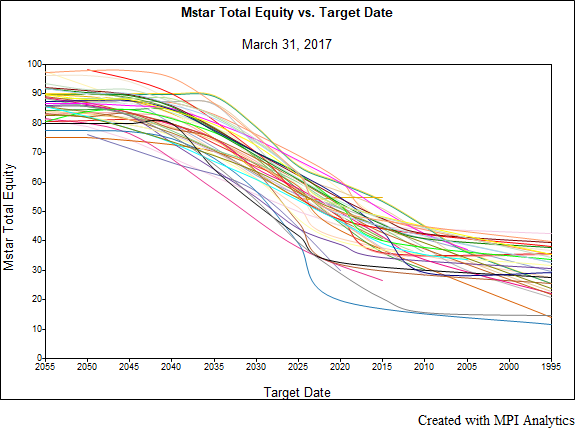

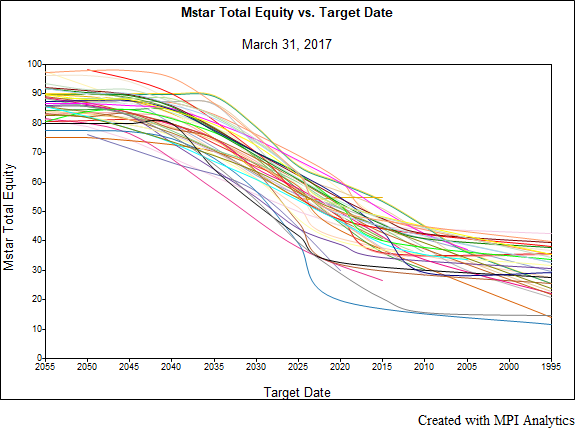

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones

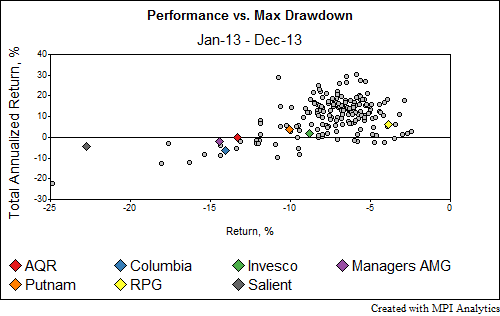

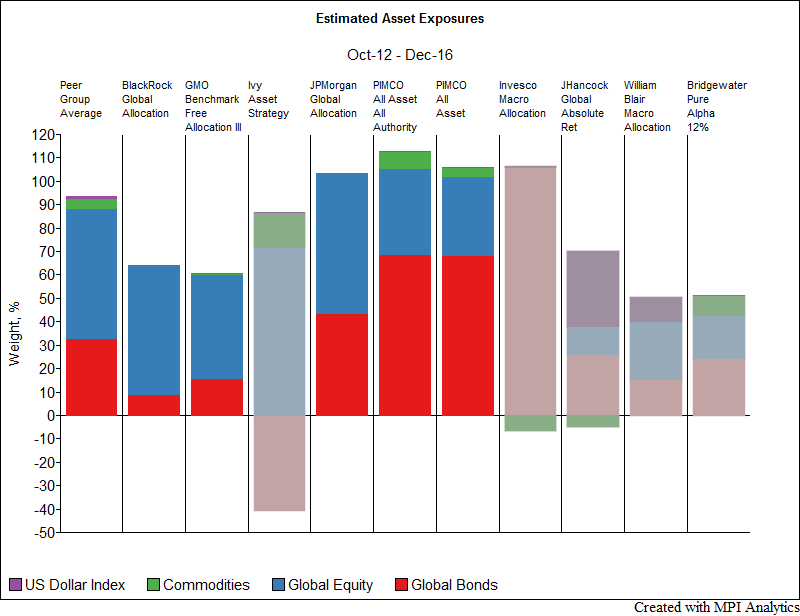

Global Tactical Asset Allocation (GTAA) funds, which seek to take advantage of changing market conditions while maintaining a globally diversified portfolio, have suffered recent underperformance. MPI was asked by Institutional Investor to look at some of the funds that have received the most interest from investors.

