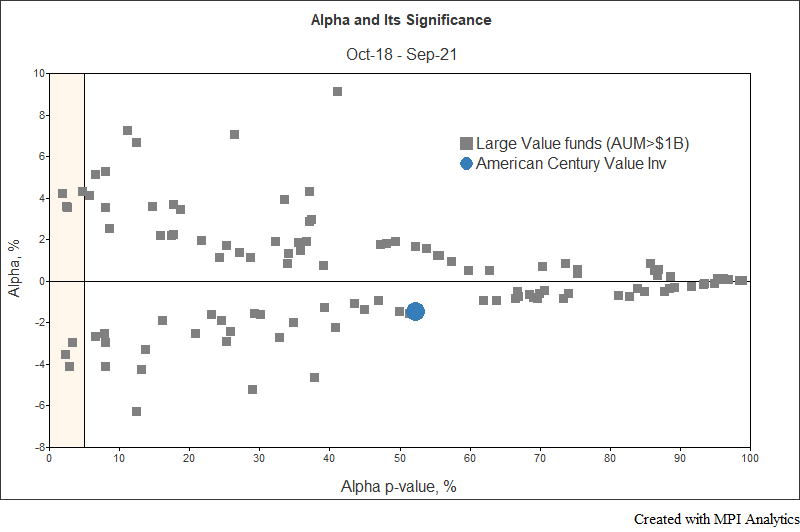

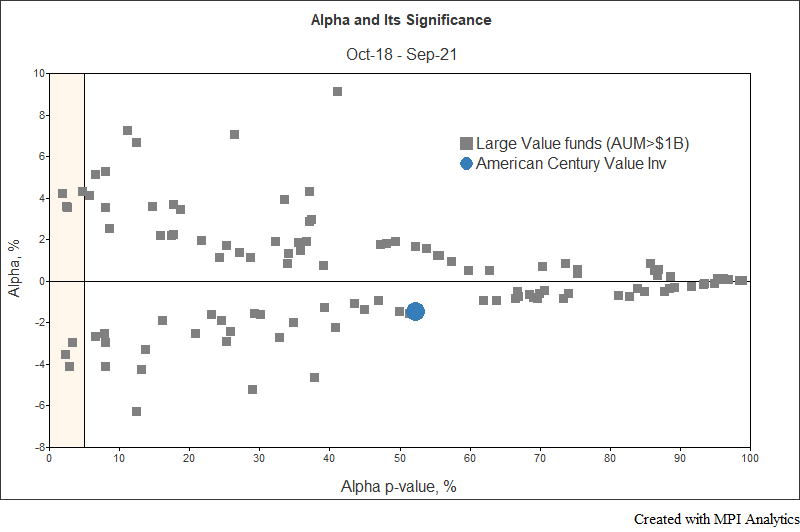

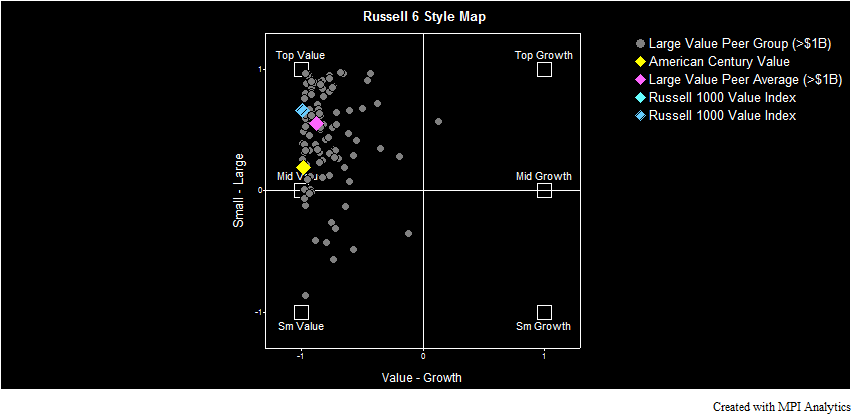

A fund’s alpha is at the core of a class-action lawsuit.

A fund’s alpha is at the core of a class-action lawsuit.

Does alleged index hugger American Century Value really belong on the naughty list?

