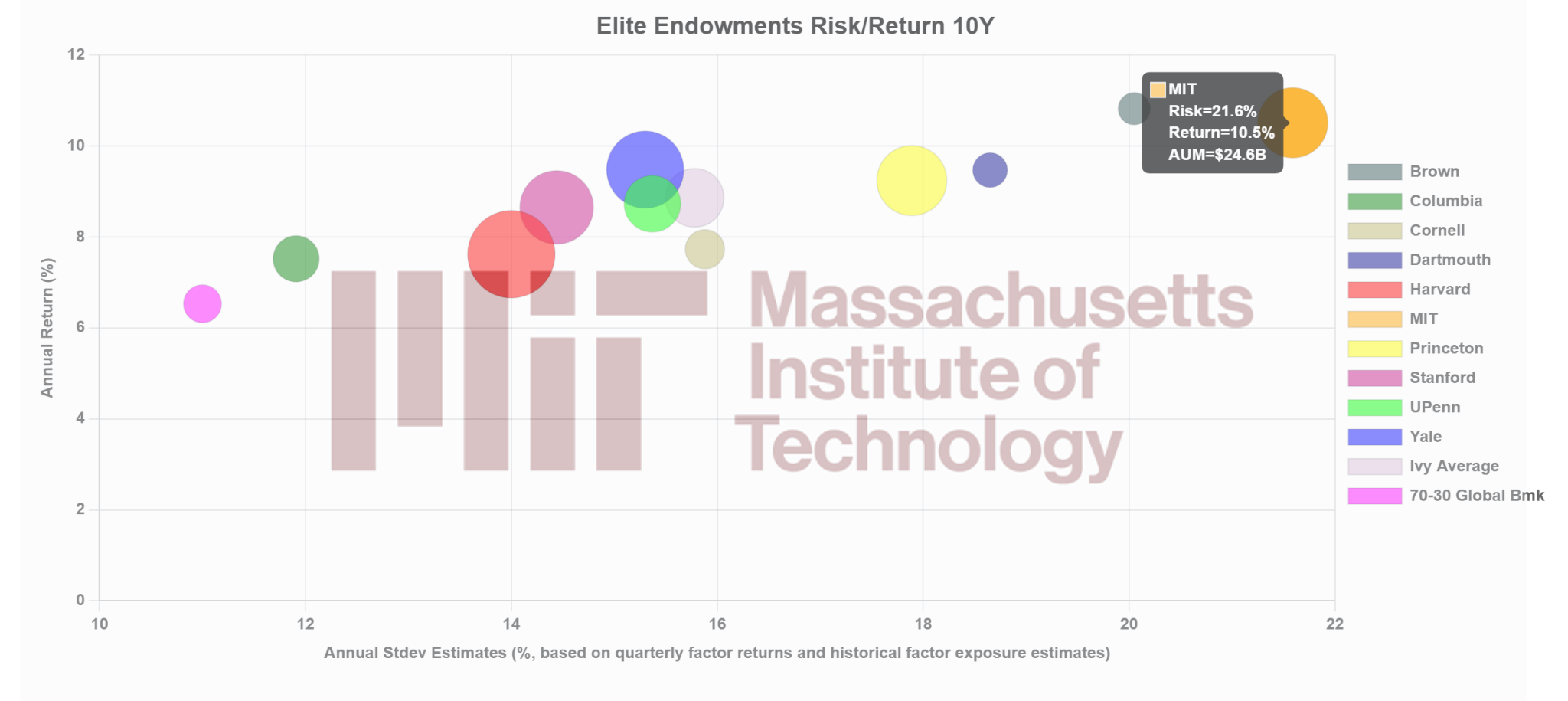

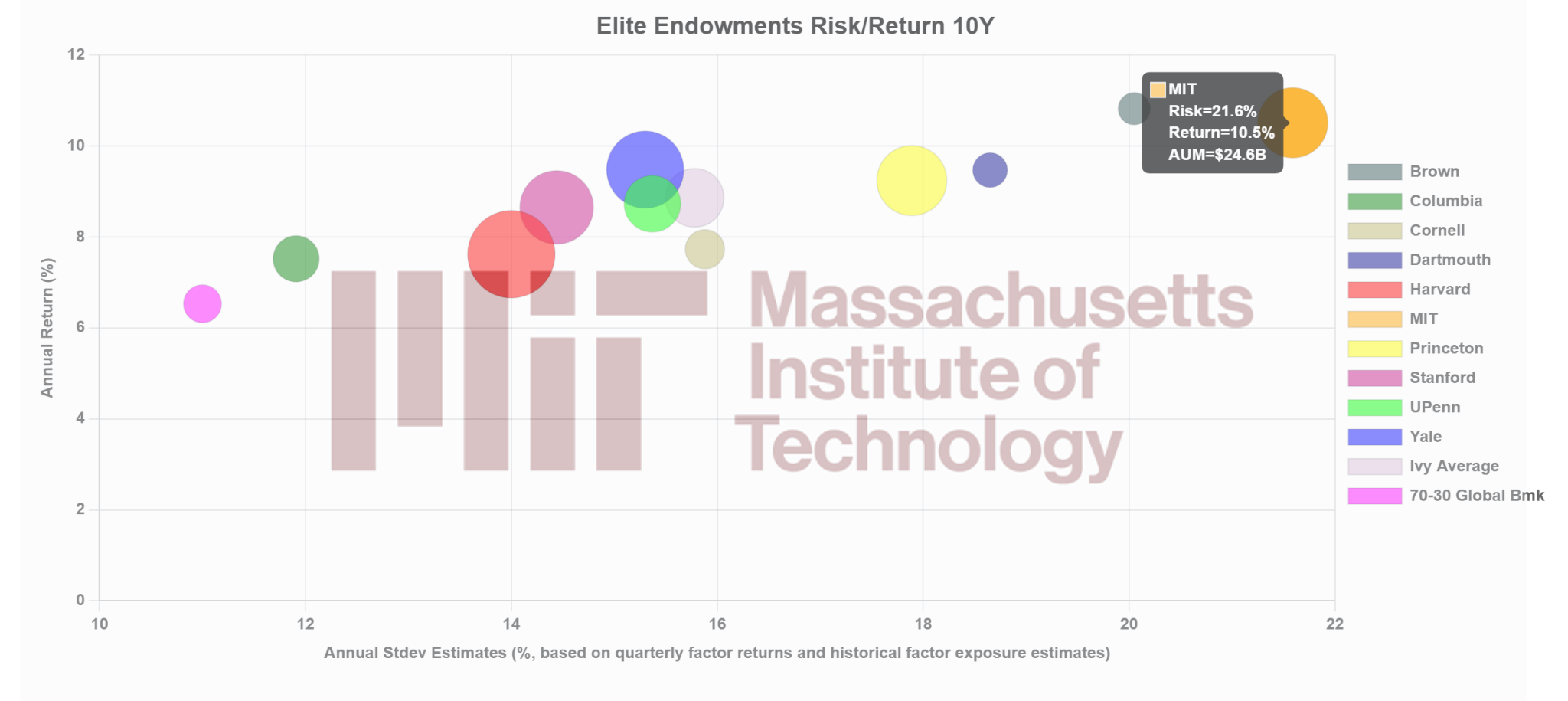

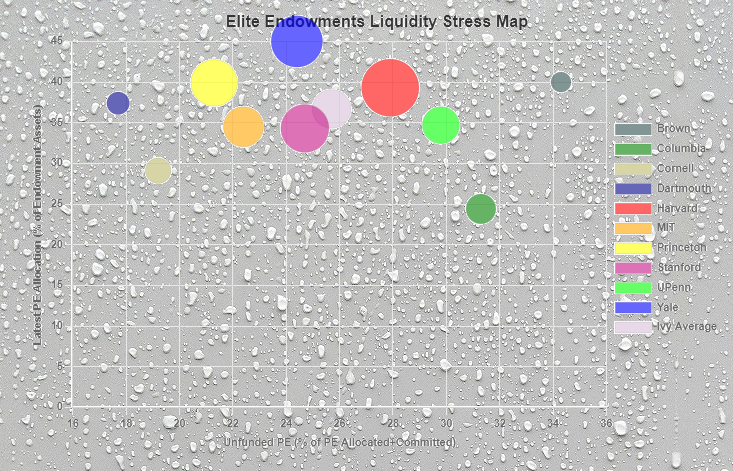

Reading the President’s warning through the lens of liquidity vs. market risk

