Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

Lessons (not) learned: our analysis shows Ivies are at pre-GFC levels of risk

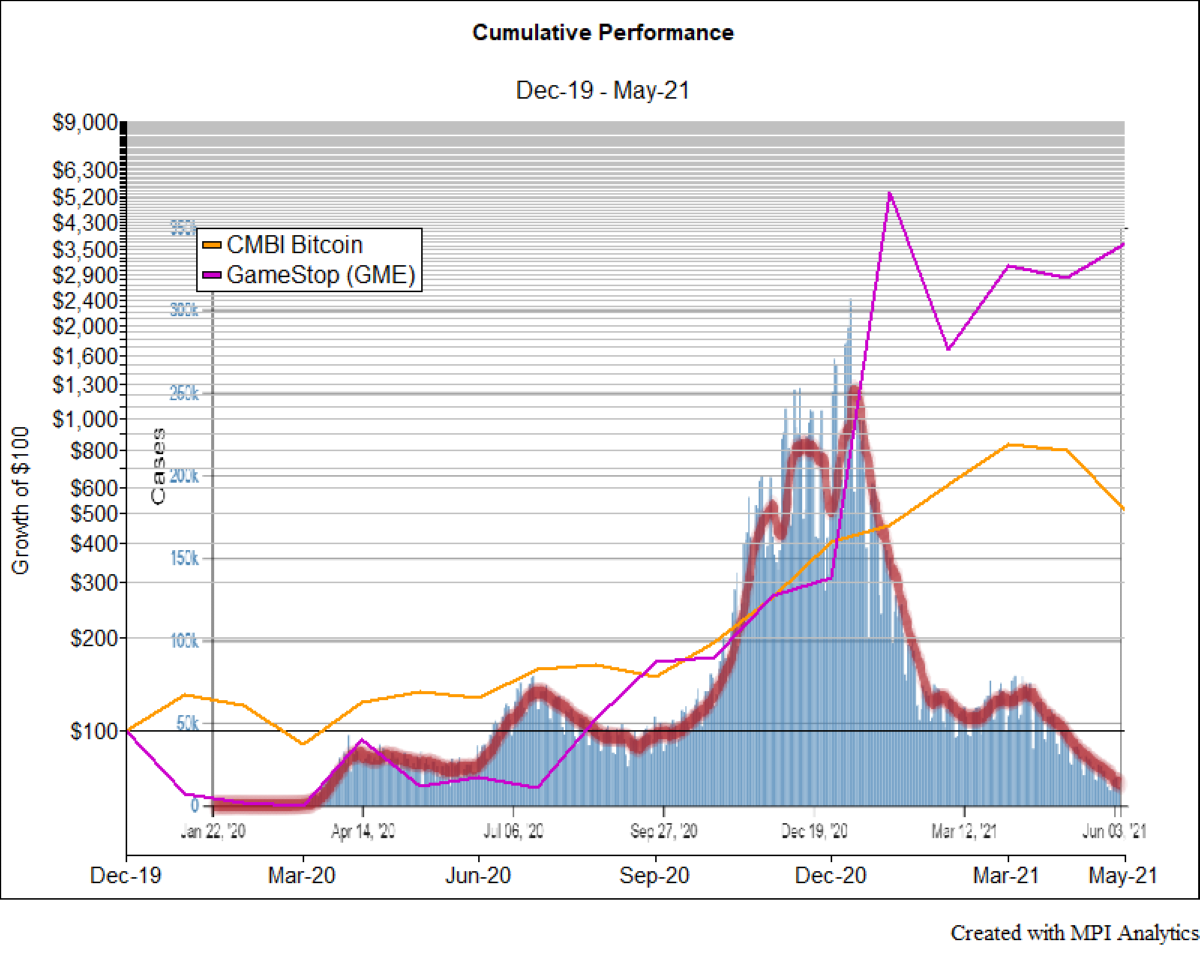

It’s been a wild rollercoaster ride these days for Bitcoin investors. The cryptocurrency hit an all-time high of $64k in April only to plummet nearly 50% a month later. Last year, as the entire world shut down access to mountain peaks and surfing spots, people started to look for stay-at-home ways to supply their adrenaline fix – and speculative trading fit the bill.