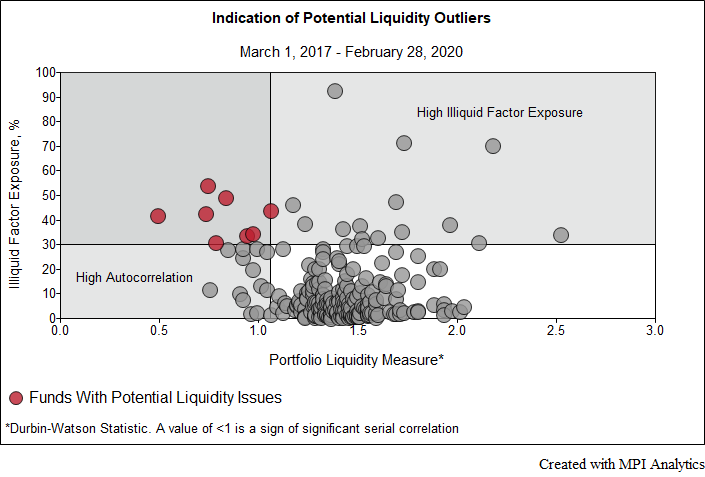

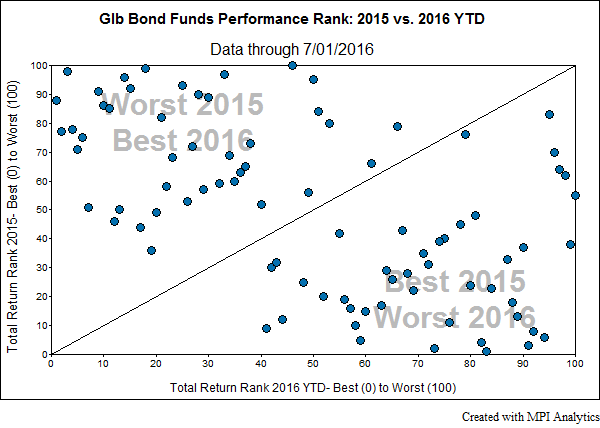

The quantitative research and approach demonstrated in this white paper, helps to provide a useful and pragmatic framework for investment practitioners to screen for liquidity risks when selecting new fixed-income products, as well as when conducting ongoing monitoring of their current bond funds.

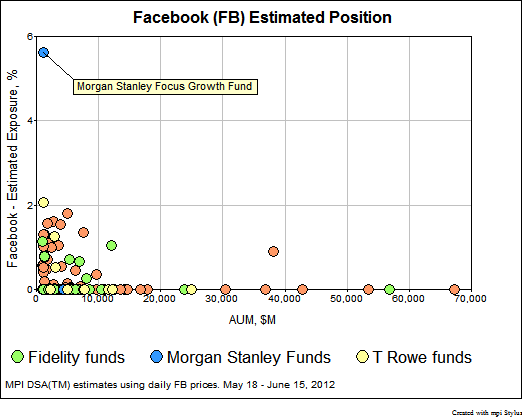

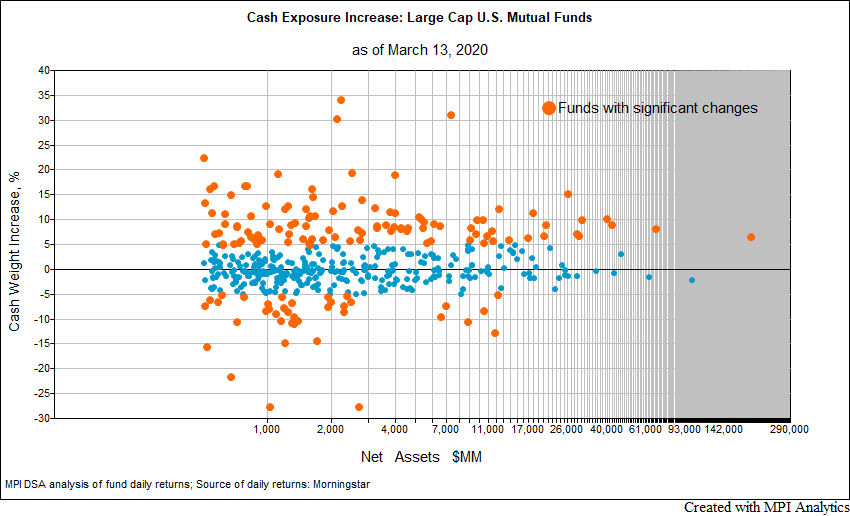

We use our Stylus Pro system’s patented Dynamic Style Analysis (DSA) with daily fund data to determine whether U.S. equity mutual funds have substantially decreased market exposure in the highly volatile period from early-February to mid-March

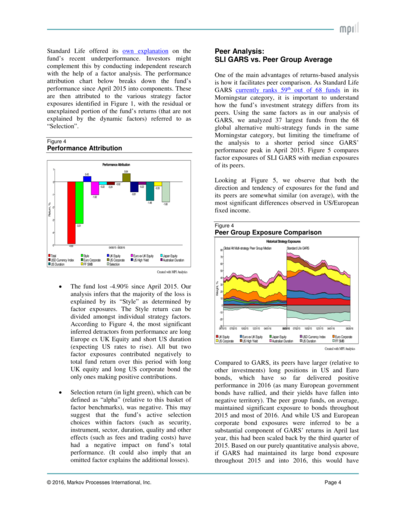

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.

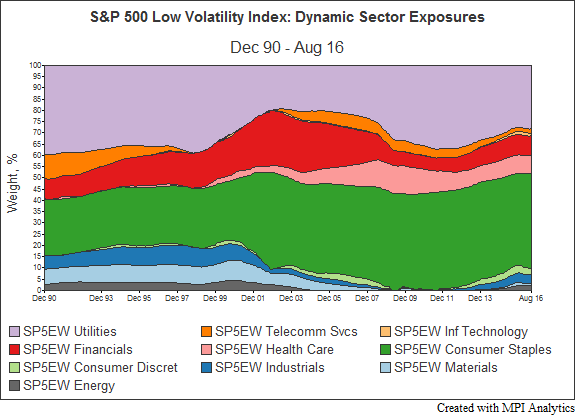

In this post we take a closer look at an important building block of many multi-factor portfolios, low volatility. Low volatility funds seek to take advantage of the “low volatility anomaly” – the empirical observation that lower risk, securities outperform their higher volatility counterparts.

In the winter of 2015, an almost unheard of situation happened. A mutual fund, normally required to guarantee daily liquidity, blocked its clients from withdrawing money. The Third Ave Focused Credit Fund (TFCIX), citing losses and a lack of liquidity in the high yield bond market, put some of its assets into a trust to be sold over time.