Reading the President’s warning through the lens of liquidity vs. market risk

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

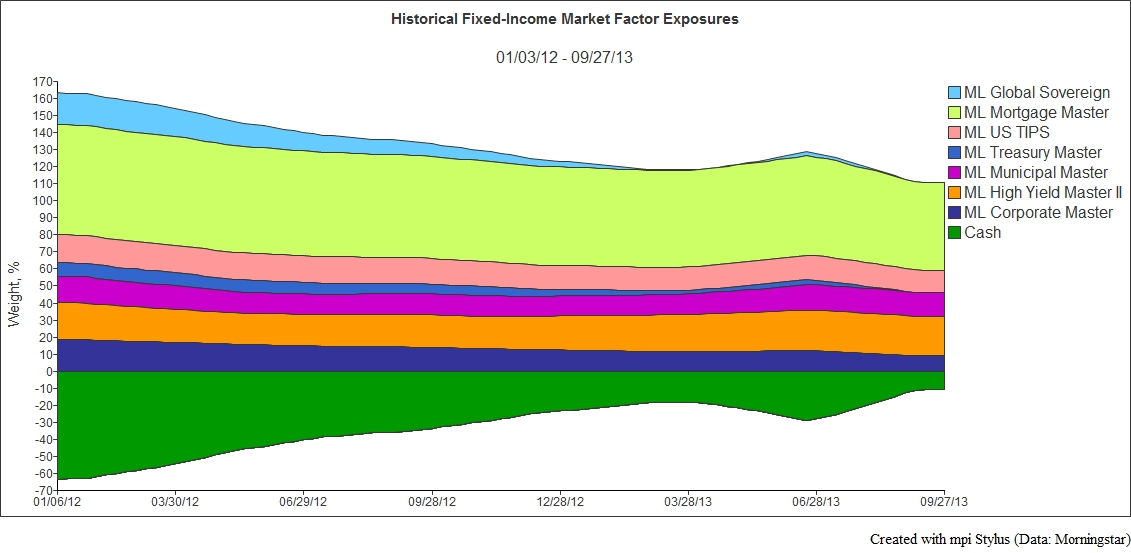

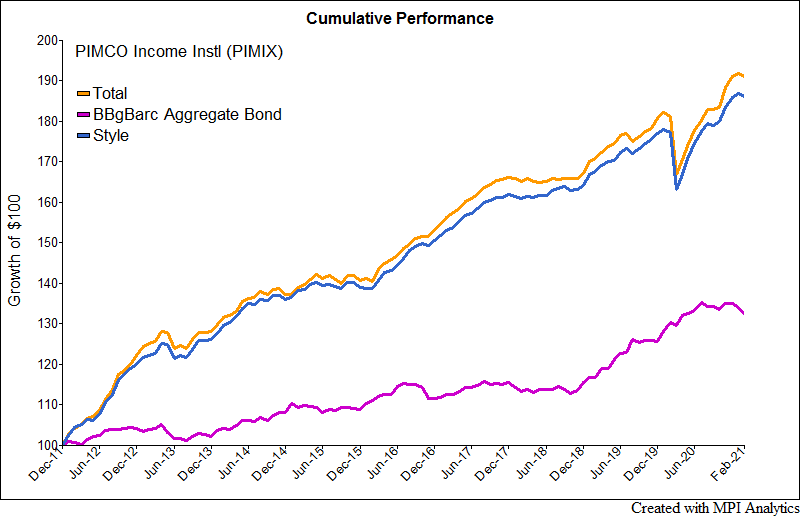

In 2019, we presented a return-based analysis framework that can be used to analyze complex fixed income funds such as PIMCO Income fund. In this updated blog, we apply a similar methodology to the fund as we did previously to evaluate the performance of the fund during the COVID market distress.

