At the midway point of fiscal year reporting for the Ivy League endowments, our research team analyzes what we know so far to identify the key drivers of returns.

At the midway point of fiscal year reporting for the Ivy League endowments, our research team analyzes what we know so far to identify the key drivers of returns.

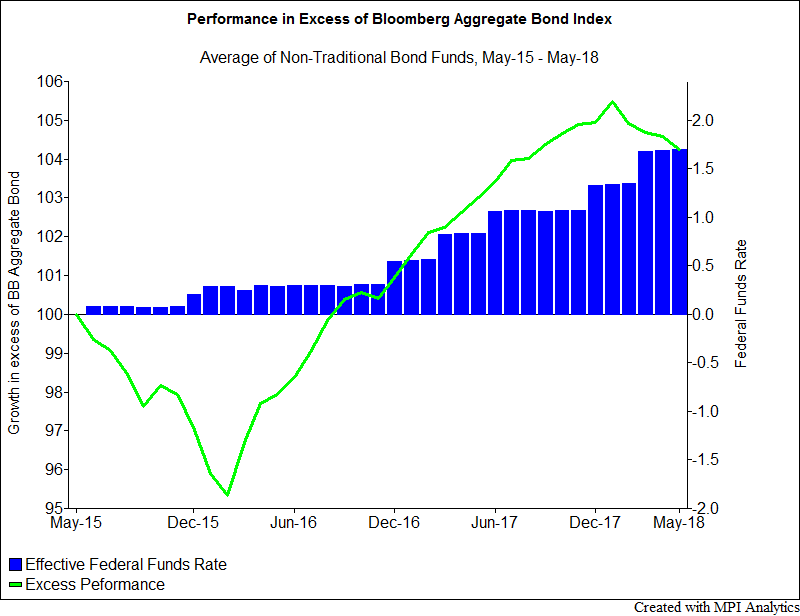

After years of underperformance following the financial crisis, the non-traditional bond fund segment is beginning to shine, outperforming the broader market index in the face of rising rates.

