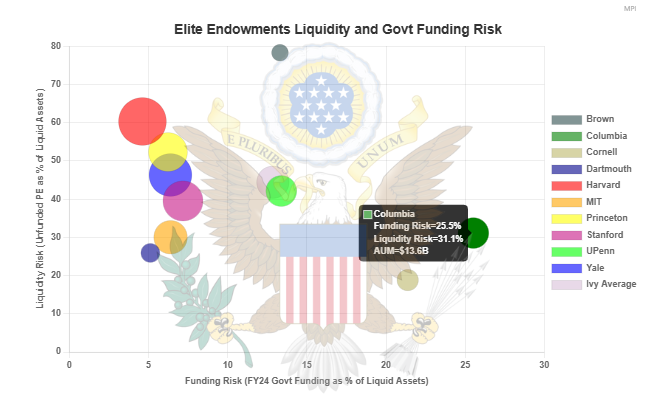

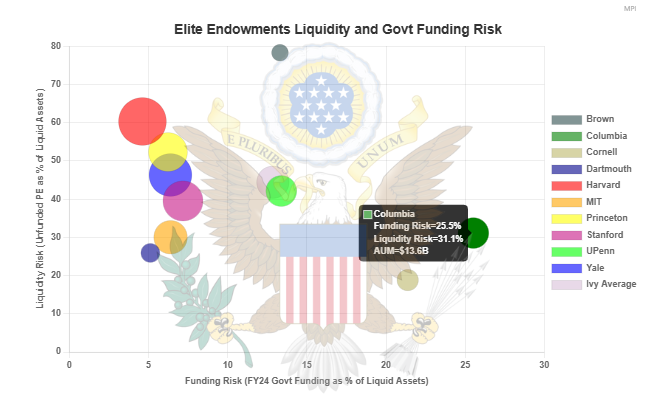

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

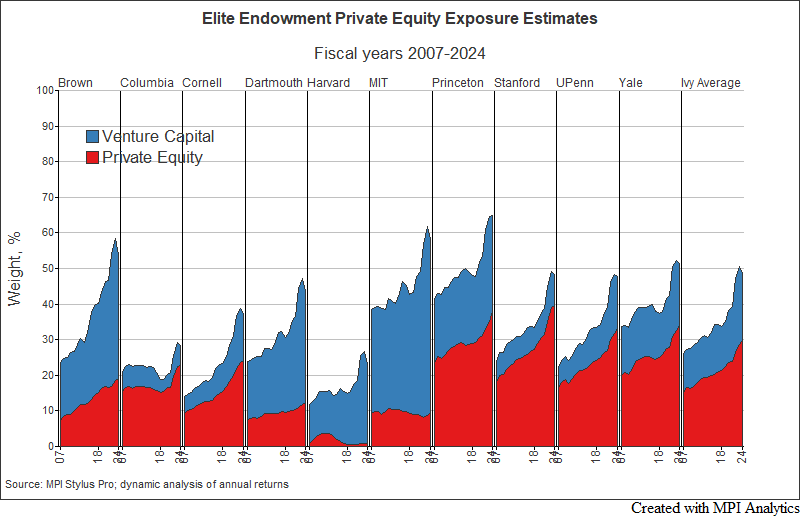

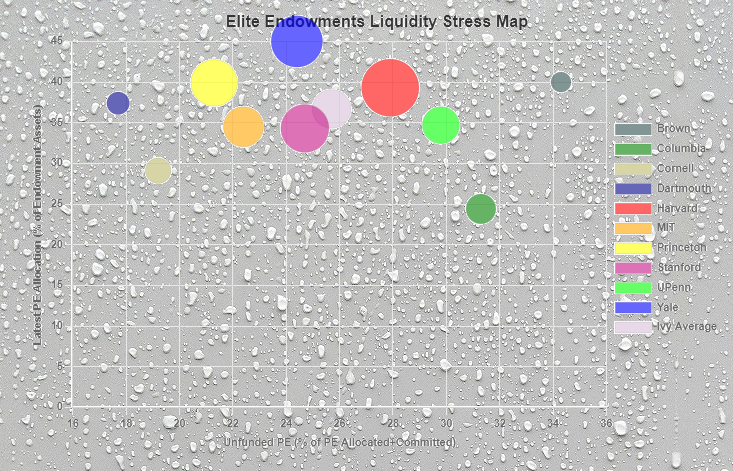

How the anemic deal climate, record low distributions and massive unfunded capital commitments are pushing endowments further into illiquid private equity & venture capital, increasing risk & leverage in portfolios (and markets broadly)

