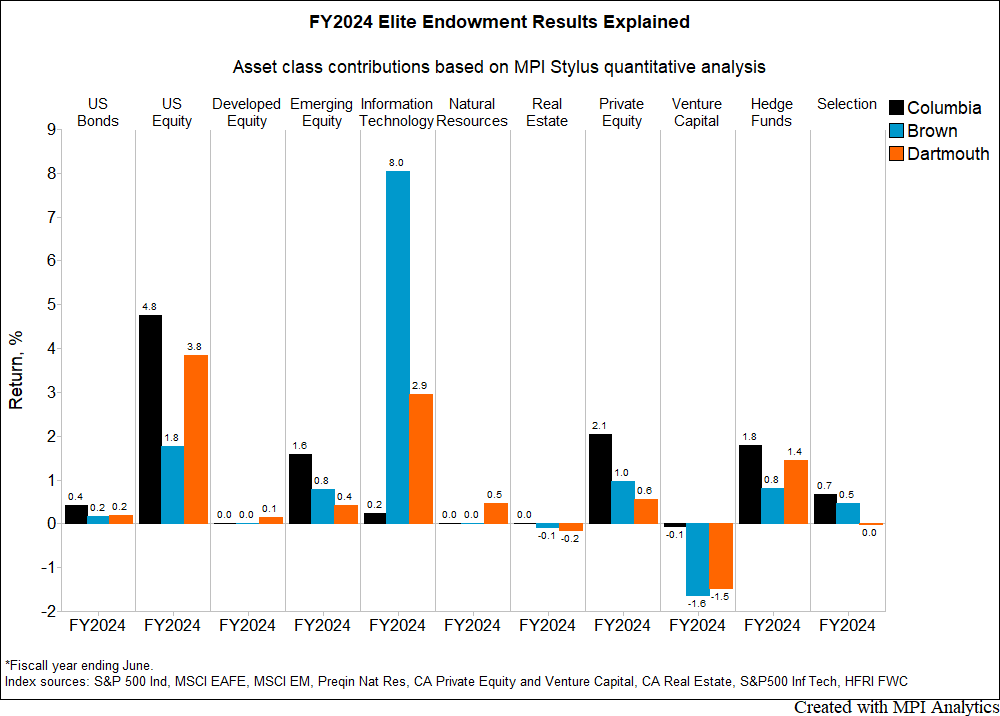

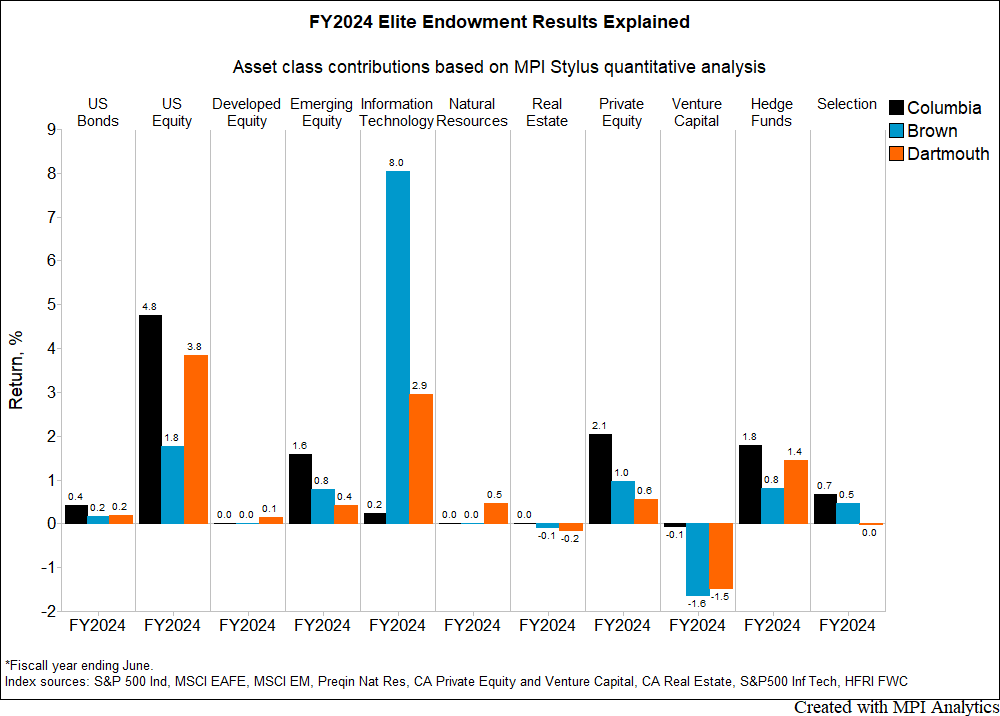

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

With Mag 7 stocks trouncing VC and Private Markets trailing in FY2024, Columbia and Brown lead Ivy endowments but with vastly different risk and exposures