2017 Yale endowment report rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found…

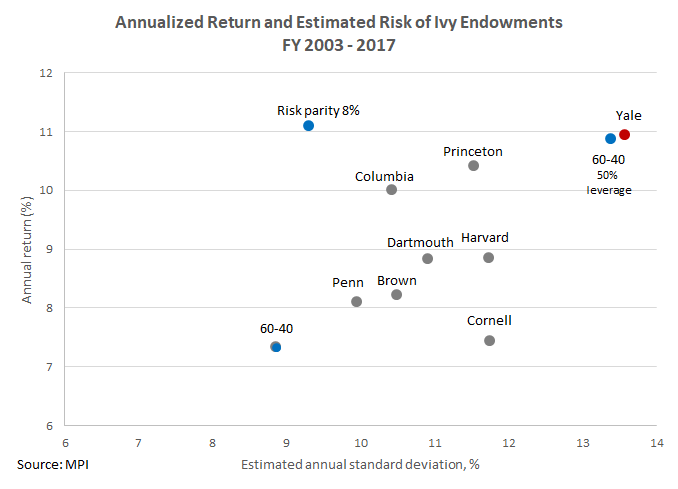

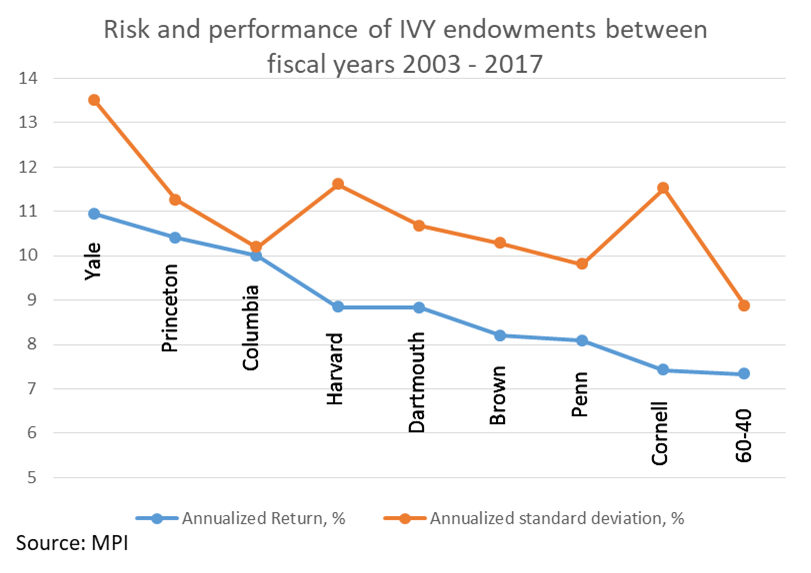

It is generally known that endowments invest in risky assets, but quantifying such risks has remained challenging due to a lack of information about returns. We set out to address this challenge and developed a new basis for estimating endowment risks.

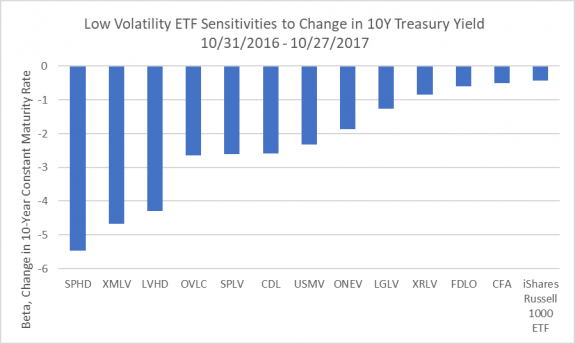

Investors have a tendency to downplay interest rate sensitivity as a factor influencing equity products, with the assumption being that its effect must be negligible at most. One of a handful of exceptions to that assumption, however, is concern over the rate sensitivity of low volatility “smart beta” funds.

