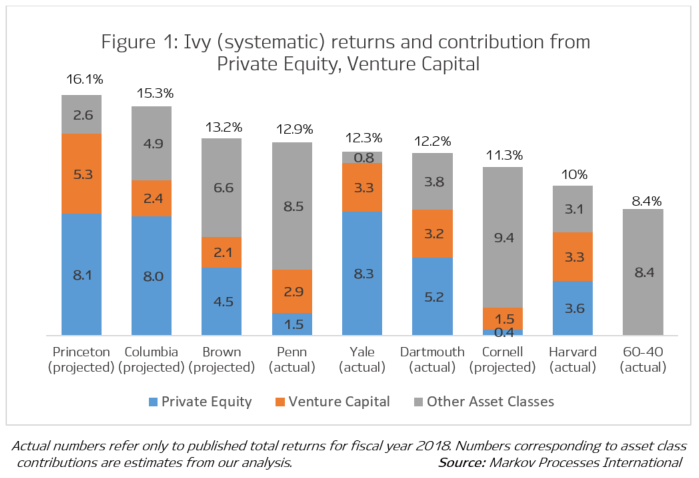

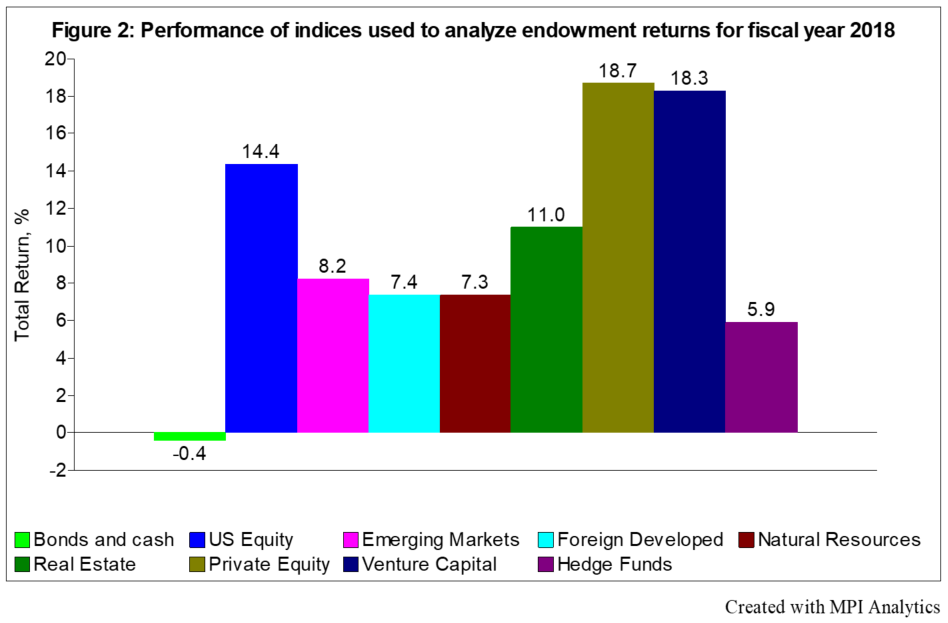

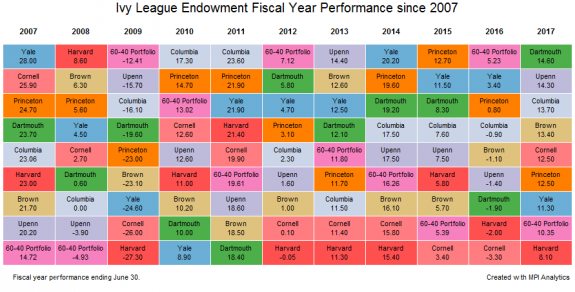

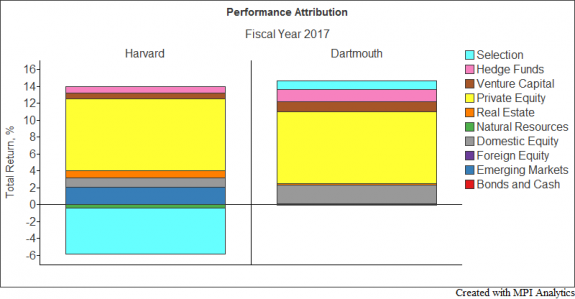

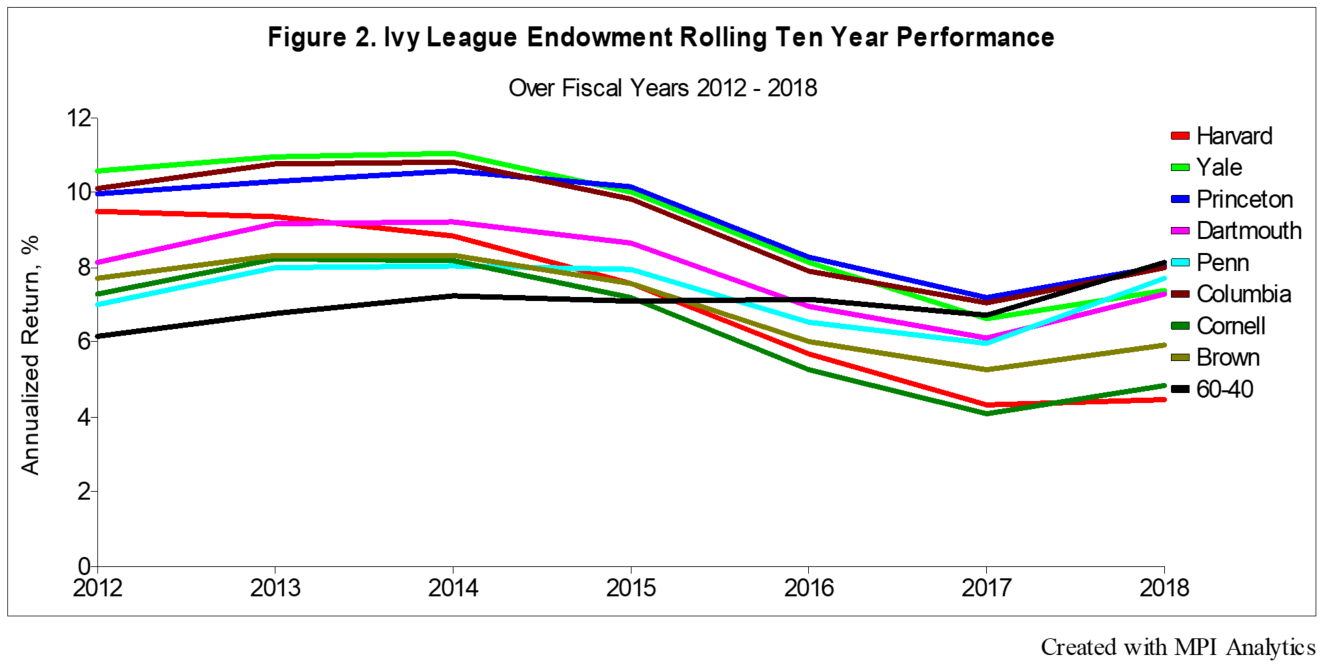

Similar to 2017 performance, this past fiscal year was a strong one for most Ivy League endowments. Fiscal year 2018 is noteworthy, however, for being the first year that long horizon (10-year) returns from all Ivy endowments lagged behind the 60-40 portfolio.