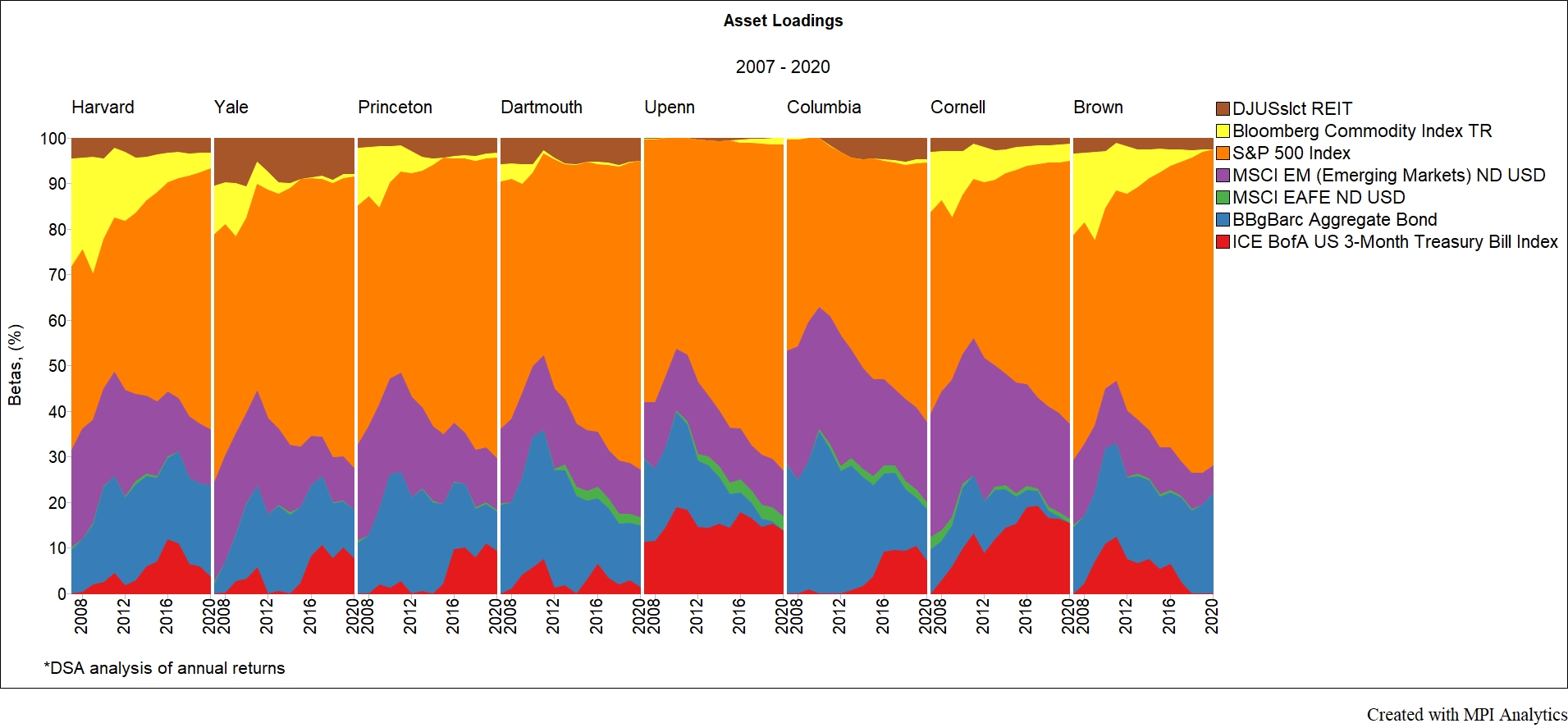

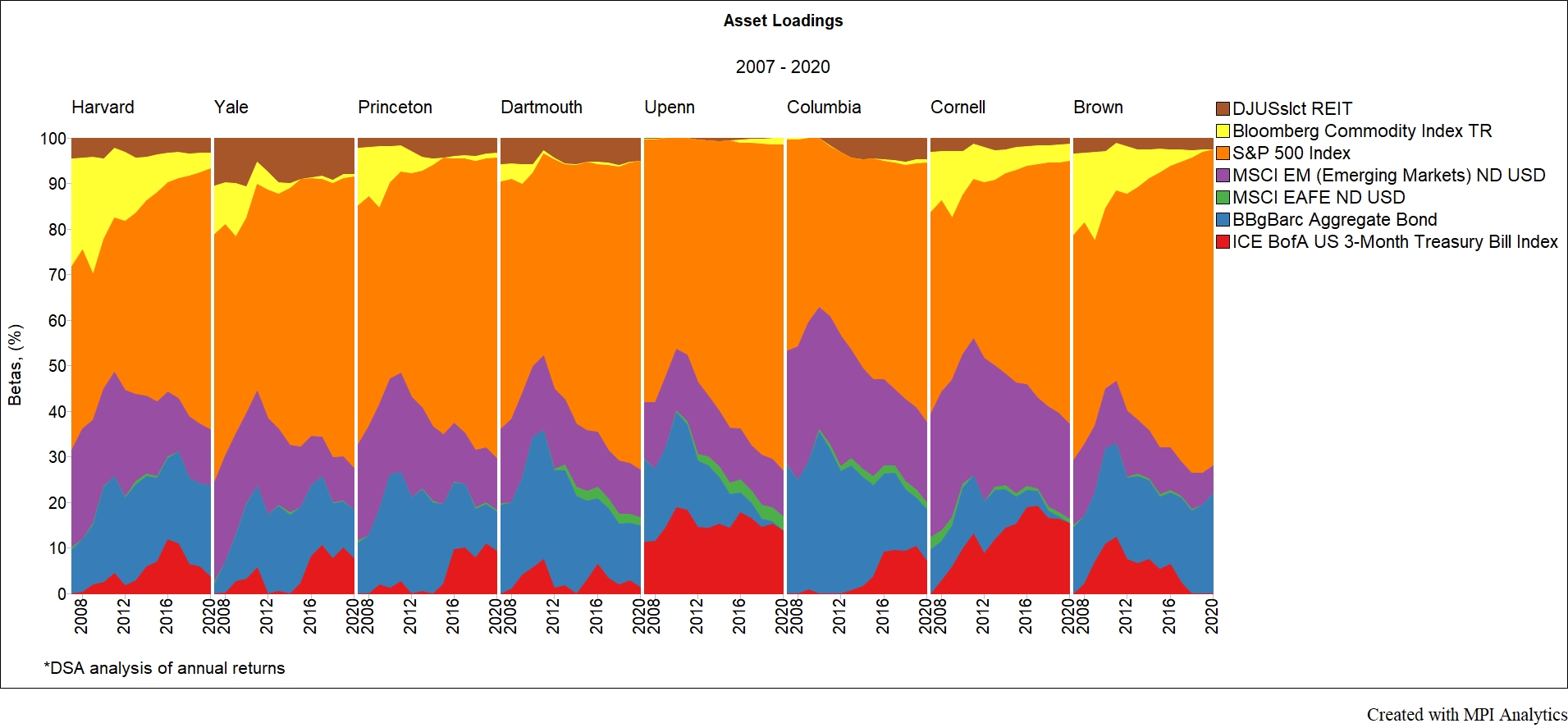

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

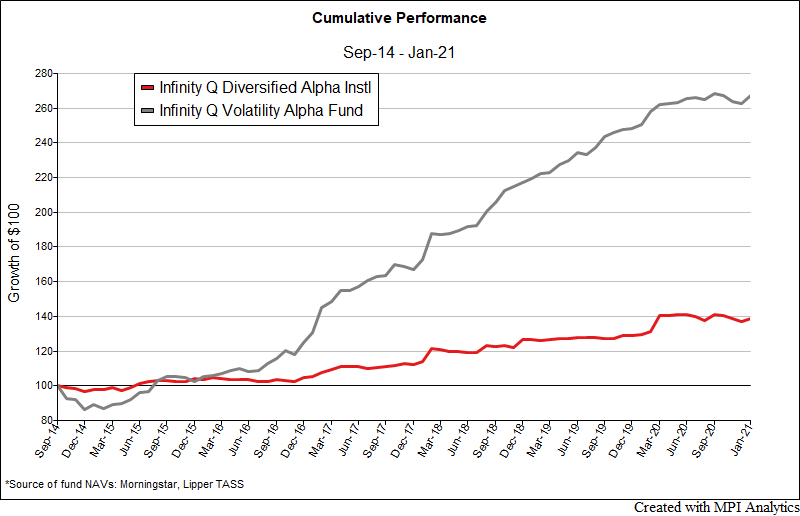

Following up on our most recent article, “Infinity Q: Too Much Alpha,” Infinity Q also managed a hedge fund product, Infinity Q Volatility Alpha, which exclusively employed volatility strategies. Using known sub-strategies as regression factors for a multi-strategy product can prove very useful in identifying the source of both skill and risk in a more complex product.

