Bloomberg Opinion by John Authers: Pension Matters

In “Points of Return” this week, Bloomberg Opinion’s Richard Annerquaye Abbey and John Authers featured a comprehensive discussion of pensions investing based on our FY2024 return estimates for the largest U.S. public pensions: Magnificent Seven: Don’t Dismiss the Correction Too Much – Bloomberg

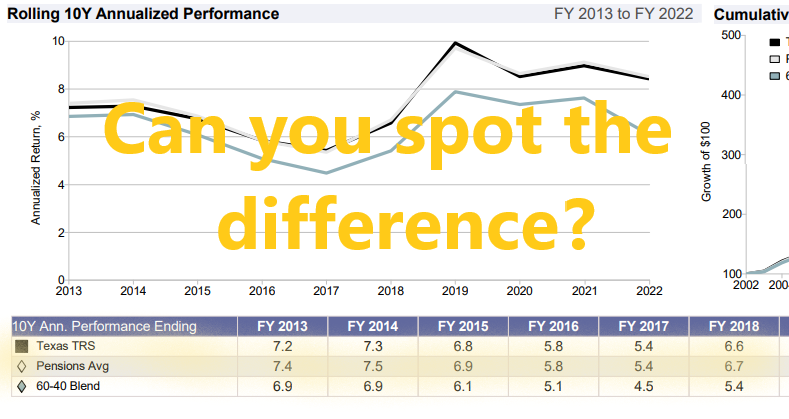

“Unlike mutual funds, it’s impossible to have anything close to a real-time measure of the performance of the big public pension funds based on their holdings, no matter how tempting the idea may be. While we wait [for pensions to publish their fiscal year performance], an analysis by Markov Processes International using its proprietary model to project the performance of public pension funds managing more than $20 billion in the year from July 2023 to June 2024, came to one conclusion — funds with higher allocation in US equities are poised to outperform. No other asset comes close.”