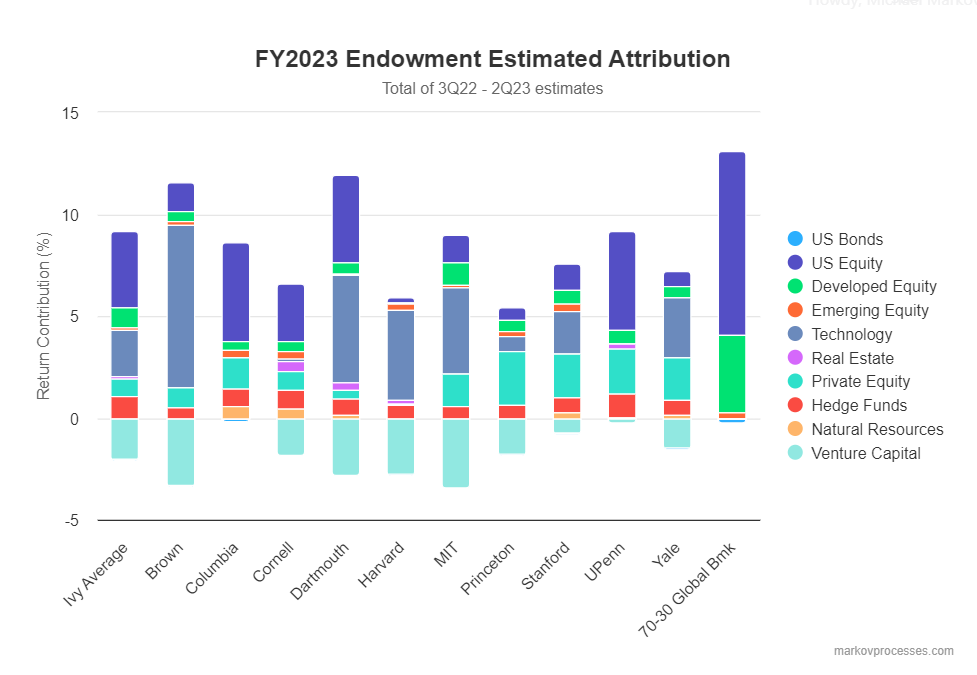

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

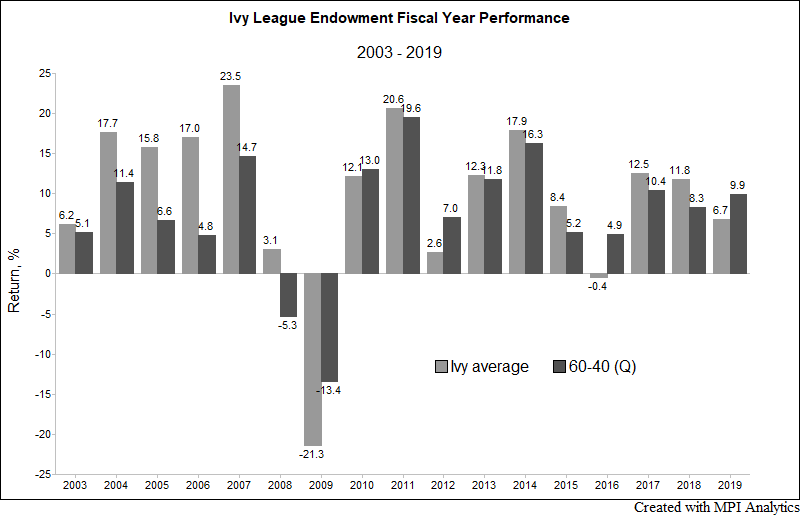

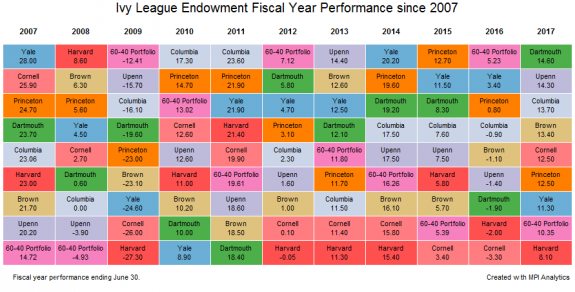

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.