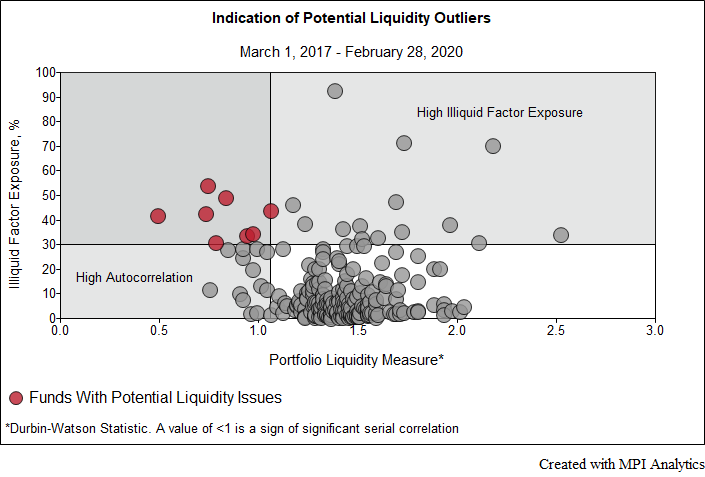

The quantitative research and approach demonstrated in this white paper, helps to provide a useful and pragmatic framework for investment practitioners to screen for liquidity risks when selecting new fixed-income products, as well as when conducting ongoing monitoring of their current bond funds.

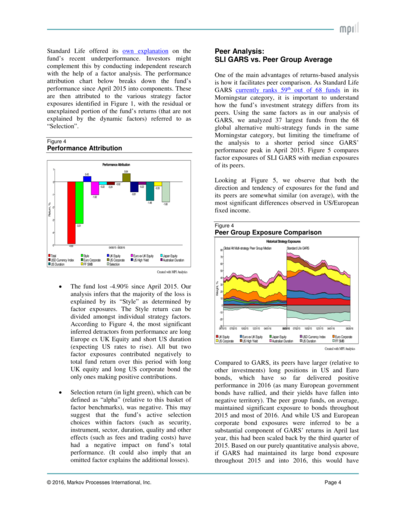

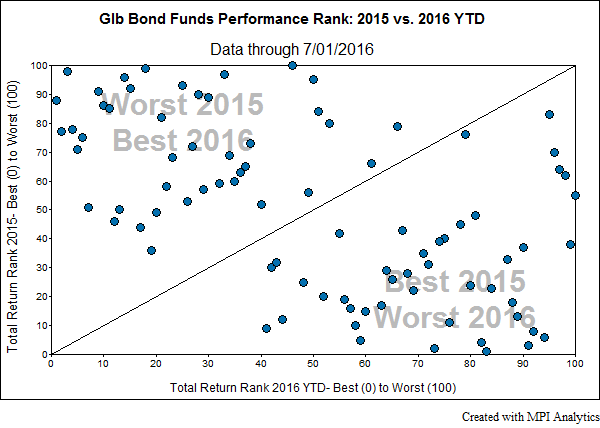

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.

In the winter of 2015, an almost unheard of situation happened. A mutual fund, normally required to guarantee daily liquidity, blocked its clients from withdrawing money. The Third Ave Focused Credit Fund (TFCIX), citing losses and a lack of liquidity in the high yield bond market, put some of its assets into a trust to be sold over time.