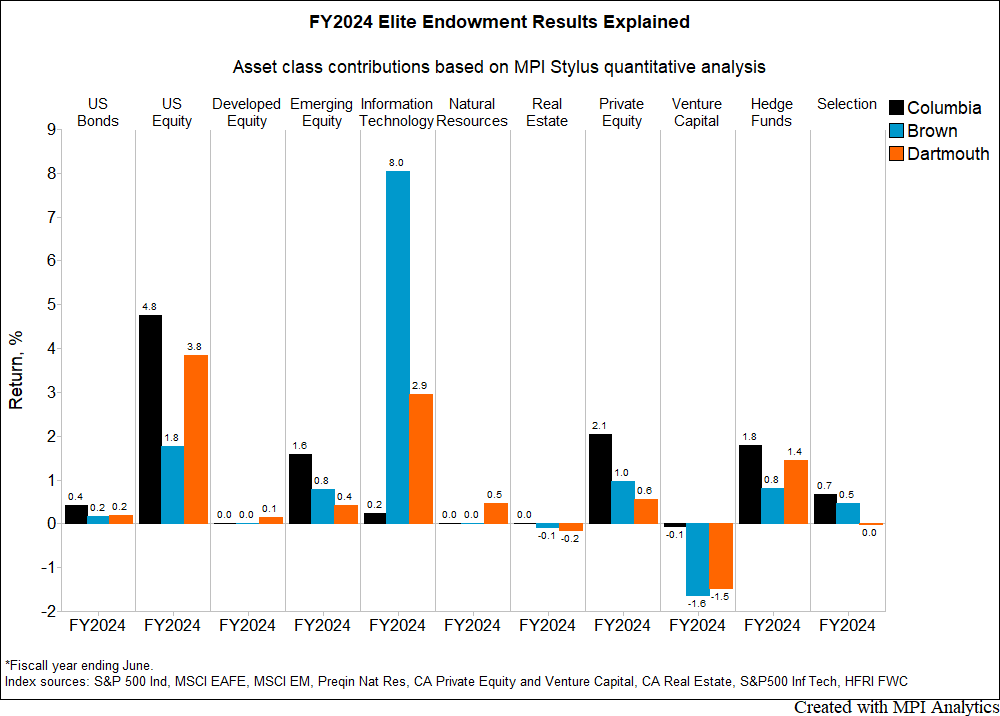

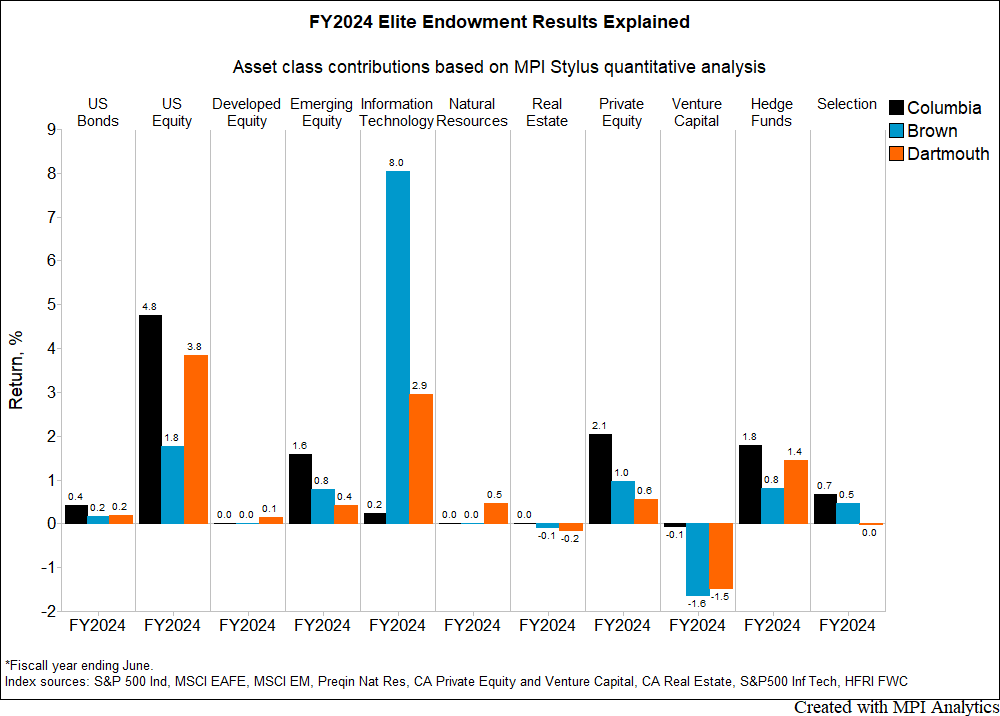

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

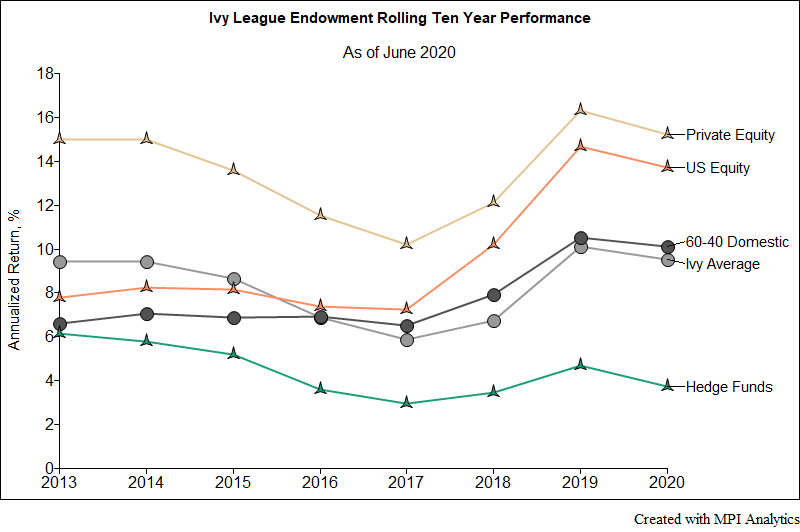

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

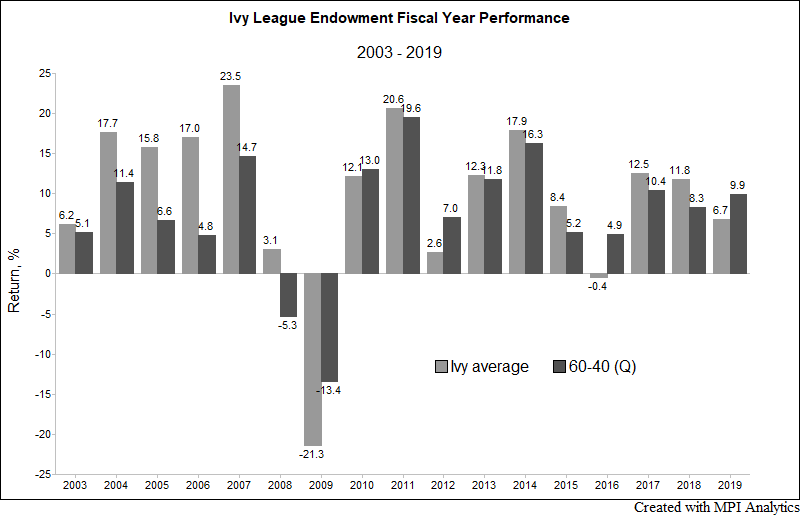

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.

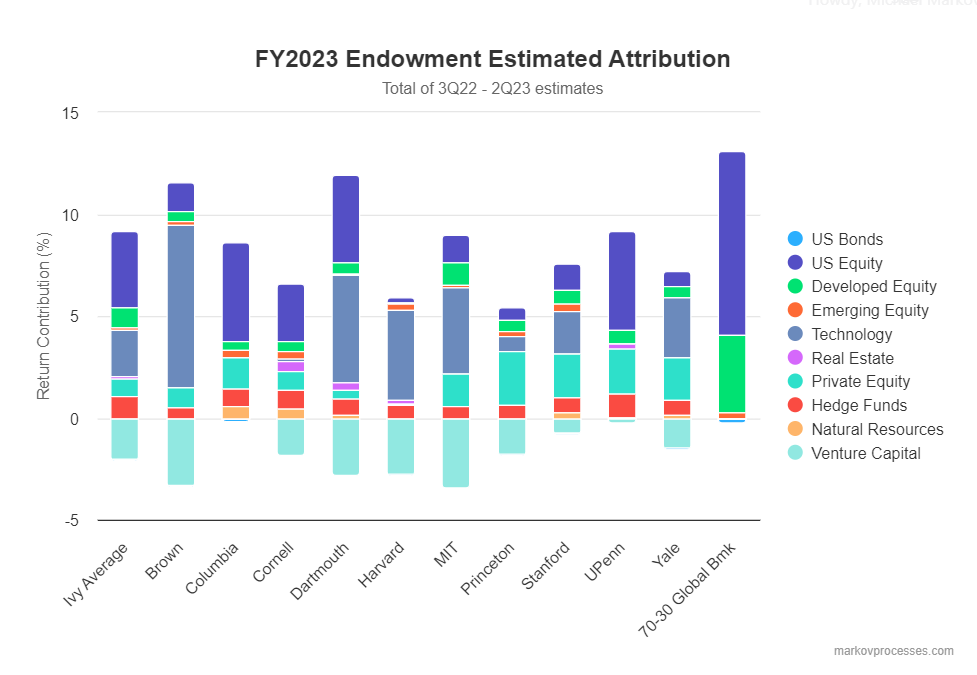

In stark contrast to FY 2016, this past year was a strong one for most endowments. In fact, nearly all the Ivy League endowments, Harvard being the only exception, beat the 60-40 portfolio, a commonly cited benchmark that endowments measure their performance against.

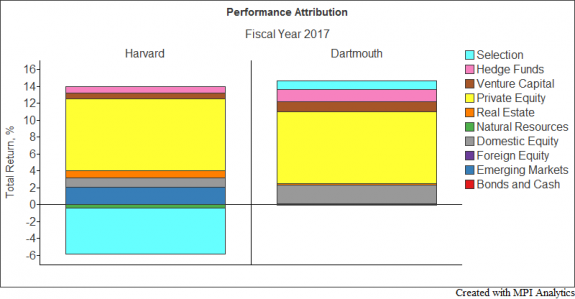

The returns of endowments can be attributed to two fundamental components: asset allocation and security selection. Asset allocation is what a factor model is generally able to explain, shown in terms of factor exposures.