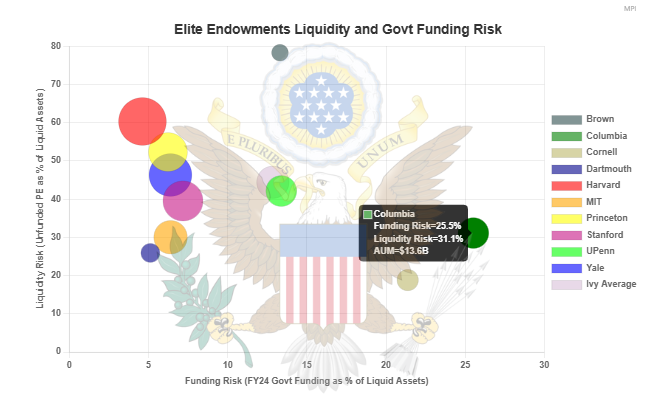

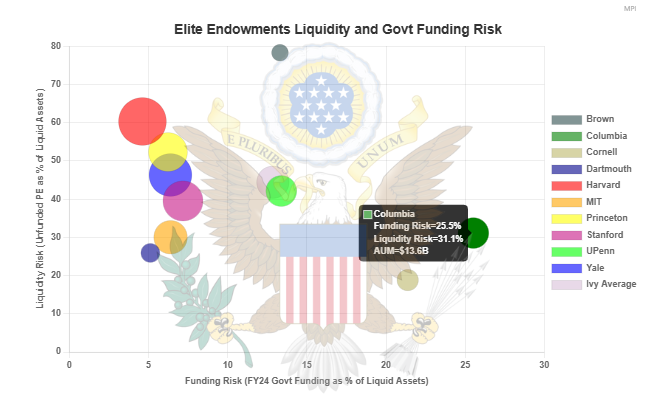

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

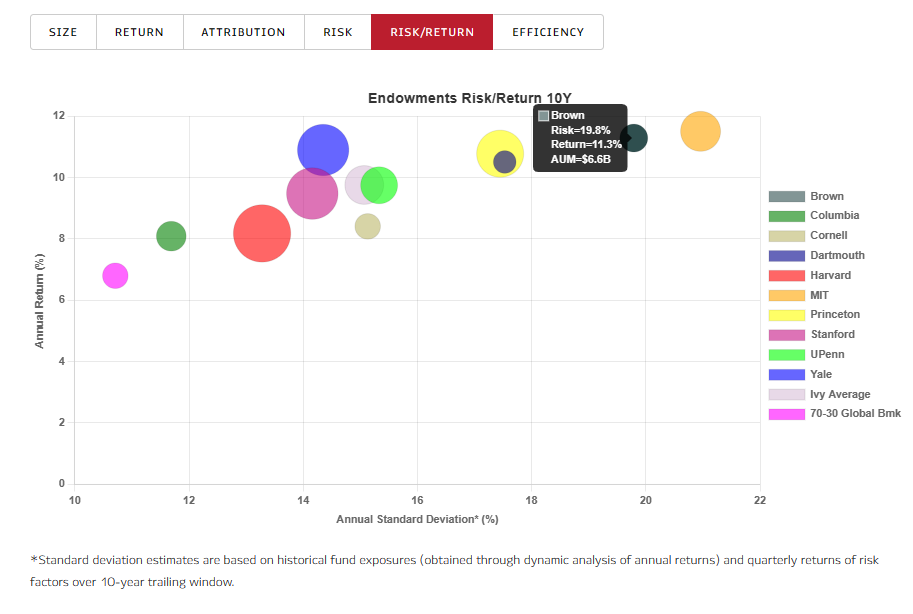

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

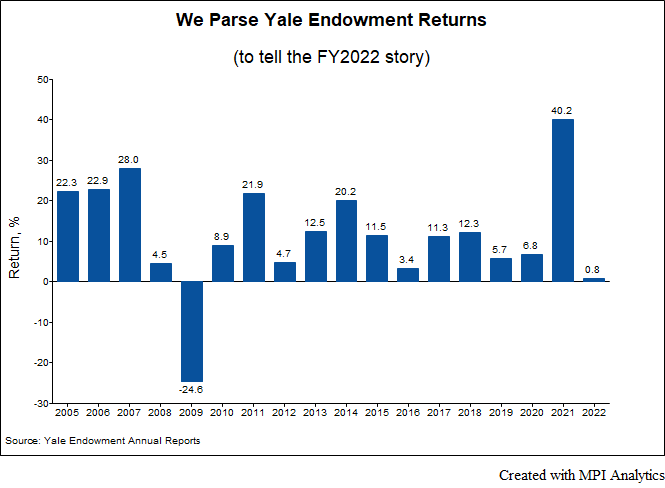

Yale’s been cutting private equity and real estate for years to stay liquid. Did they cut too much, or did they find the right balance for FY2022?