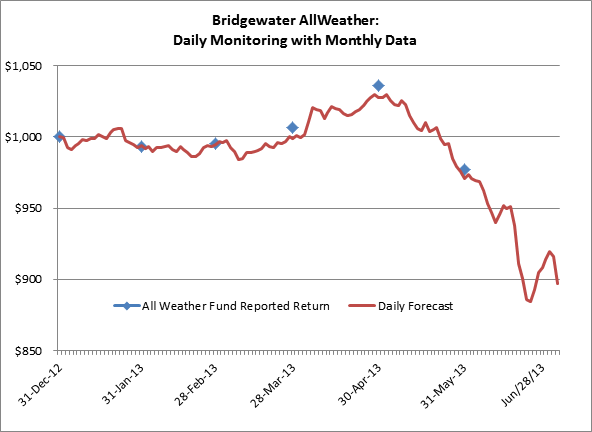

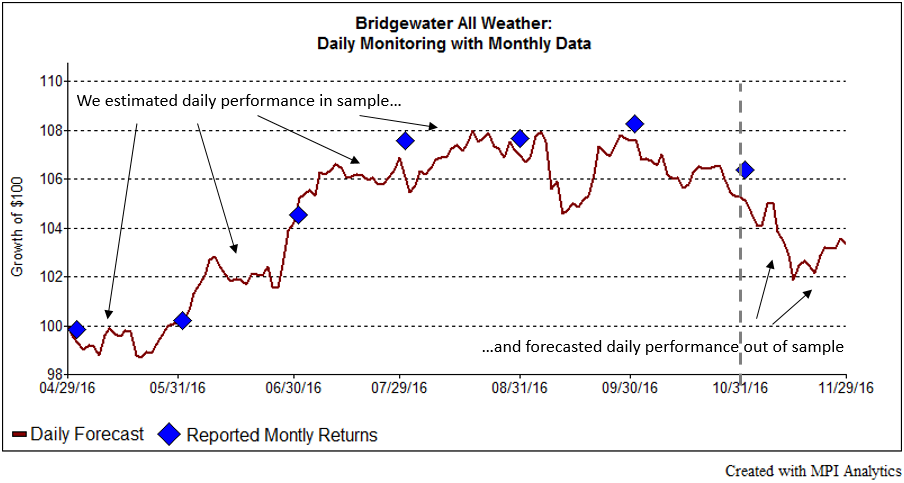

We use Bridgewater All Weather, one of the largest hedge funds, to illustrate how to quantitative techniques could provide investors with a more dynamic understanding of the potential fund behavior intra-month using only monthly fund data.

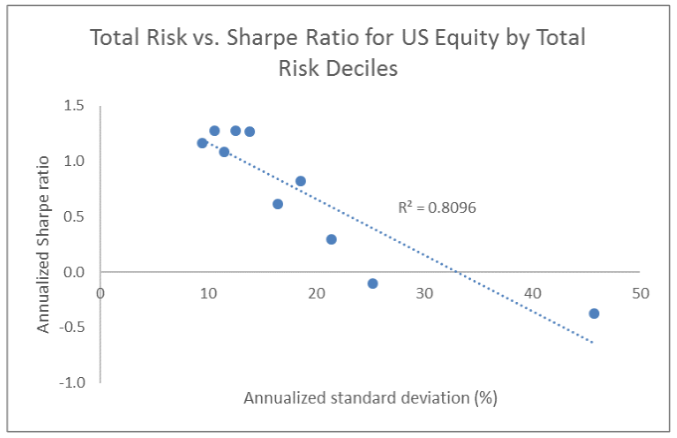

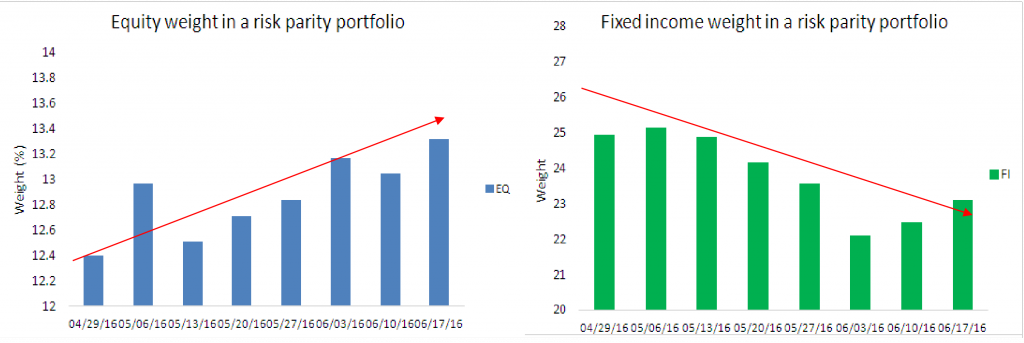

This white paper looks at the period of the increased volatility in the financial markets leading up to and on November 8th and provides valuable insights into internal workings of risk parity strategies during periods of heightened volatility.

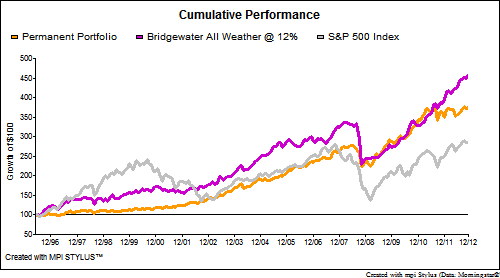

Risk parity strategies hold the promise of smooth sailing through periods of market turbulence, offering consistent performance via risk diversification. However, during Brexit the losses they experienced were very high by historical standards as they came very close to exceeding, or exceeded, the 95% worst outcome as estimated by the historical VaR.