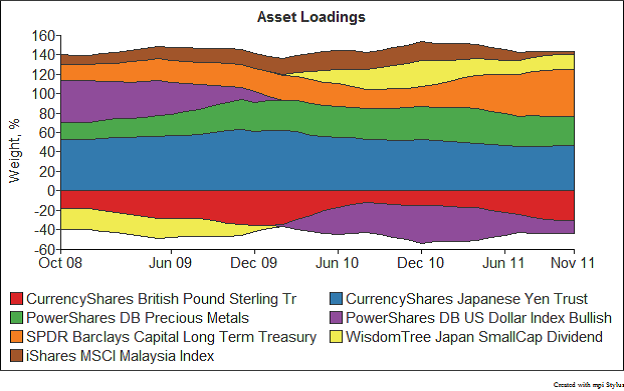

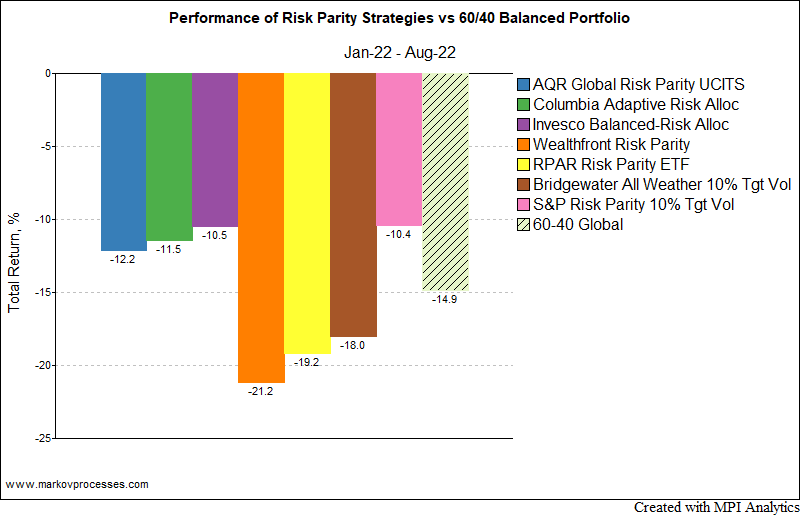

Risk parity strategies can look very different from each other in implementation. They may have different risk budgets, risk targets, asset class buckets or even different definitions of risk. In this particular period, however, the disparity in performance is staggering.