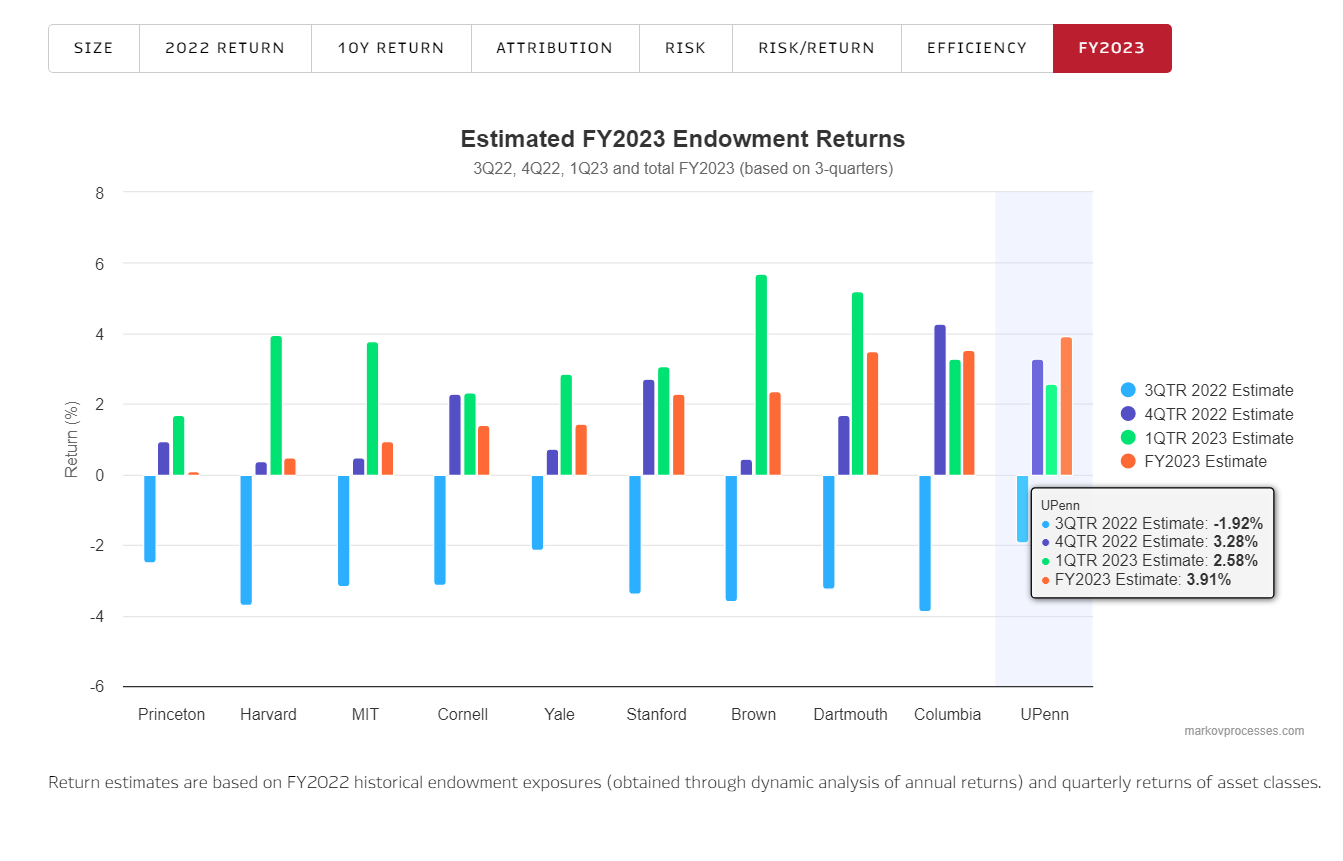

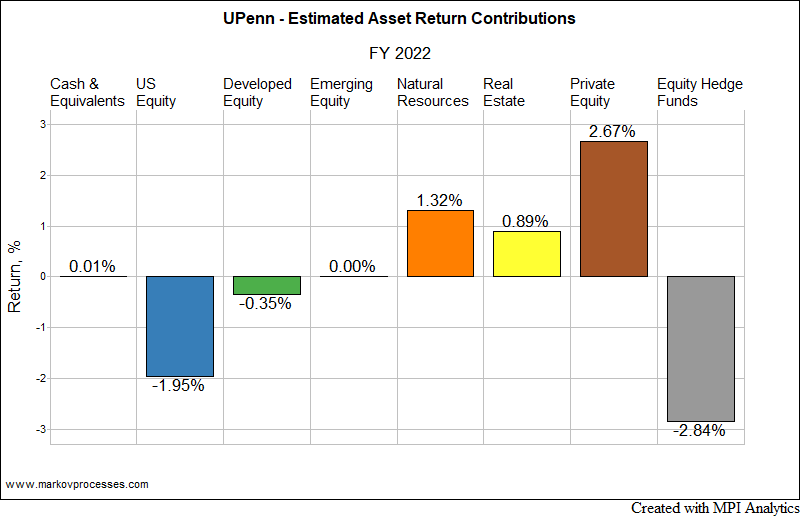

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

These widely cited projections come from MPI’s Transparency Lab, which provides unique insights into the styles, risks, and performance of traditionally opaque pensions and endowments.

Endowments and pensions continue to post gains, but exposure to private markets pushes many below benchmarks

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.

