MPI Announces Key Drivers of Performance at Bowdoin, Harvard, and the University of Pennsylvania

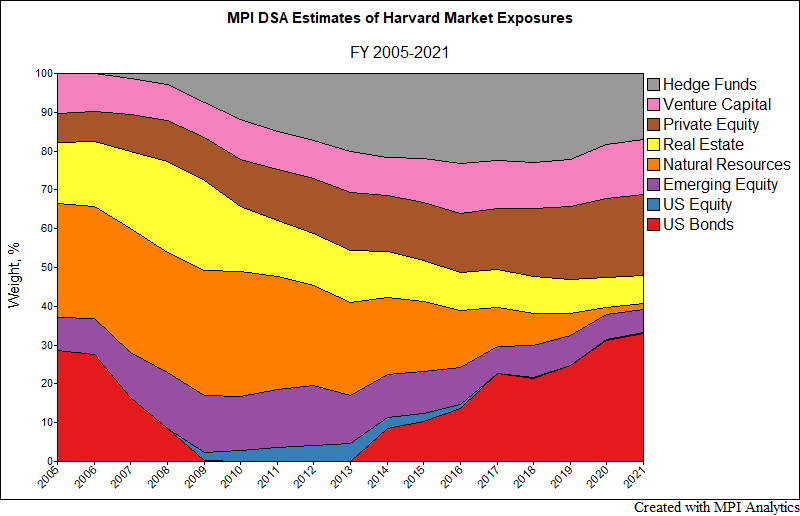

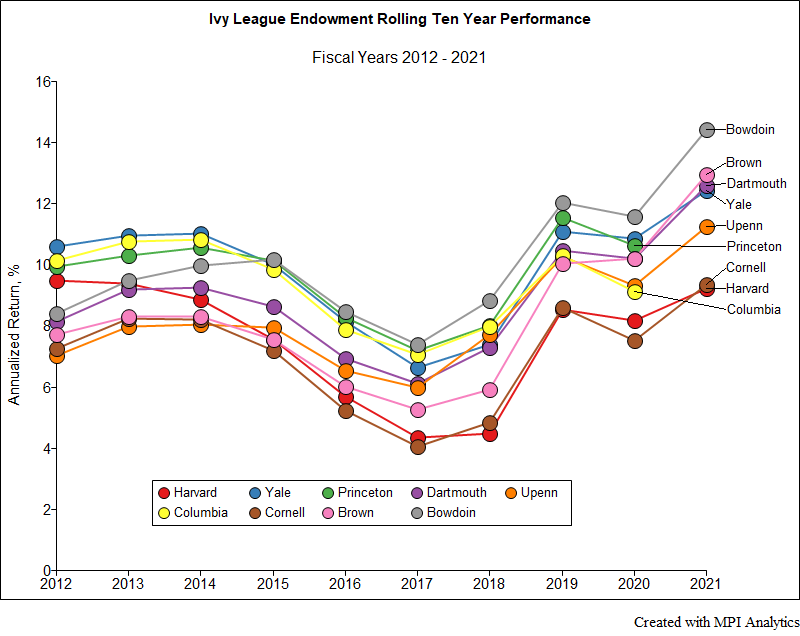

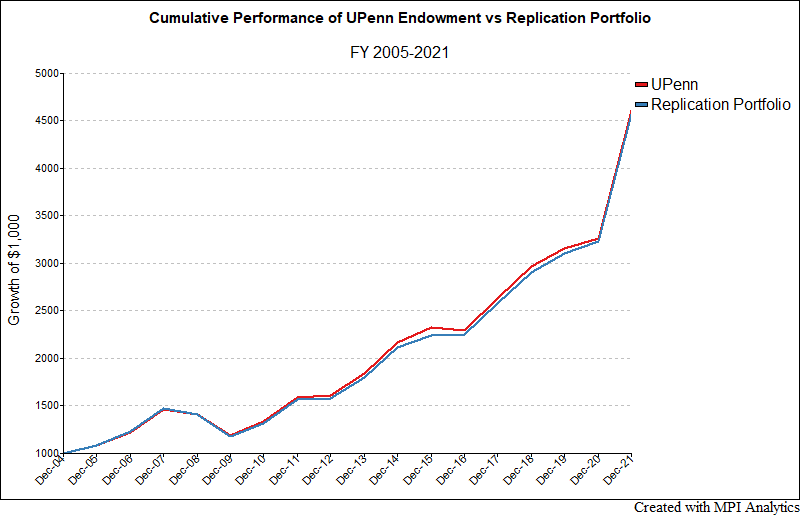

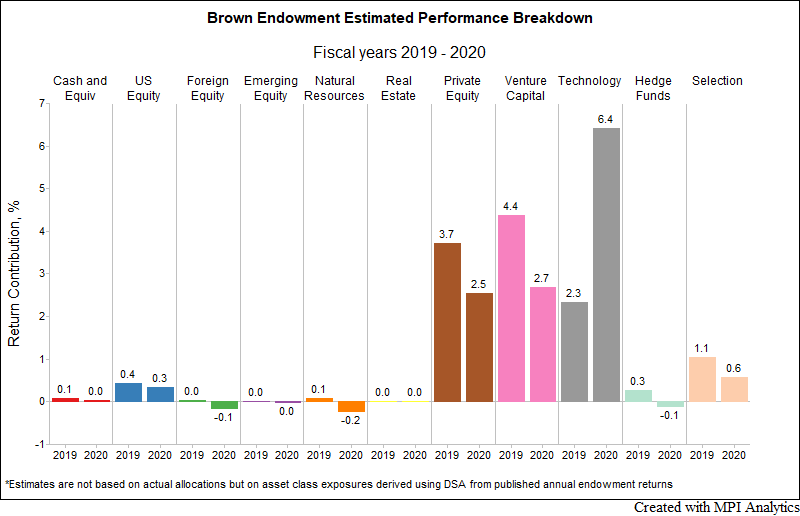

Institutional Investor features MPI’s latest research series on university endowments in fiscal year 2021. In the article, Co-founder and CEO Michael Markov discusses how asset allocation played a far more important role in returns than manager selection.