Can risk parity ride out the storm of correlated asset chaos?

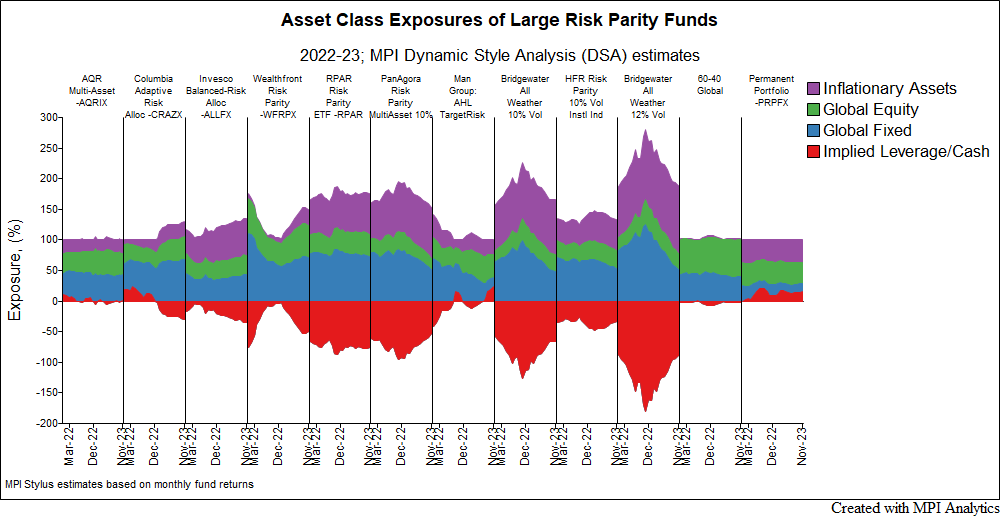

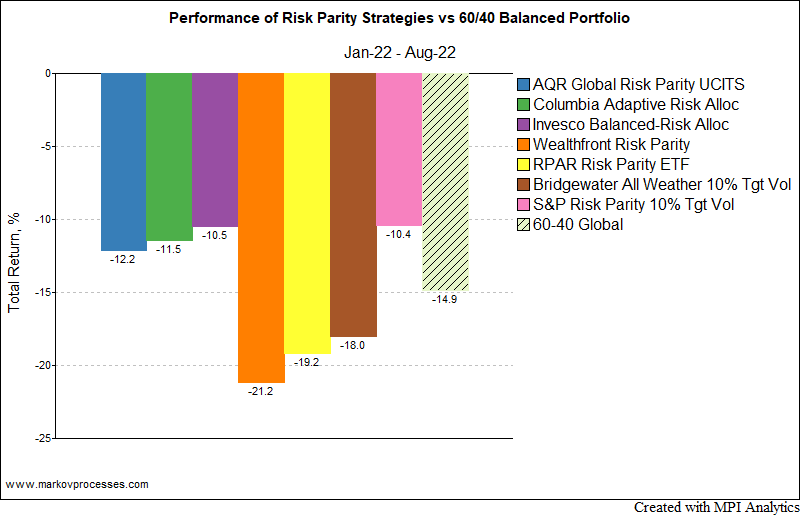

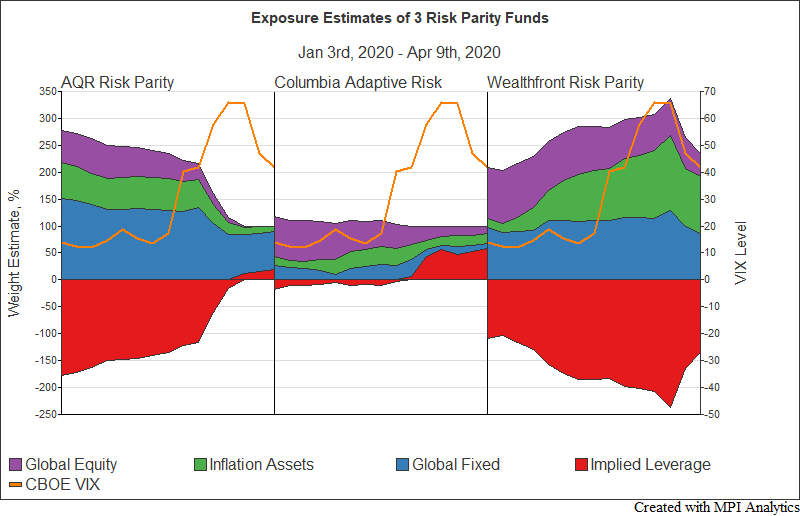

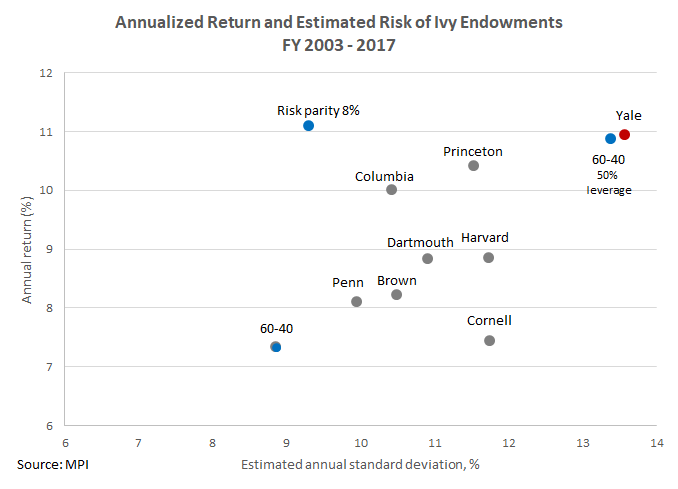

“Risk parity strategies – designed to withstand all economic circumstances – have been tested in recent times by the triple threat of unfavourable rates, spiked inflation and asset correlation breakdowns. Few managers in the field were above water through most of 2023; some saw increased portfolio risk exacerbated by leverage and untamed volatility, says a study by Markov Processes International.” – writes Luke Clancy in his Risk.net article “Can risk parity ride out the storm of correlated asset chaos?” The article extensively quotes MPI’s original research.