Barron’s cover story: Harvard and Other Universities Face an ‘Existential Threat.’

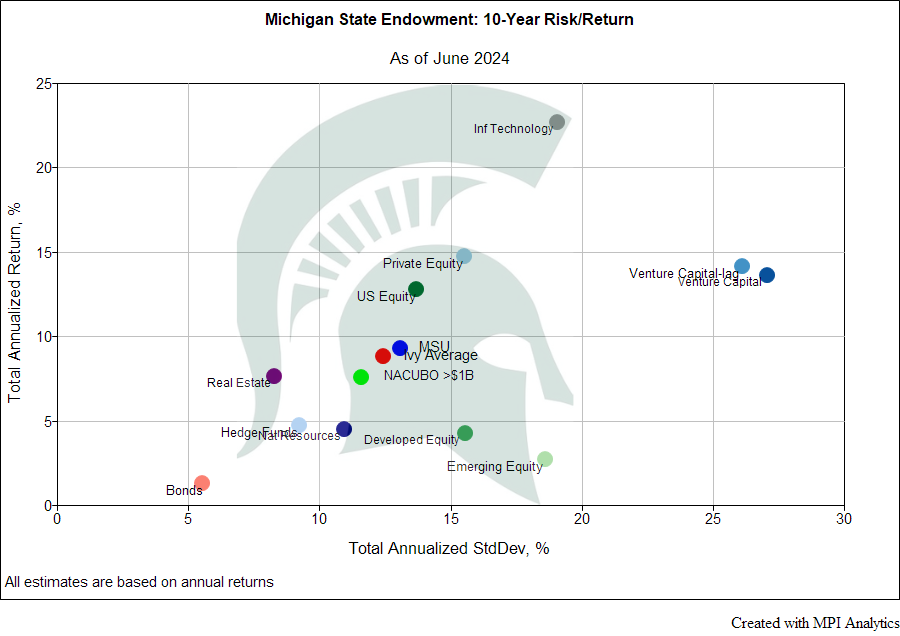

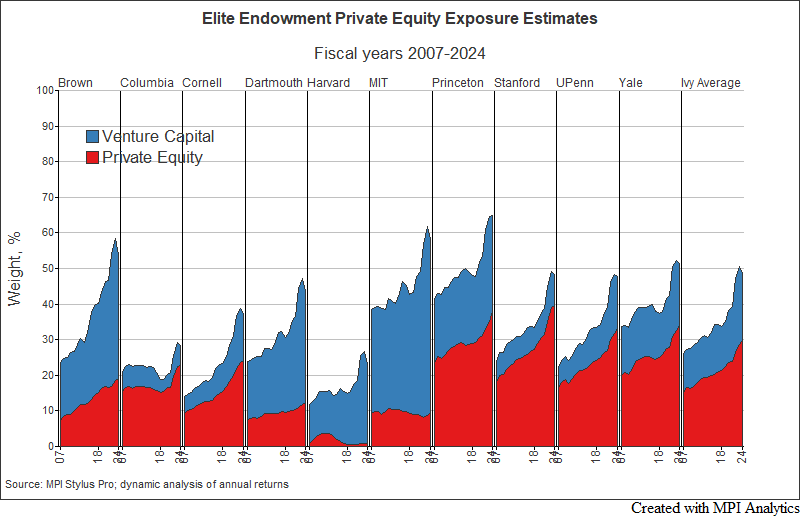

Barron’s magazine cover story Harvard and Other Universities Face an ‘Existential Threat.’ Inside Trump’s War on Endowments offers a deep dive into the financial conundrum facing elite universities—and heavily cites MPI’s data and research Elite U.S. Endowments: Government Funding and Liquidity Pressure. “Yet squeezing more from endowments isn’t simply a matter of flipping a switch. Markov’s analysis suggests that universities such as Brown, Harvard, Yale, and Princeton—in part due to their high exposure to private equity—are already constrained to generate more liquidity,” write Barron’s Abby Schultz and Andy Serwer, echoing MPI’s assertion that poor endowment liquidity is a deliberate feature of the “Yale model” pioneered by the legendary David Swensen. They argue that government pressure comes at the worst possible time for these elite institutions.