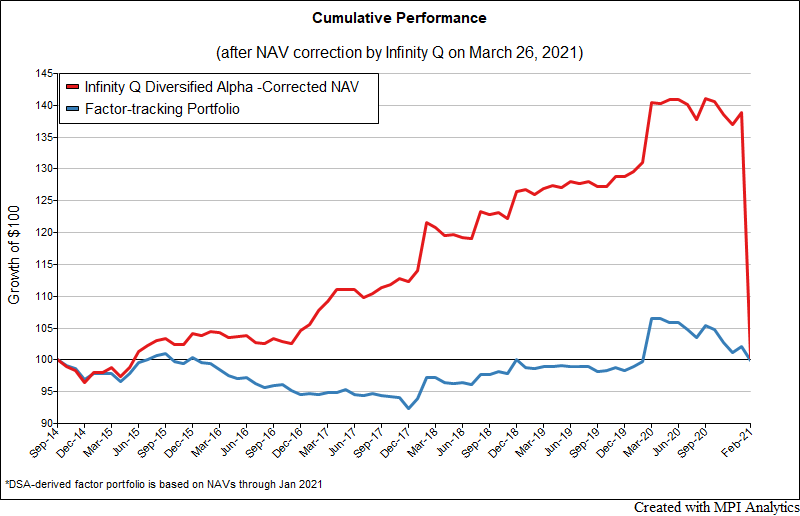

The suspension of redemptions and planned liquidation of the Infinity Q Diversified Alpha fund (IQDNX, IQDAX) – a $1.8 billion hedge fund-like multi-strategy liquid alternatives mutual fund that was started by investment staff from the family office of a private equity titan – has sent shockwaves through the fund management industry. Using MPI’s quantitative surveillance framework we discover a slew of red flags that could have alerted the fund’s investors.

Webcast: December 18, 2019

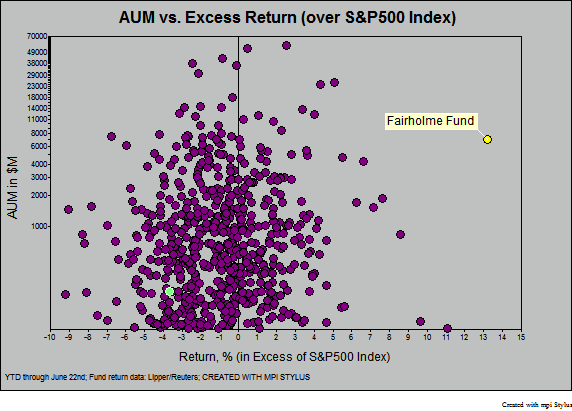

Over the past 10 years, PIMCO Income fund (PIMIX) has been the top performing fund in its category and the only one in the top quartile 10 years running. However, in 2019 the fund has fallen to the bottom quartile.

Using this fund as an example, we will demonstrate how returns-based analysis can be used to analyze complex fixed income products without delving into volumes of complex holdings reported with a lag.

New proxy-handling features also allow users to extend analysis for shorter-lived investment products and portfolios