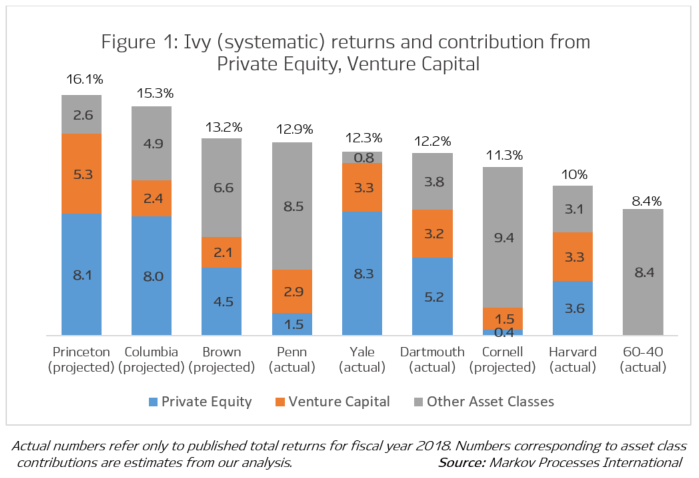

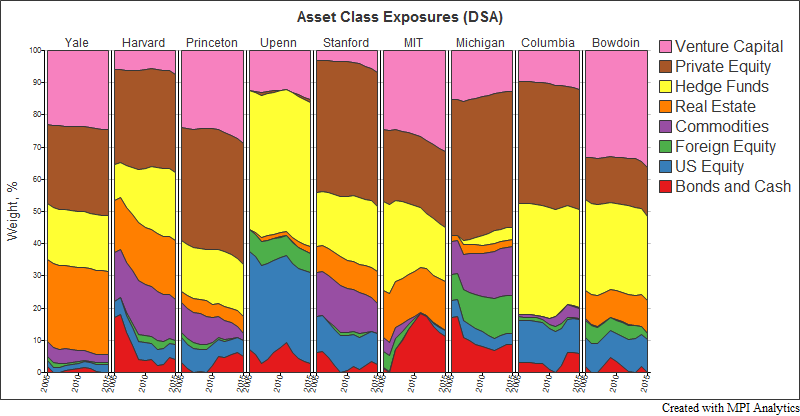

Returns across the Ivy League are largely seen as being driven by exposure to private equity and venture capital.

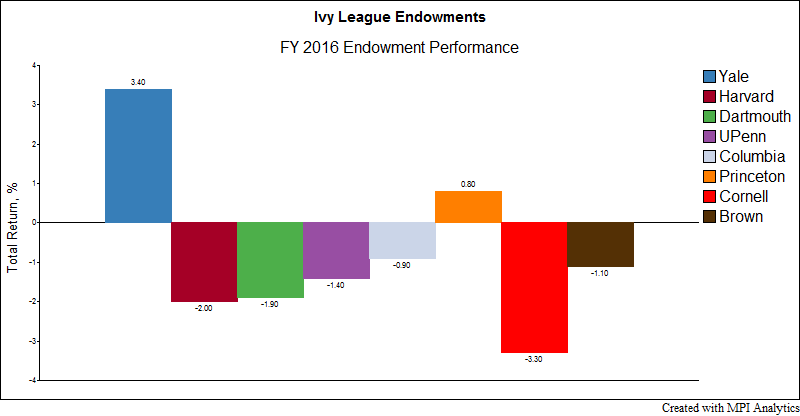

In stark contrast to FY 2016, this past year was a strong one for most endowments. In fact, nearly all the Ivy League endowments, Harvard being the only exception, beat the 60-40 portfolio, a commonly cited benchmark that endowments measure their performance against.

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.

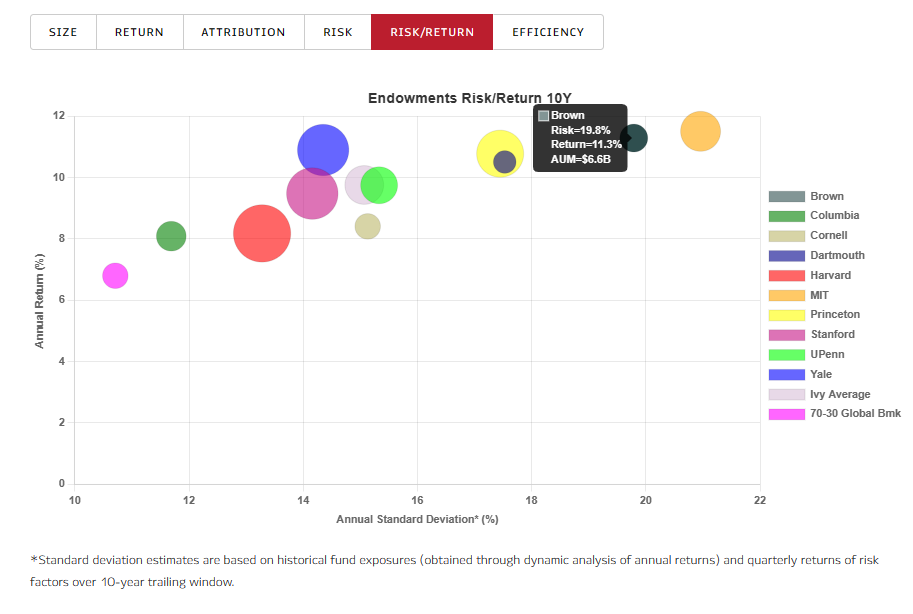

Using MPI’s Dynamic Style Analysis and public annual return disclosures we attempt to provide transparency on allocation decisions and performance results of some of the largest and most successful investors in the world.