Ivy Endowments Underperform for Second Year in a Row

ThinkAdvisor features MPI’s analysis on the FY20 Ivy Endowment results, with Brown standing out as the exception; beating a 60–40 portfolio of U.S. domestic stocks and bonds.

ThinkAdvisor features MPI’s analysis on the FY20 Ivy Endowment results, with Brown standing out as the exception; beating a 60–40 portfolio of U.S. domestic stocks and bonds.

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

“Last year was a great one for private equity and venture capital, but Ivy League endowments, with their huge allocations to alternative investments, didn’t all benefit, according to MPI.,” writes Julie Segal about MPI’s research in her article in Institutional Investor.

Ivy endowment report offers cautionary tale for investors and allocators to private markets

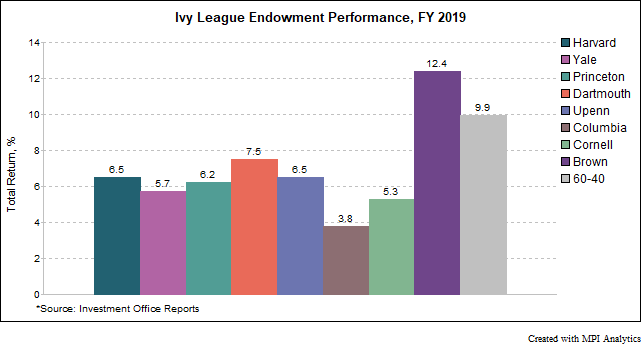

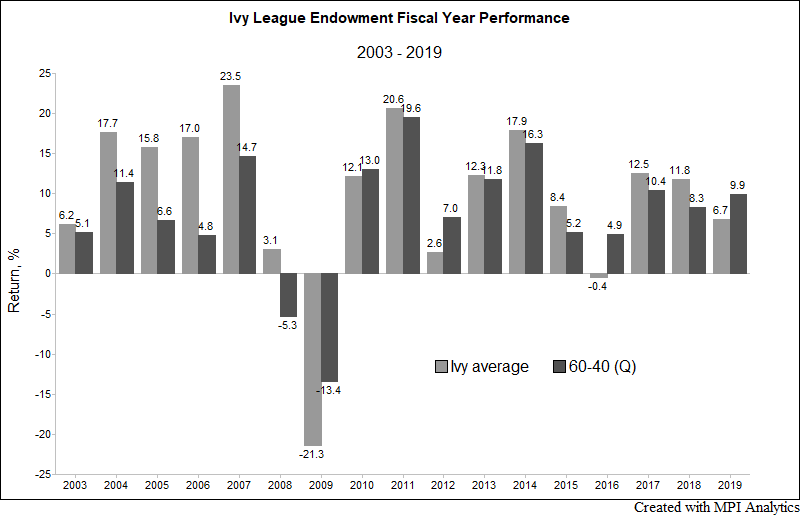

Fiscal year 2019 was a curious year for the Ivy League endowments. In a year with strong returns in key private market investment classes, the average Ivy underperformed a traditional domestic balanced 60-40 portfolio in FY 2019. Ivies also experienced a wider dispersion of returns and saw a shift in the historical positioning of performance leaders and laggards.

Ian McGugan, investing columnist at Canada’s premier daily Globe & Mail wrote a column reviewing the decade and discussing why beta was so hard to beat has a prominent mention of the Ivy endowments’ failure to beat a 60/40 portfolio and MPI’s research.

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.

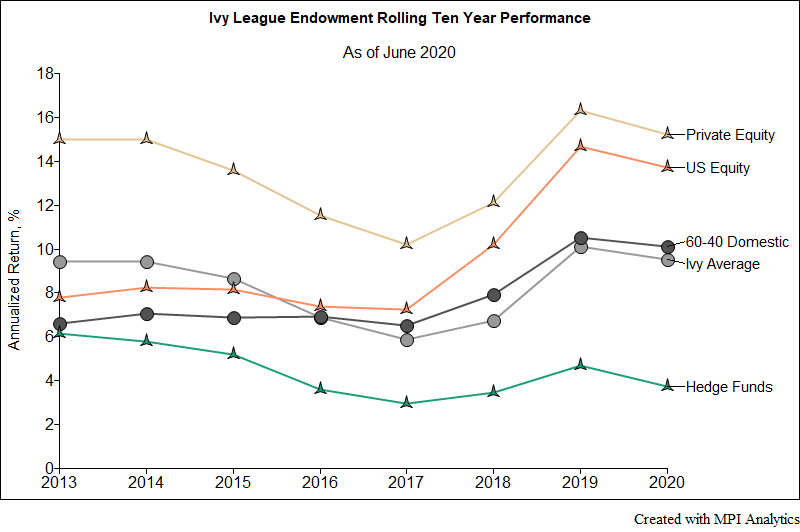

PE and VC exposure seen as drivers of Ivy returns in 2018, but the group’s 10-year performance falls below the traditional 60-40 portfolio