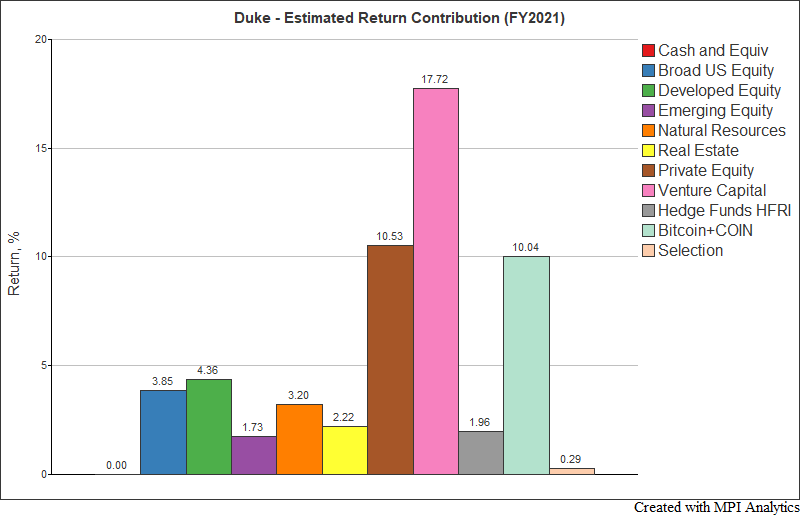

A smart Coinbase investment launched Duke into rare heights in FY 2021. We use MPI Stylus to estimate the size of Duke’s Coinbase position and its impact on this year’s results.

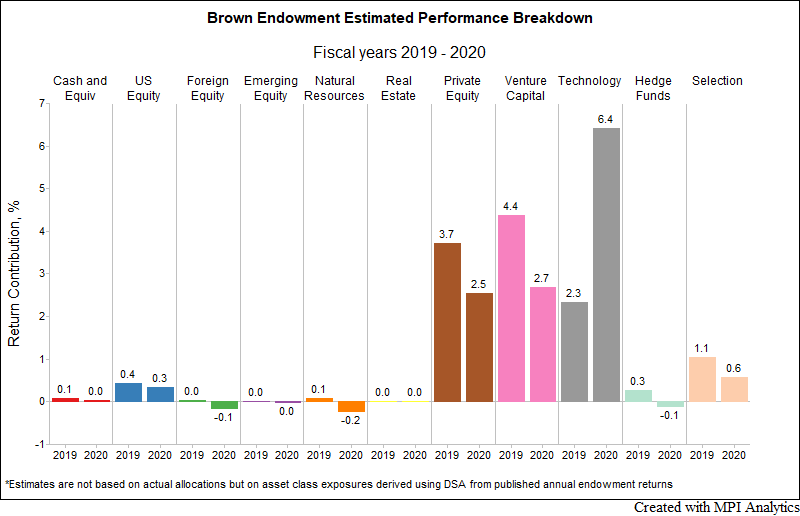

For the second straight year, Brown outperformed all other Ivy endowments by a large margin. Our research team, using MPI Stylus Pro to dissect the endowment annual returns, provides a plausible explanation of the endowment’s spectacular results.

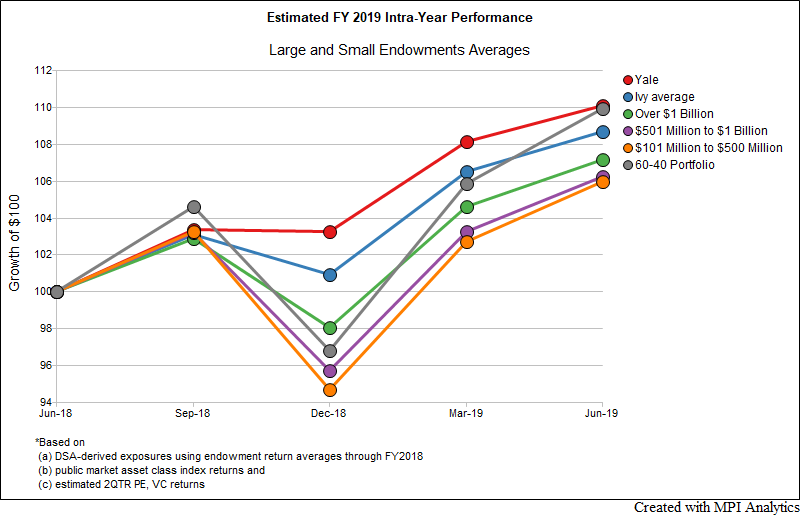

Using our analytical tools and publicly available endowment annual performance data, we project FY2019 performance of large and small endowments, as well as the Ivy League average and Yale

