Hedge Funds have a place in investor portfolios, they’re just too darn expensive and not easy to pick

Hedge Funds have a place in investor portfolios, they’re just too darn expensive and not easy to pick

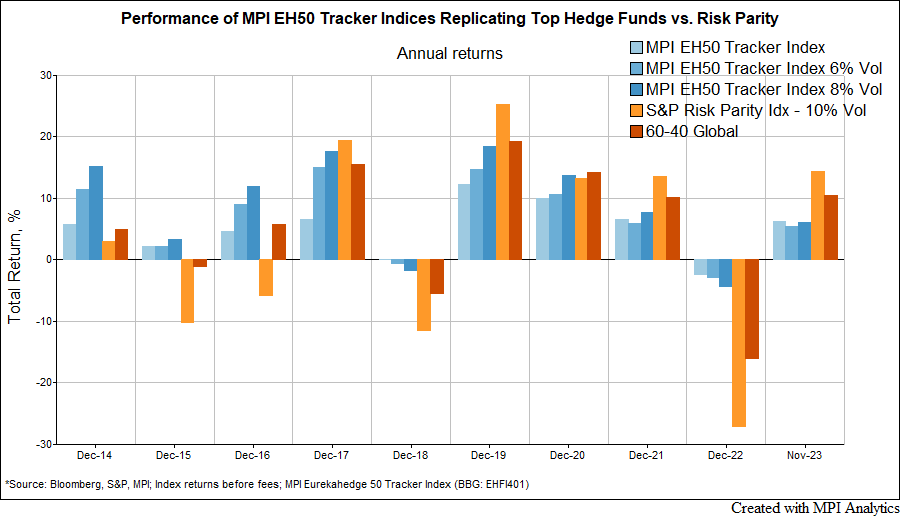

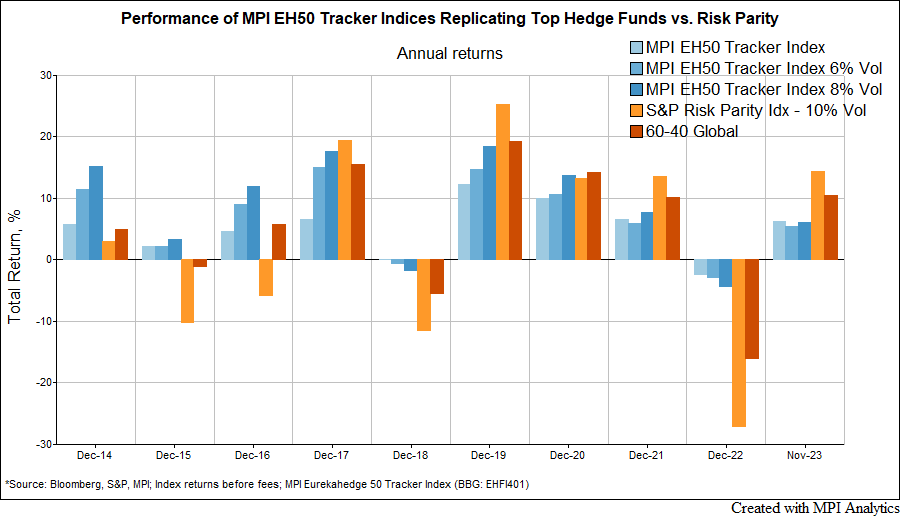

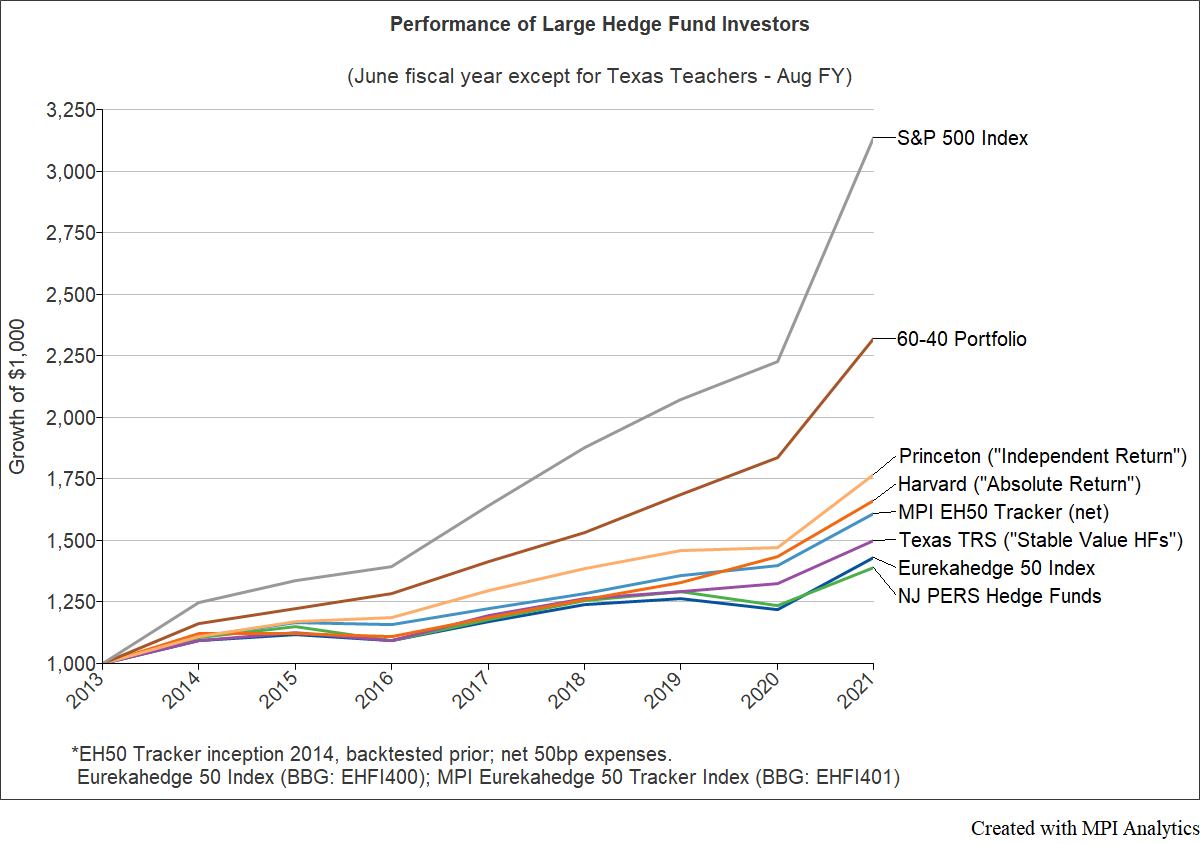

MPI today released eight-year performance data for its MPI Eurekahedge 50 Tracker Index that indicate its basket of liquid, retail exchange-traded funds can deliver the performance of a diversified portfolio of institutional-quality hedge funds.

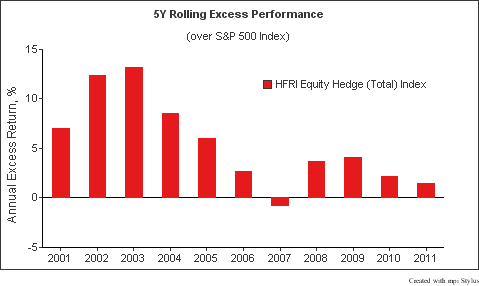