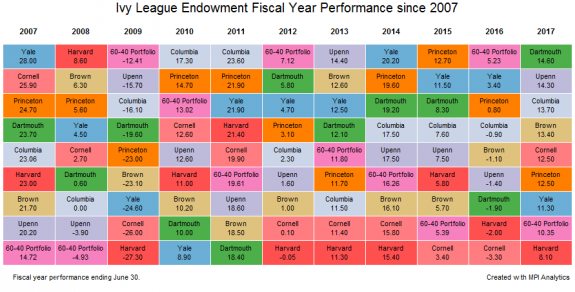

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

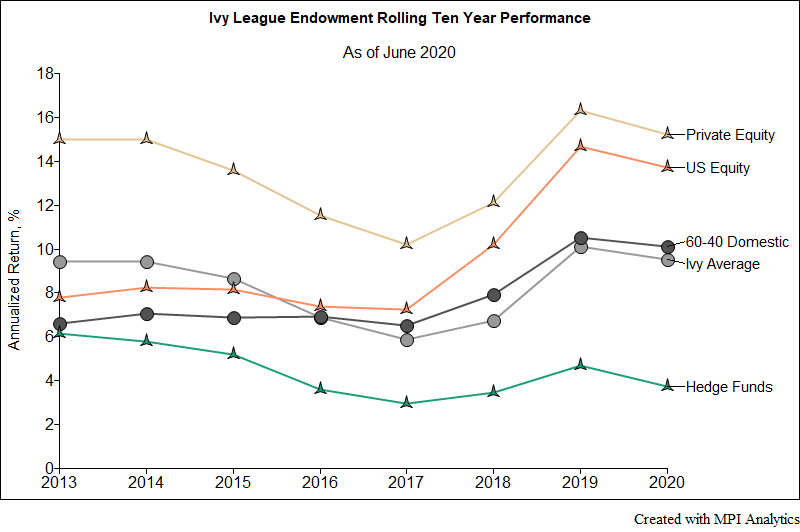

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

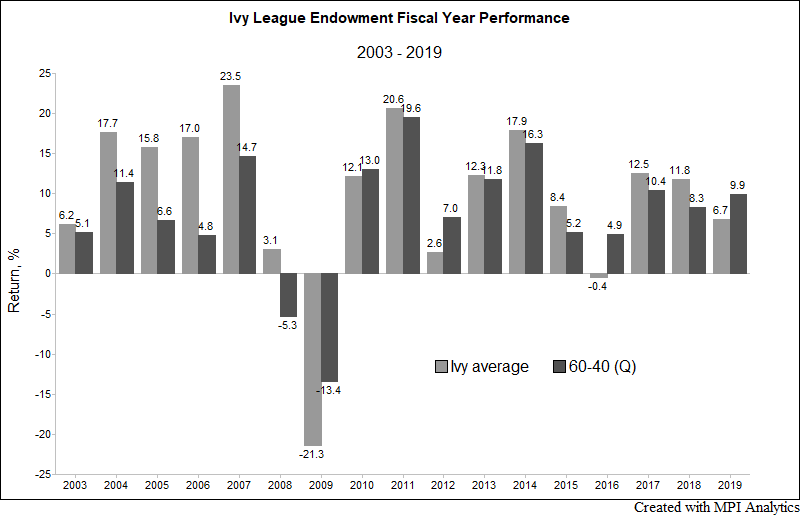

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.

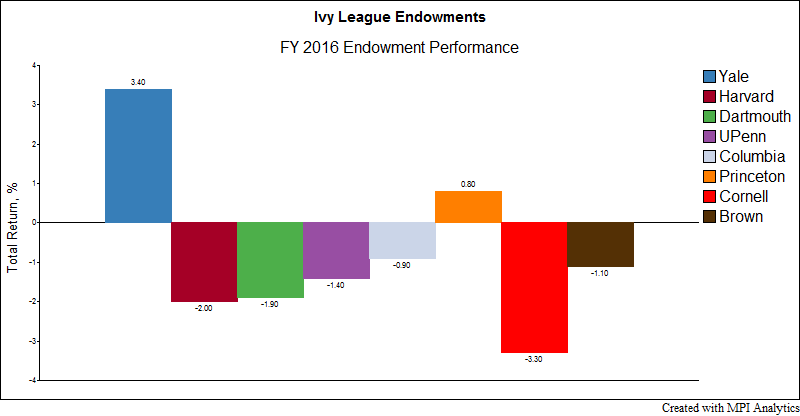

In stark contrast to FY 2016, this past year was a strong one for most endowments. In fact, nearly all the Ivy League endowments, Harvard being the only exception, beat the 60-40 portfolio, a commonly cited benchmark that endowments measure their performance against.

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.