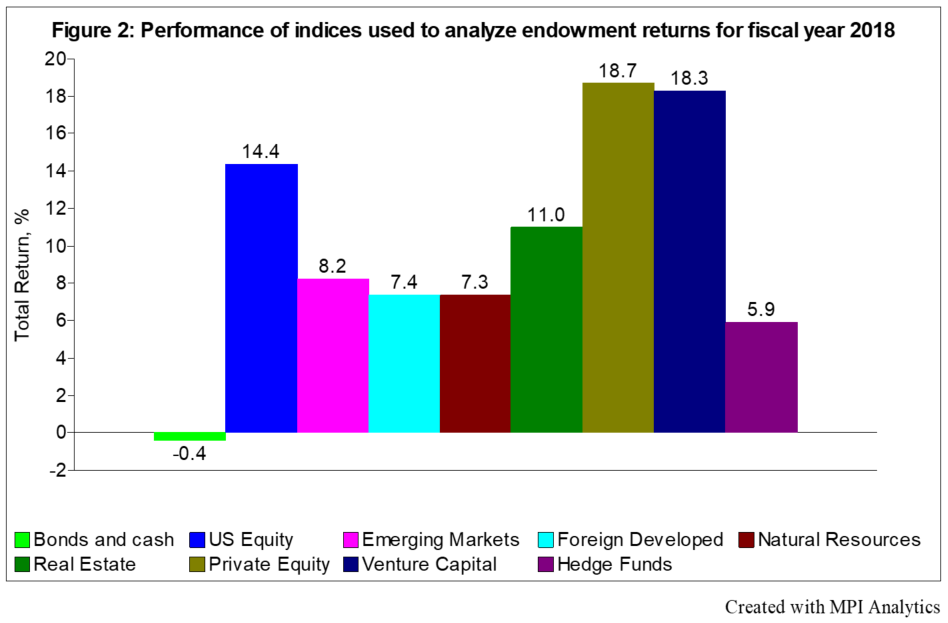

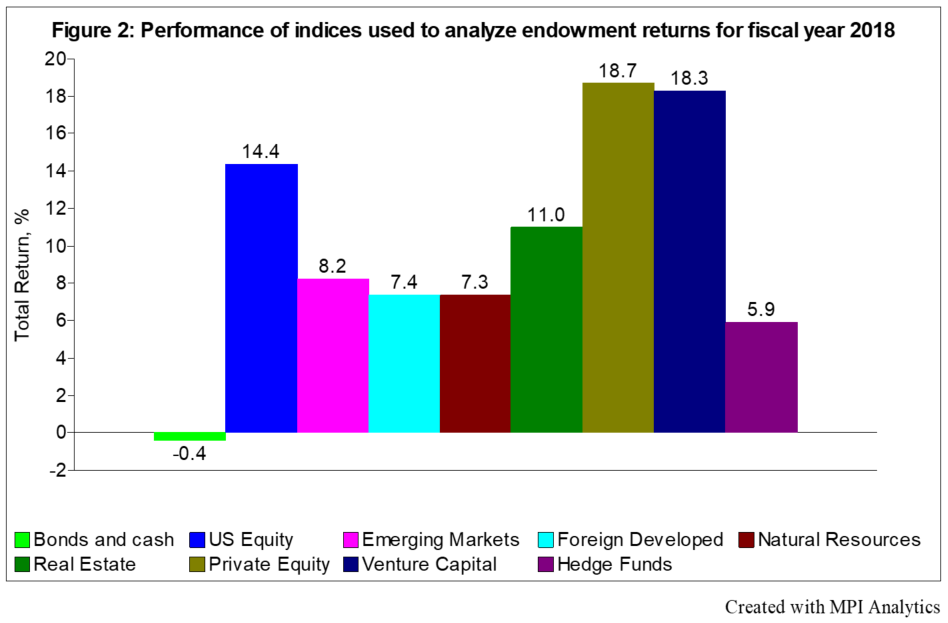

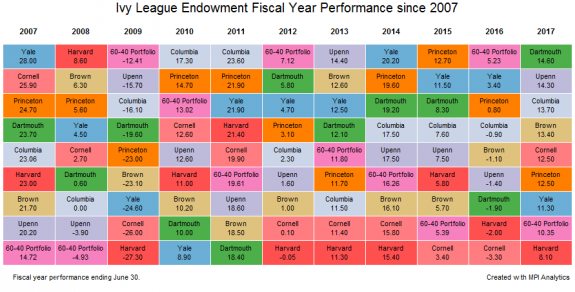

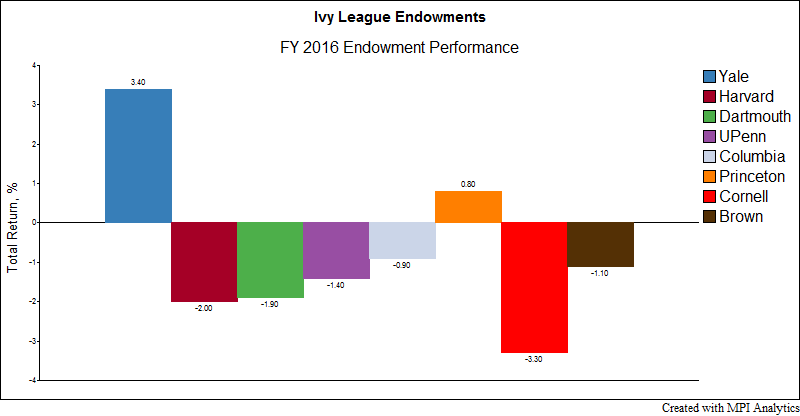

In stark contrast to FY 2016, this past year was a strong one for most endowments. In fact, nearly all the Ivy League endowments, Harvard being the only exception, beat the 60-40 portfolio, a commonly cited benchmark that endowments measure their performance against.

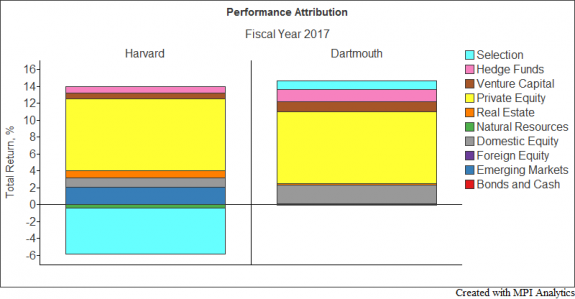

The returns of endowments can be attributed to two fundamental components: asset allocation and security selection. Asset allocation is what a factor model is generally able to explain, shown in terms of factor exposures.

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.