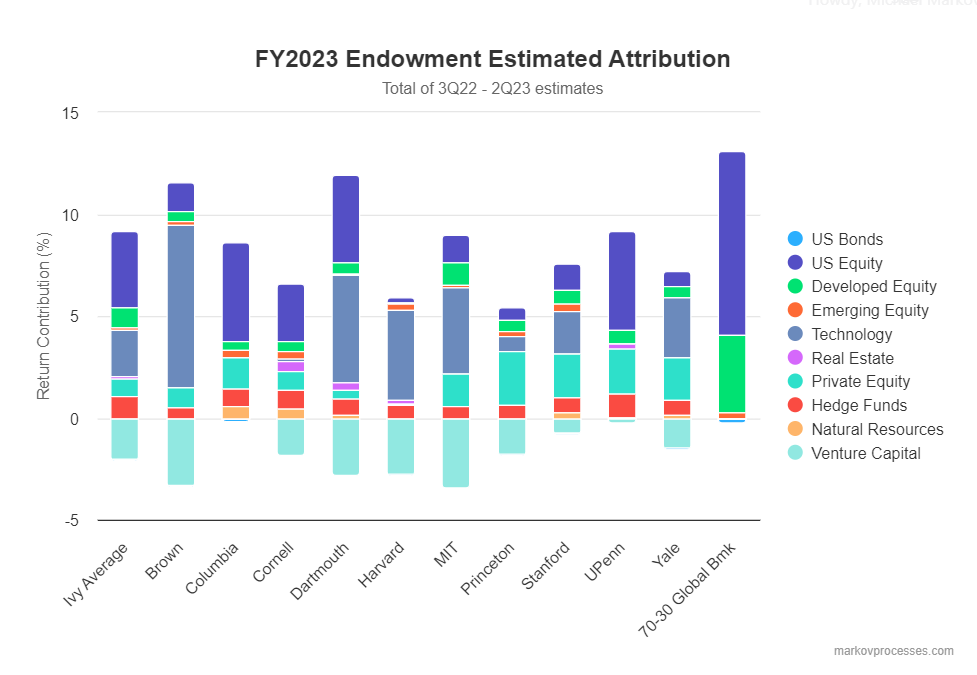

We provide some clues as to why some of the largest endowments have disappointing results in FY2023

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

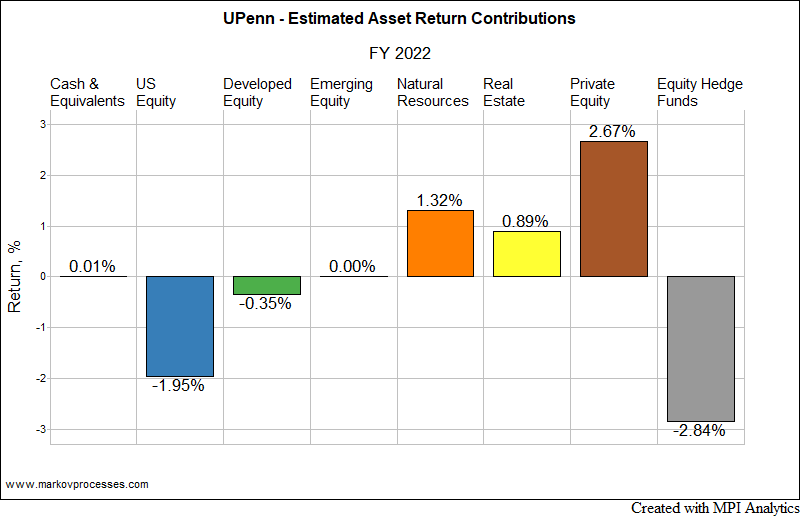

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.