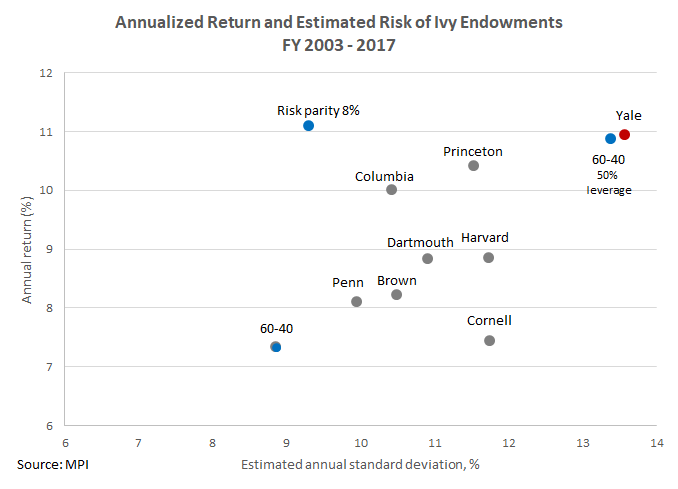

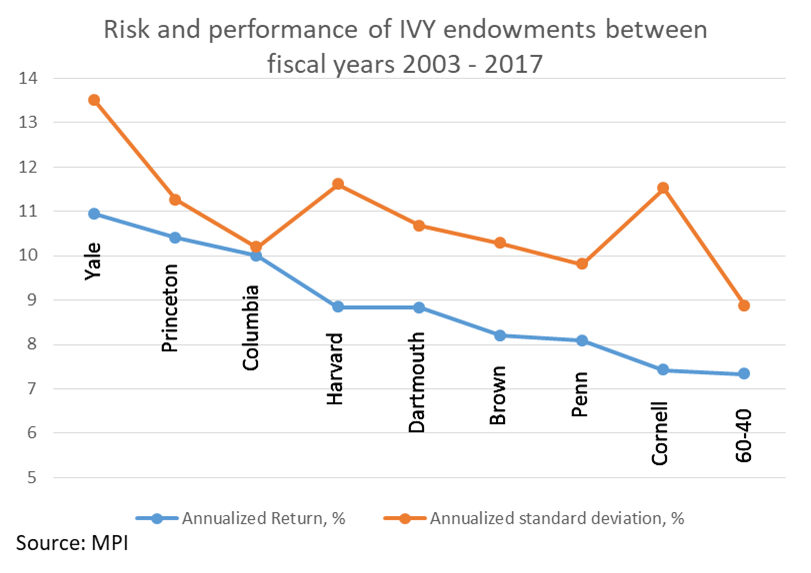

2017 Yale endowment report rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found…

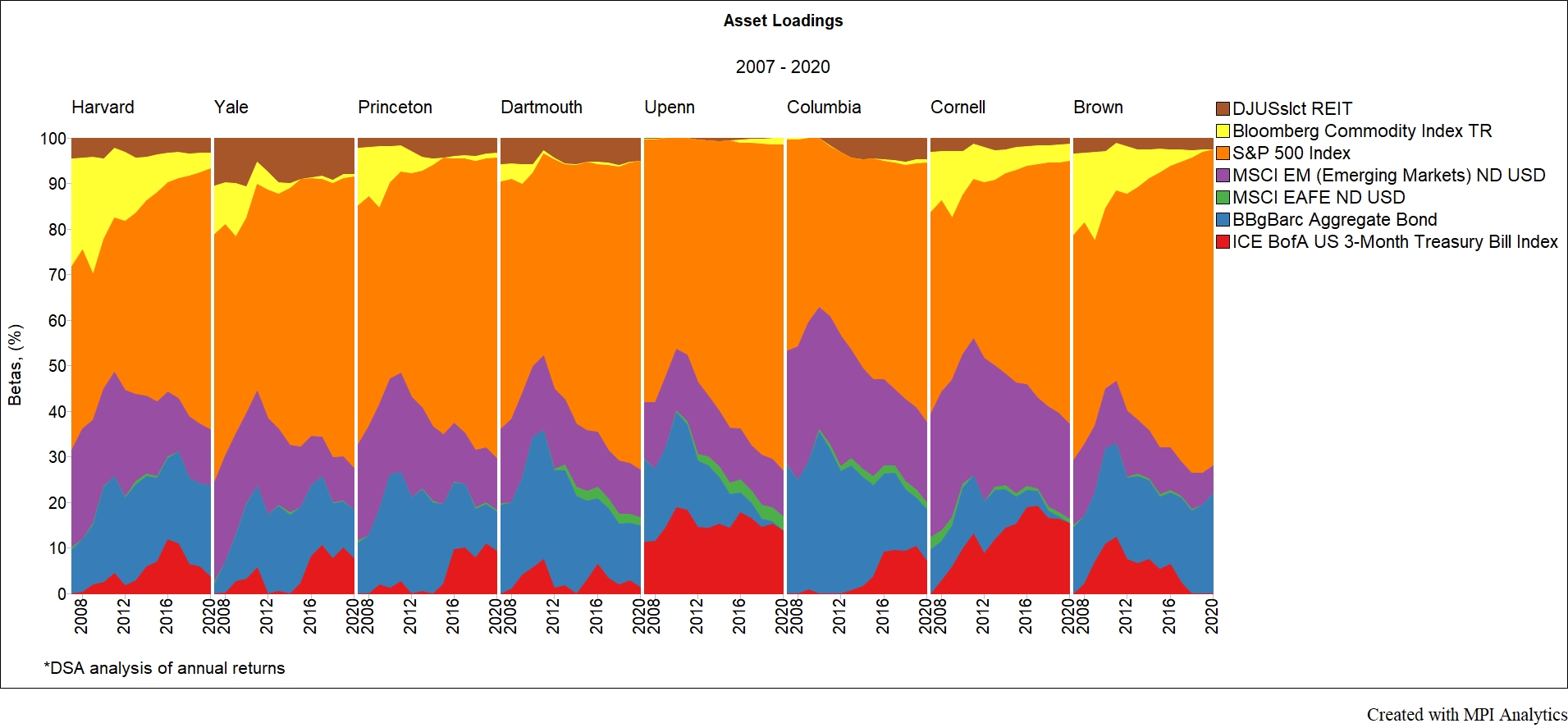

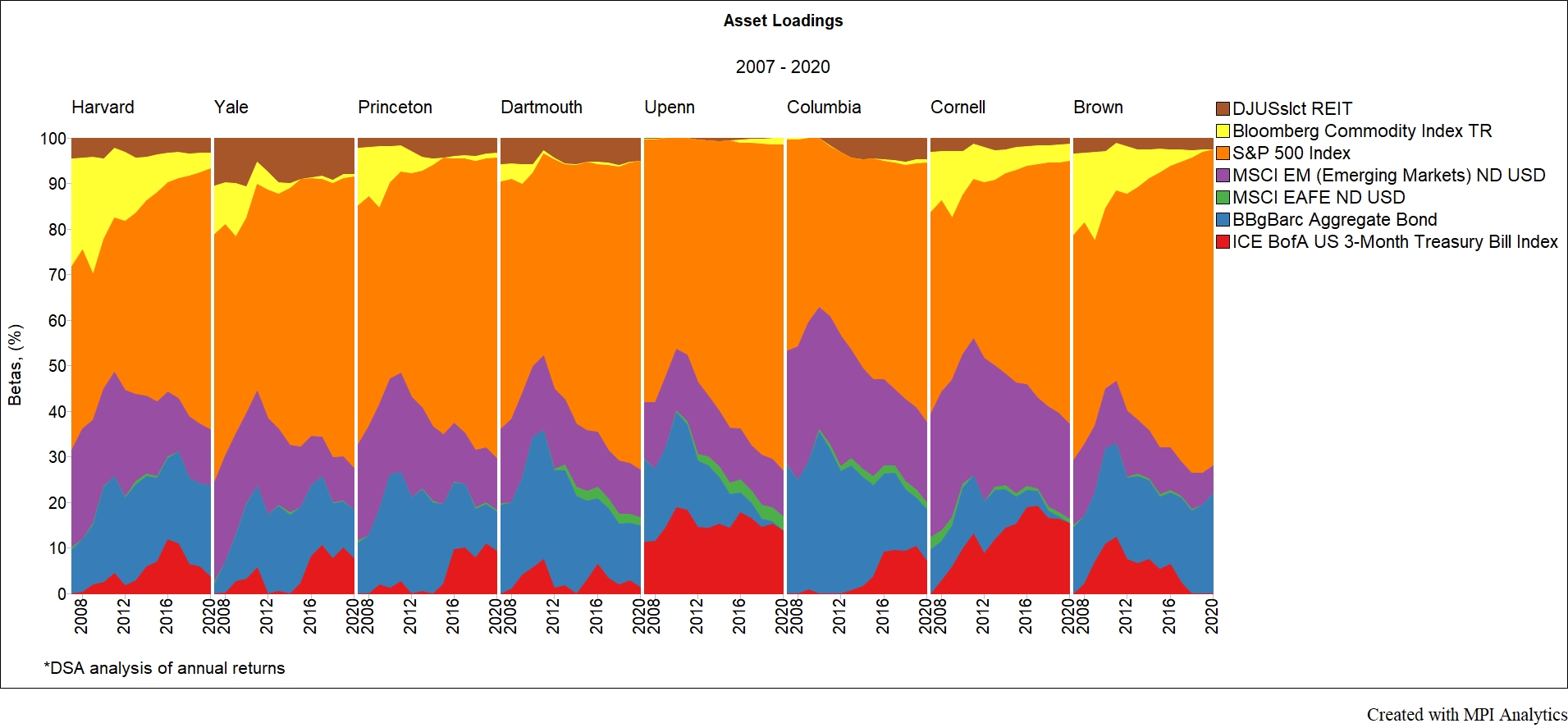

It is generally known that endowments invest in risky assets, but quantifying such risks has remained challenging due to a lack of information about returns. We set out to address this challenge and developed a new basis for estimating endowment risks.

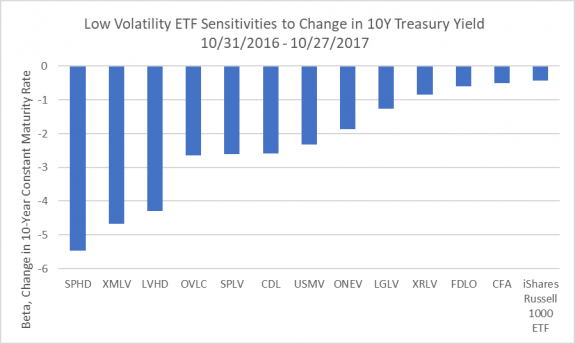

Investors have a tendency to downplay interest rate sensitivity as a factor influencing equity products, with the assumption being that its effect must be negligible at most. One of a handful of exceptions to that assumption, however, is concern over the rate sensitivity of low volatility “smart beta” funds.

