Hedge Funds have a place in investor portfolios, they’re just too darn expensive and not easy to pick

Hedge Funds have a place in investor portfolios, they’re just too darn expensive and not easy to pick

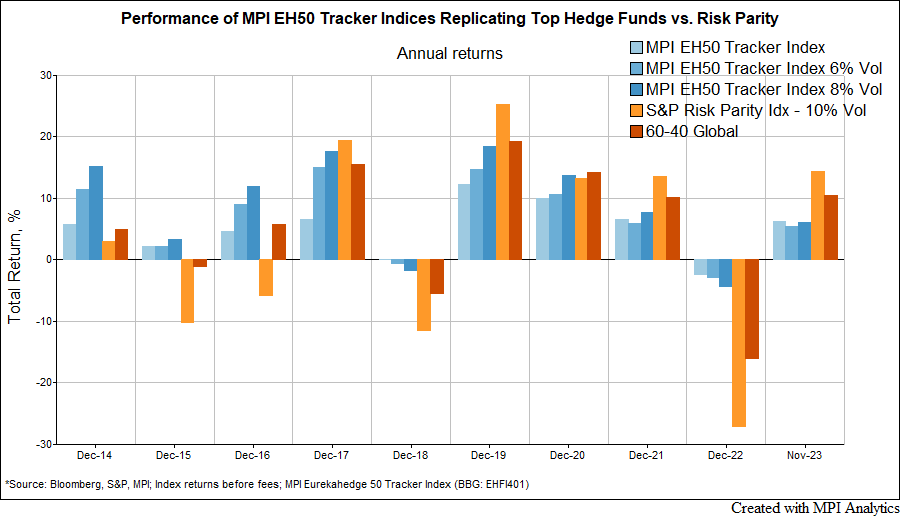

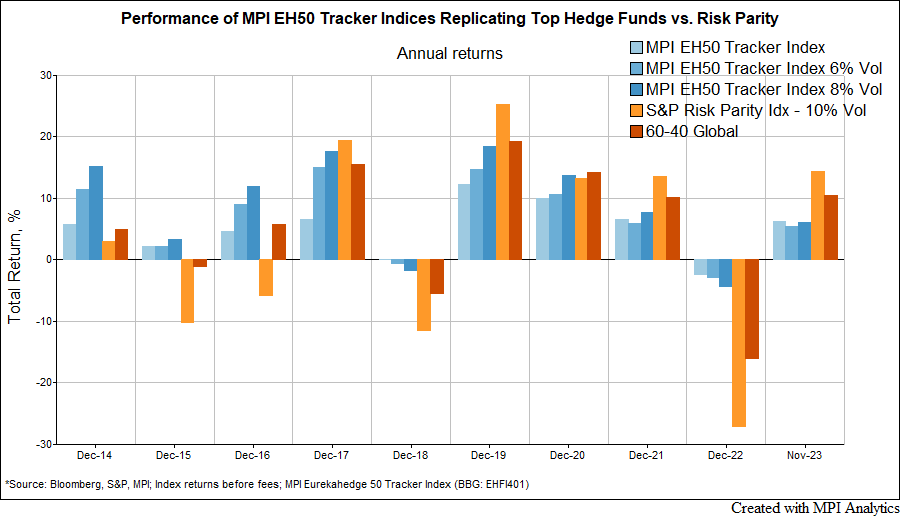

MPI today released eight-year performance data for its MPI Eurekahedge 50 Tracker Index that indicate its basket of liquid, retail exchange-traded funds can deliver the performance of a diversified portfolio of institutional-quality hedge funds.