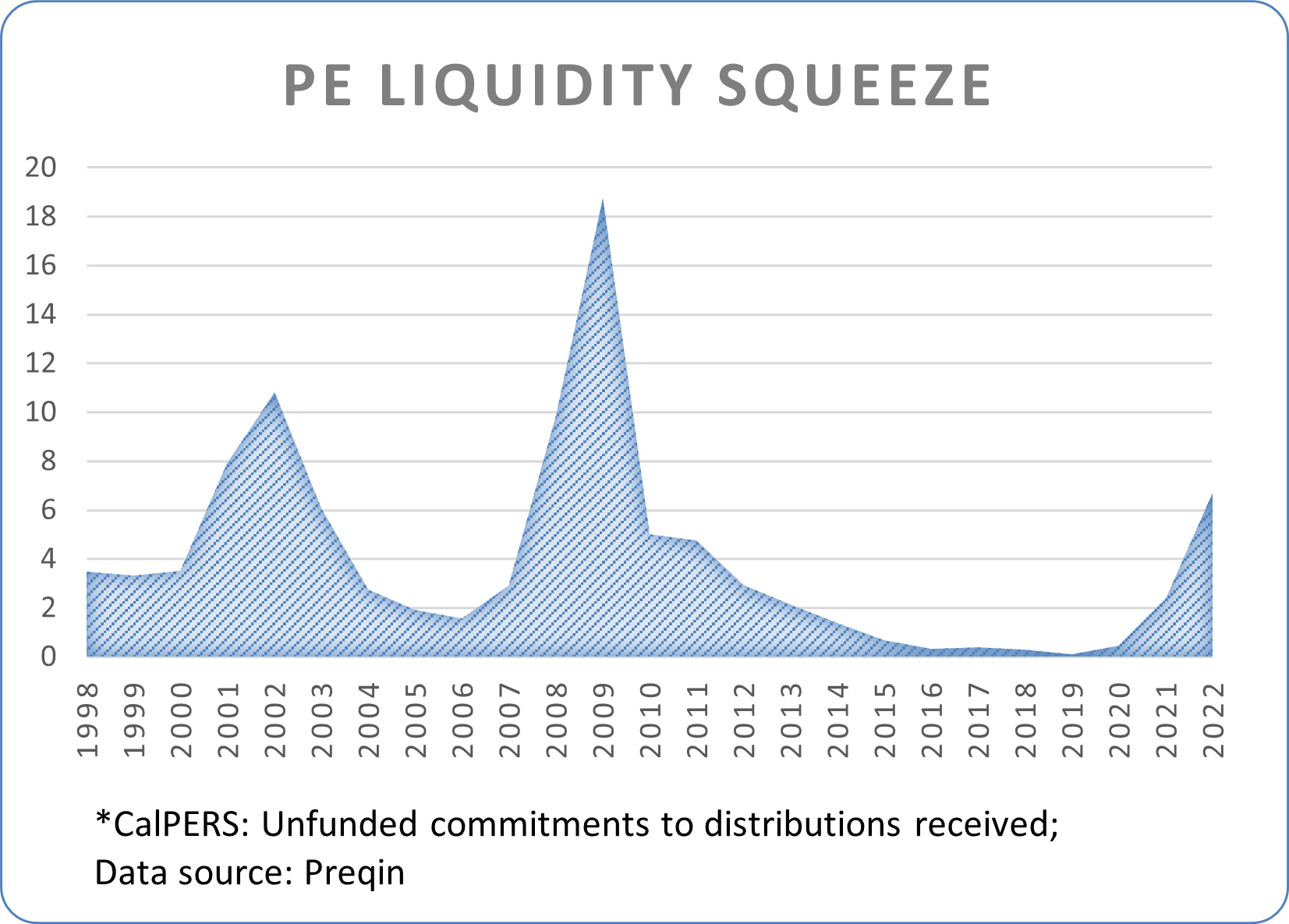

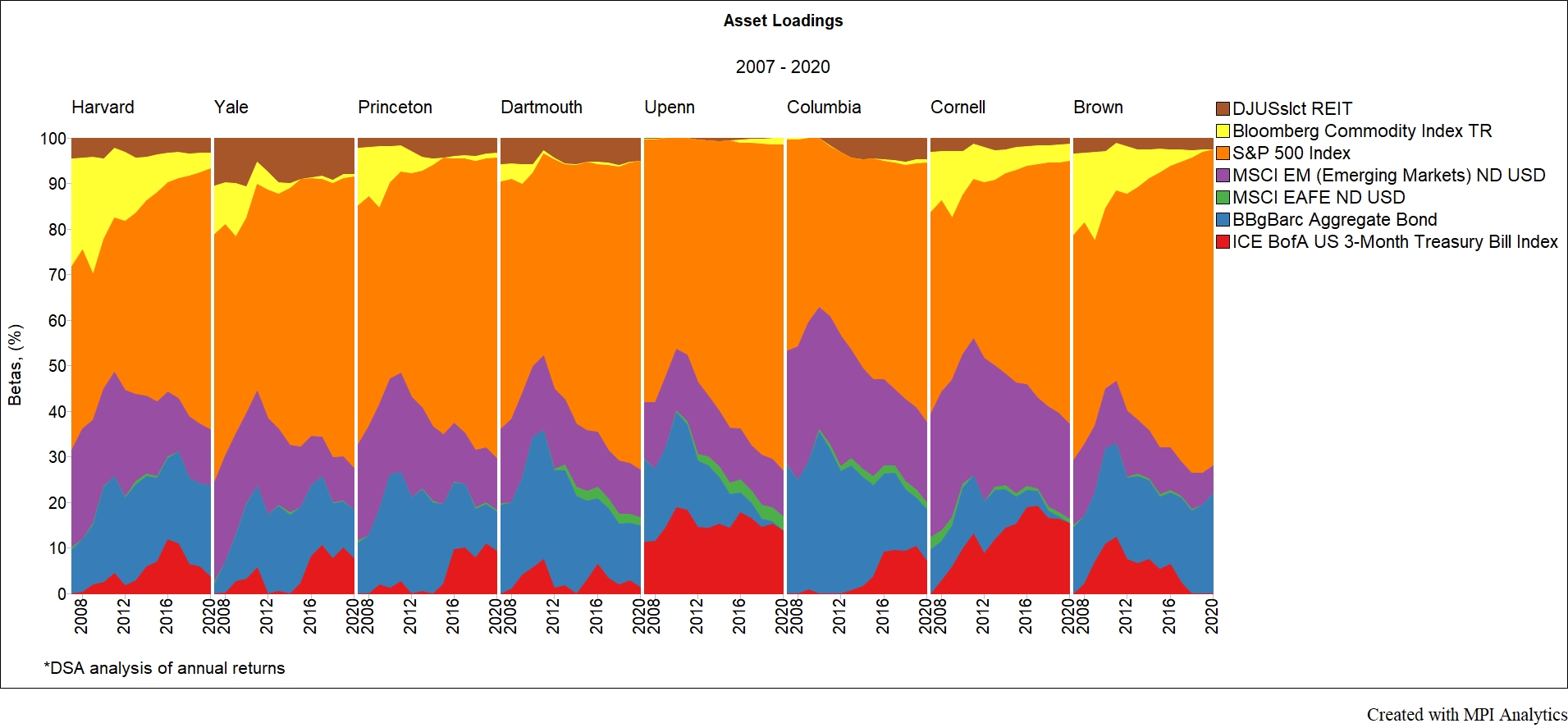

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

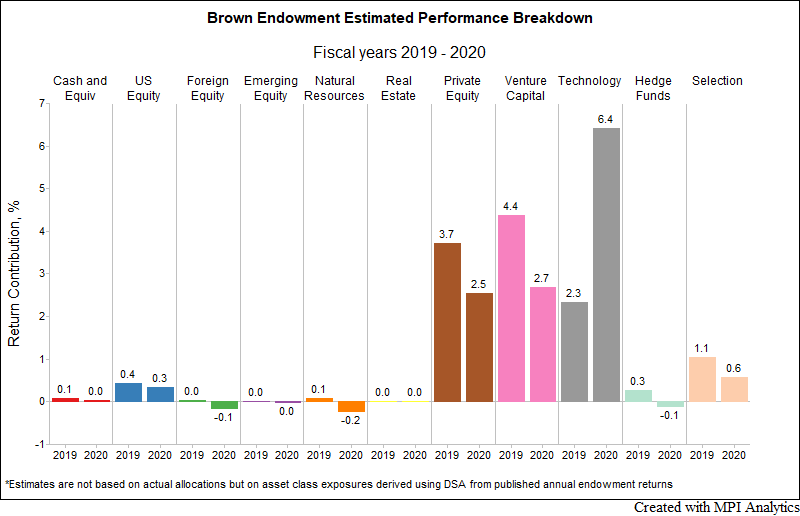