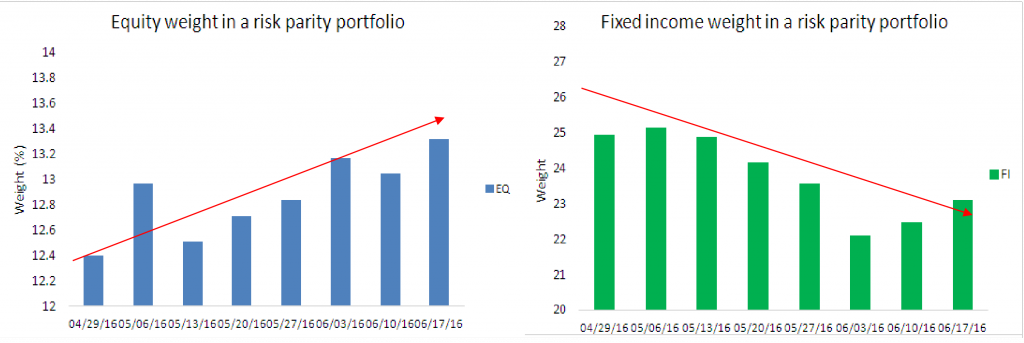

This white paper looks at the period of the increased volatility in the financial markets leading up to and on November 8th and provides valuable insights into internal workings of risk parity strategies during periods of heightened volatility.

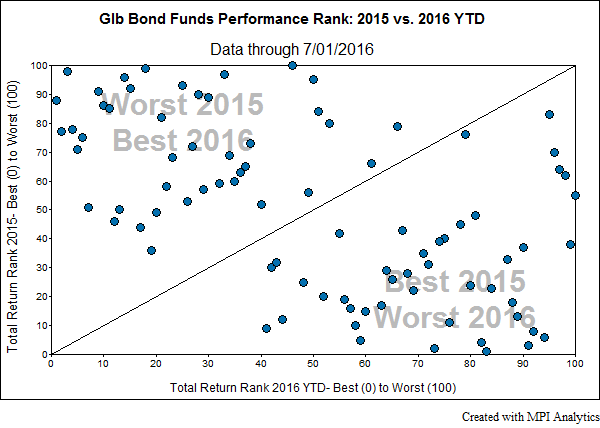

In the winter of 2015, an almost unheard of situation happened. A mutual fund, normally required to guarantee daily liquidity, blocked its clients from withdrawing money. The Third Ave Focused Credit Fund (TFCIX), citing losses and a lack of liquidity in the high yield bond market, put some of its assets into a trust to be sold over time.

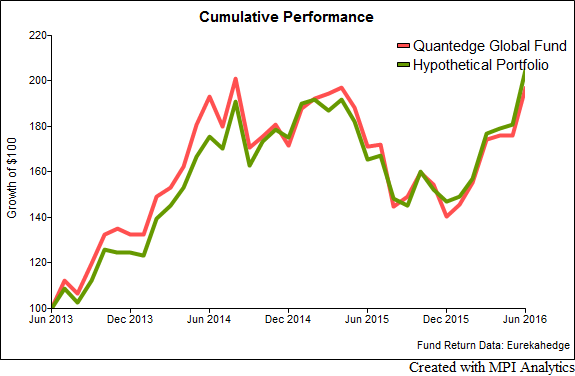

A July 20th WSJ article featured Quantedge Capital, a quantitative global macro hedge fund manager that gained 40% after fees year-to-date through June. We provide a quantitative insight into potential sources of such performance.

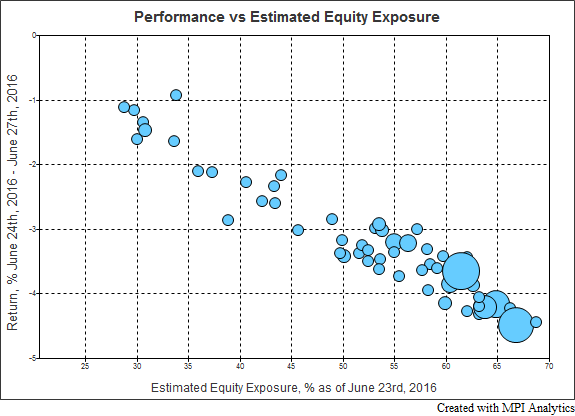

We illustrate how such an event such as “Brexit” could be (a) used as a litmus test to reconcile TDF information with performance results; and (b) alert to suitability of the selected investment option.

Risk parity strategies hold the promise of smooth sailing through periods of market turbulence, offering consistent performance via risk diversification. However, during Brexit the losses they experienced were very high by historical standards as they came very close to exceeding, or exceeded, the 95% worst outcome as estimated by the historical VaR.