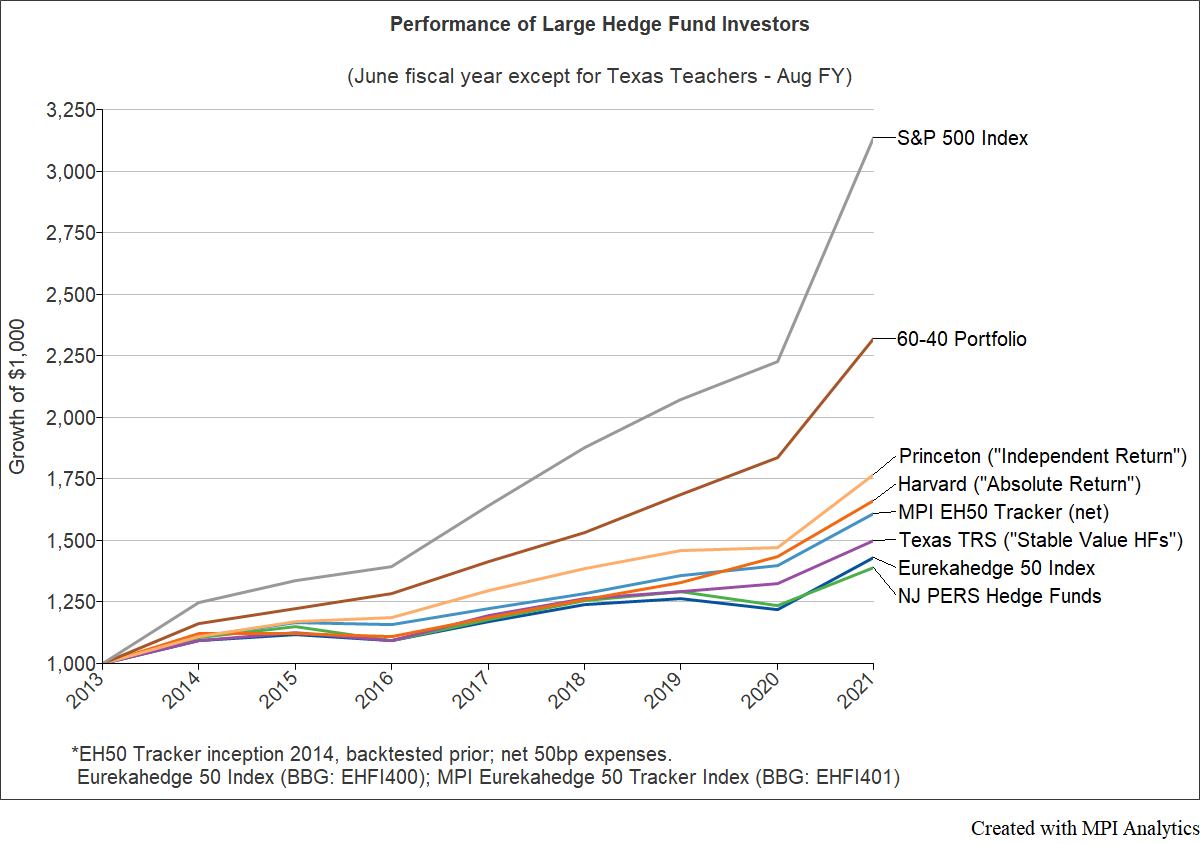

“Evidence is piling up that allocators may be better off replicating the returns of the best hedge funds — a more complex version of indexing — rather than investing in them directly, ” writes Julie Segal with Institutional Investor in her piece about MPI’s latest research on Eurekahedge 50 index, developed in partnership with Eurekahedge, and the MPI Eurekahedge 50 Tracker.

Eight years ago, we partnered with Eurekahedge to develop a unique hedge fund benchmark. We review live performance of the index and its liquid tracker – MPI Eurekahedge 50 Tracker Index.

New Benchmarks Deliver Greater Precision for Manager Selection and Daily Monitoring of Portfolio Performance and Risk

MPI partners with Eurekahedge to create and maintain the Eurekahedge 50 Index, a new benchmark index tracking the top 50 hedge funds. The Eurekahedge 50 Index was created to meet the demands of institutional hedge fund investors seeking a more selective benchmark reflective of diversified institutional quality hedge fund portfolios. The Eurekahedge 50 Index tracks the returns of the top hedge funds based on longevity, assets under management and quality of risk-adjusted returns, taking into account stability and consistency. See the press release here.