For the second straight year, Brown outperformed all other Ivy endowments by a large margin. Our research team, using MPI Stylus Pro to dissect the endowment annual returns, provides a plausible explanation of the endowment’s spectacular results.

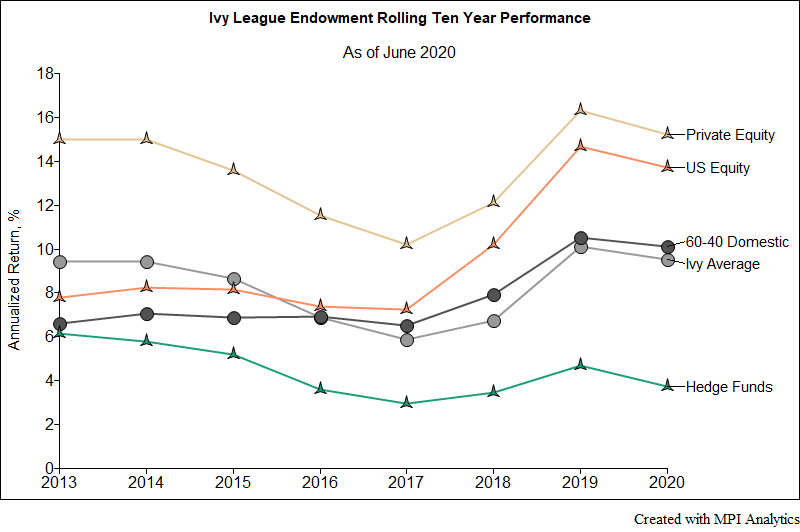

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

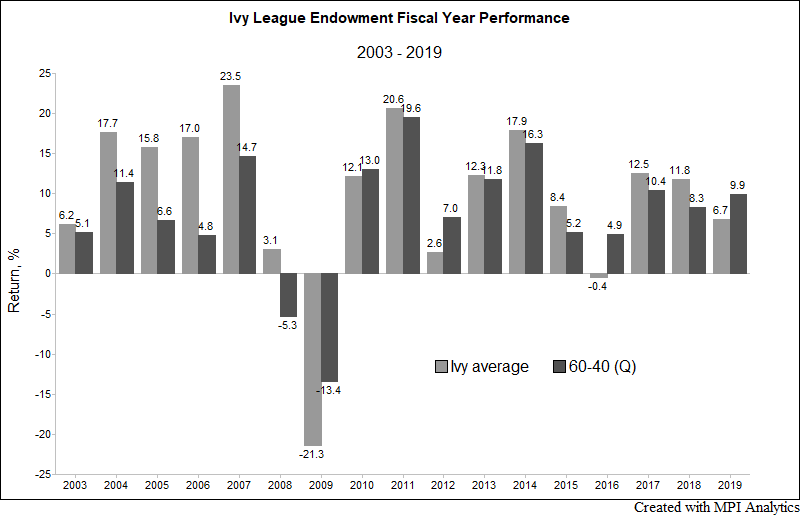

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.