Eight years ago, we partnered with Eurekahedge to develop a unique hedge fund benchmark. We review live performance of the index and its liquid tracker – MPI Eurekahedge 50 Tracker Index.

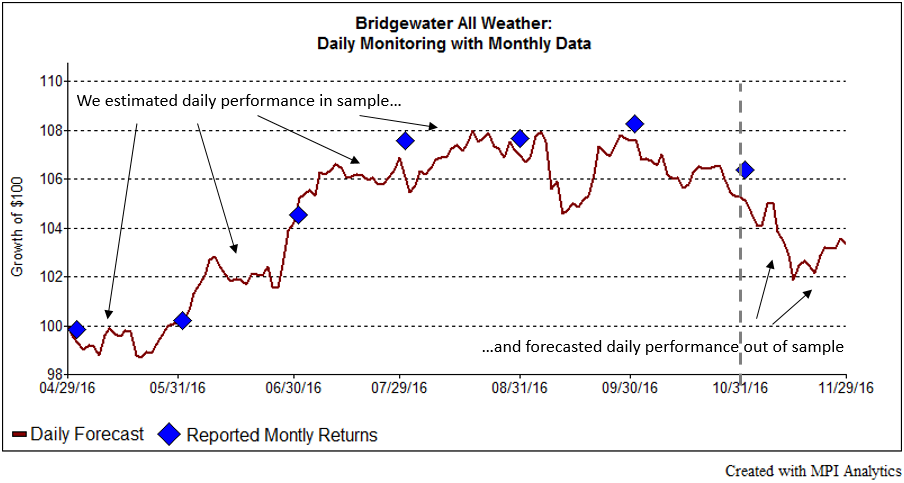

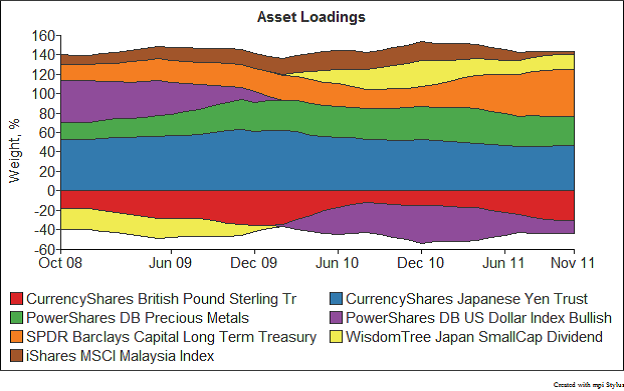

We use Bridgewater All Weather, one of the largest hedge funds, to illustrate how to quantitative techniques could provide investors with a more dynamic understanding of the potential fund behavior intra-month using only monthly fund data.

Using predictive analytics to reproduce the beta exposures of the largest hedge fund