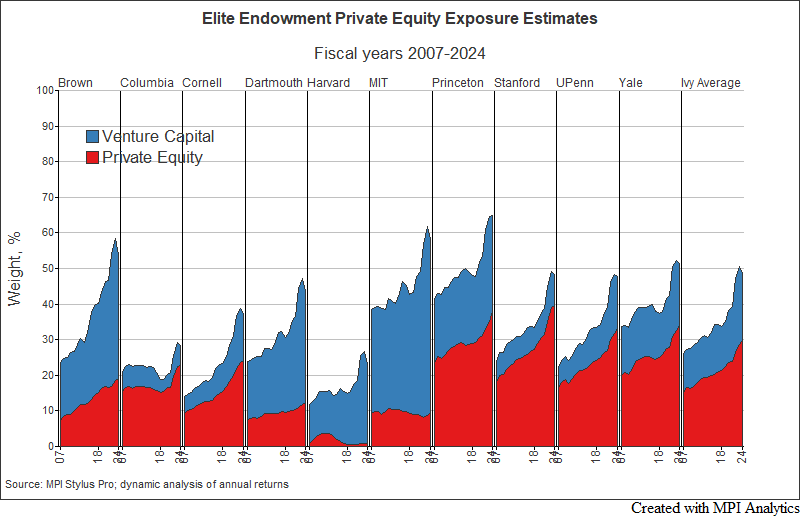

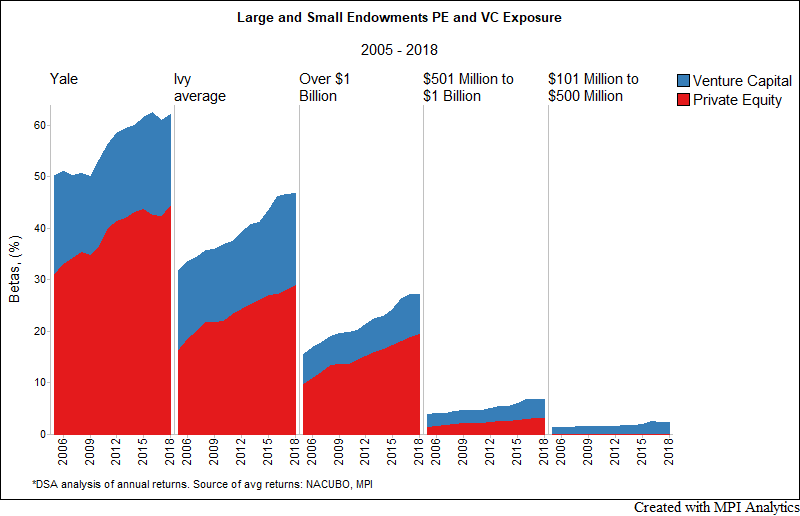

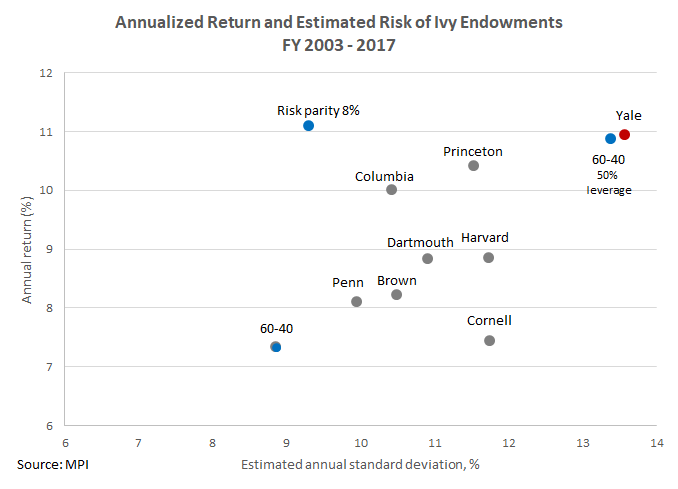

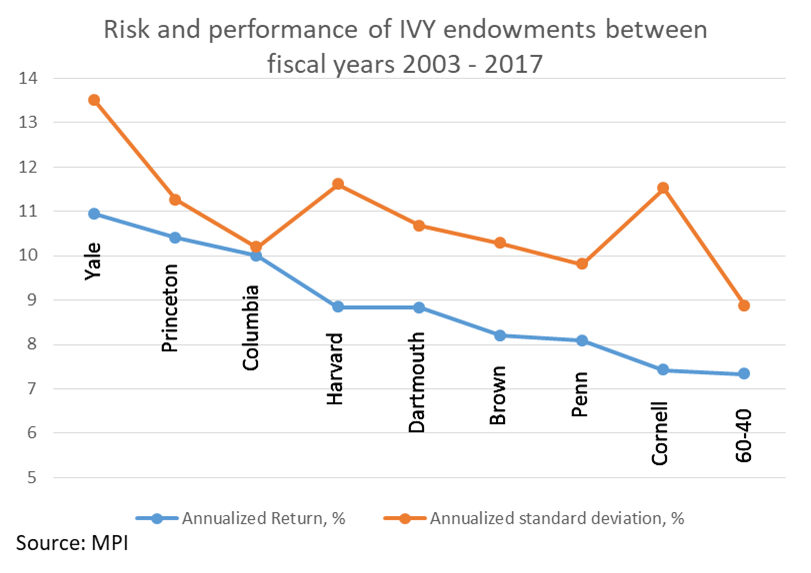

We sought to examine the relationships between endowment size, pedigree and exposure to private assets and what impact that may have on portfolio risk using advanced quantitative methods and a cutting edge methodology to better model the true behavior and risk profile of private market assets.

2017 Yale endowment report rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found…

It is generally known that endowments invest in risky assets, but quantifying such risks has remained challenging due to a lack of information about returns. We set out to address this challenge and developed a new basis for estimating endowment risks.