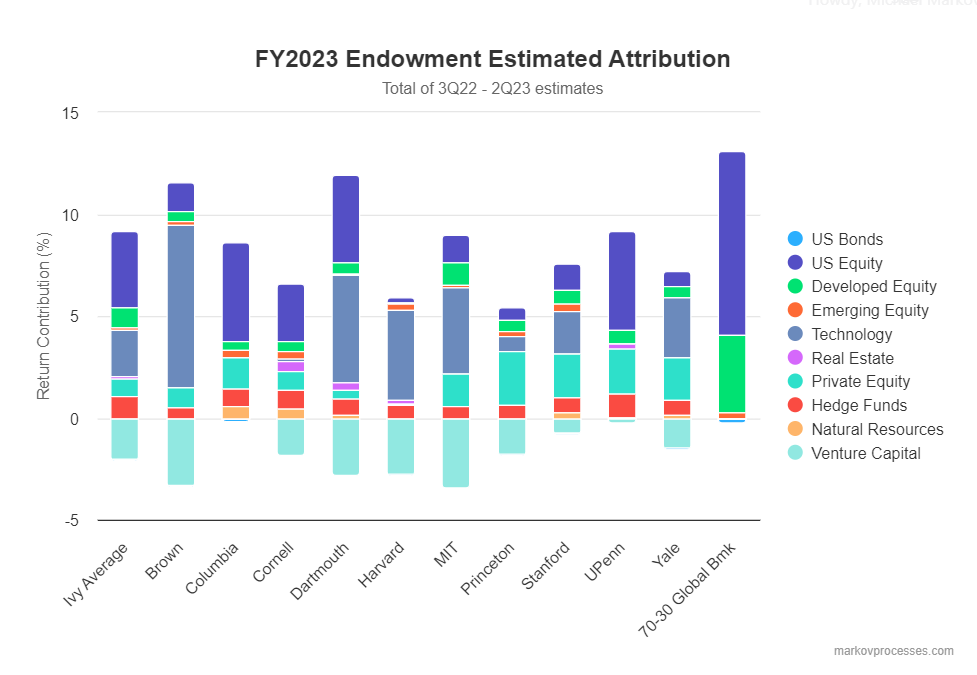

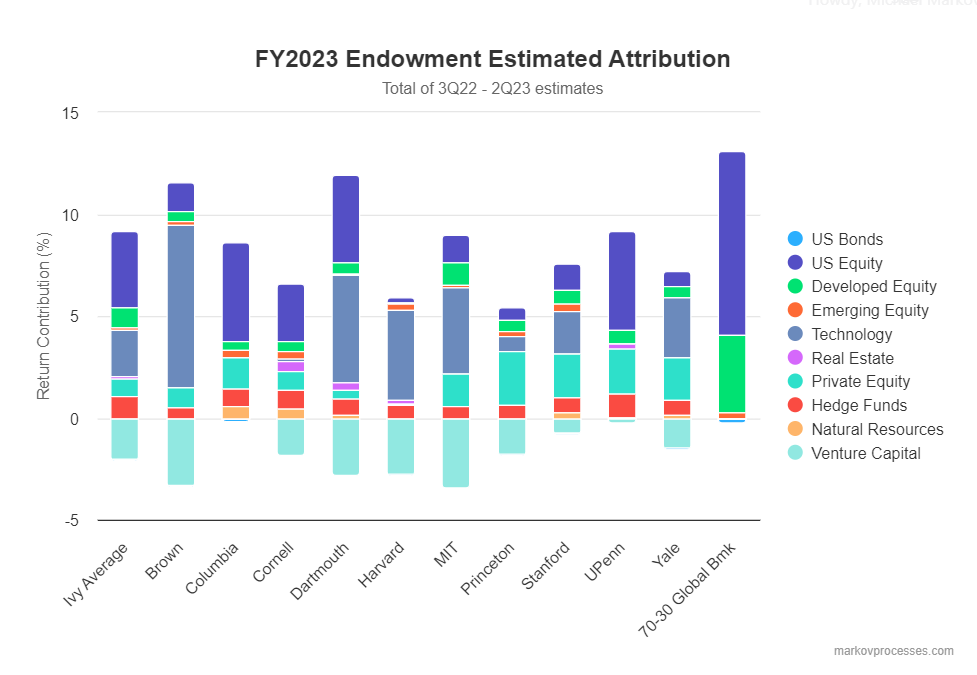

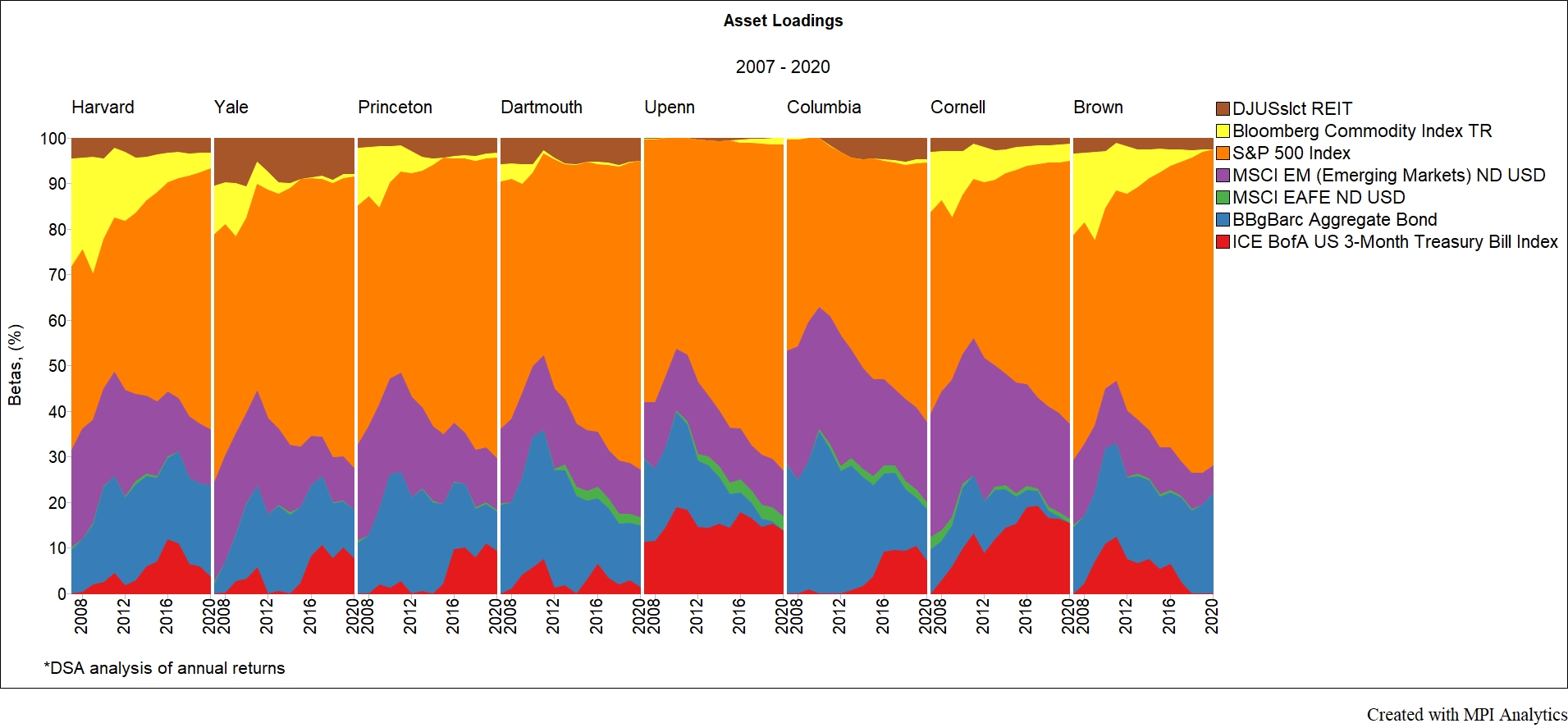

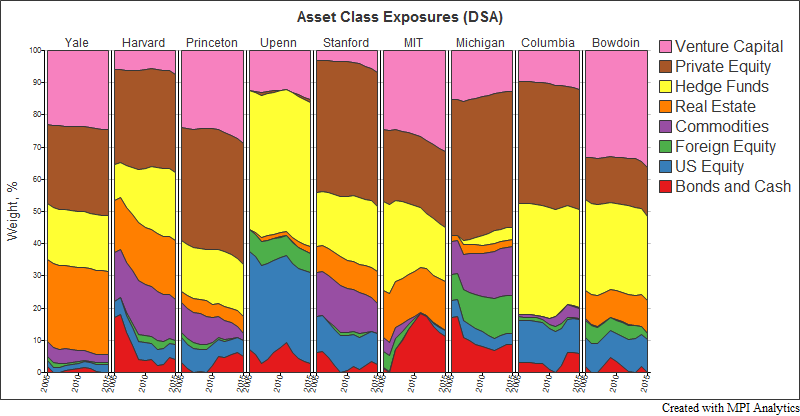

Using MPI’s Dynamic Style Analysis and public annual return disclosures we attempt to provide transparency on allocation decisions and performance results of some of the largest and most successful investors in the world.