An analysis of the third mystery fund linked to both Archegos and the Allianz Structured Alpha funds’ meltdowns hints at the need for efficient and scalable top-down counterparty risk surveillance and monitoring for banks and investors.

An analysis of the third mystery fund linked to both Archegos and the Allianz Structured Alpha funds’ meltdowns hints at the need for efficient and scalable top-down counterparty risk surveillance and monitoring for banks and investors.

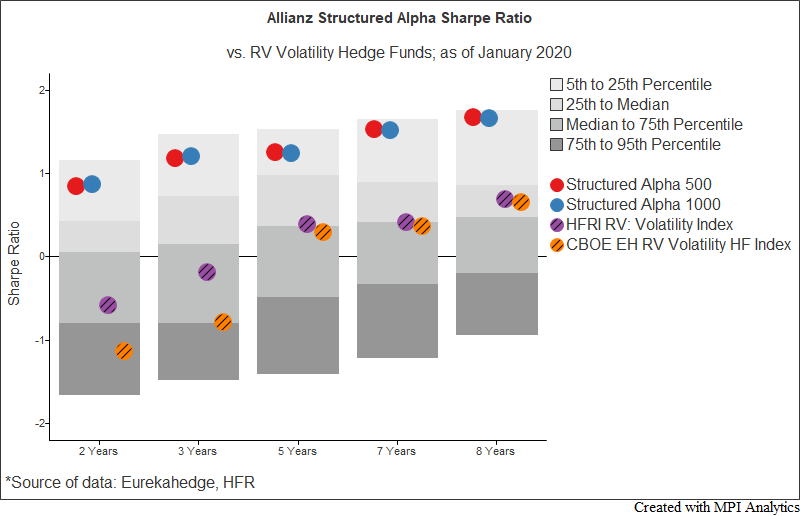

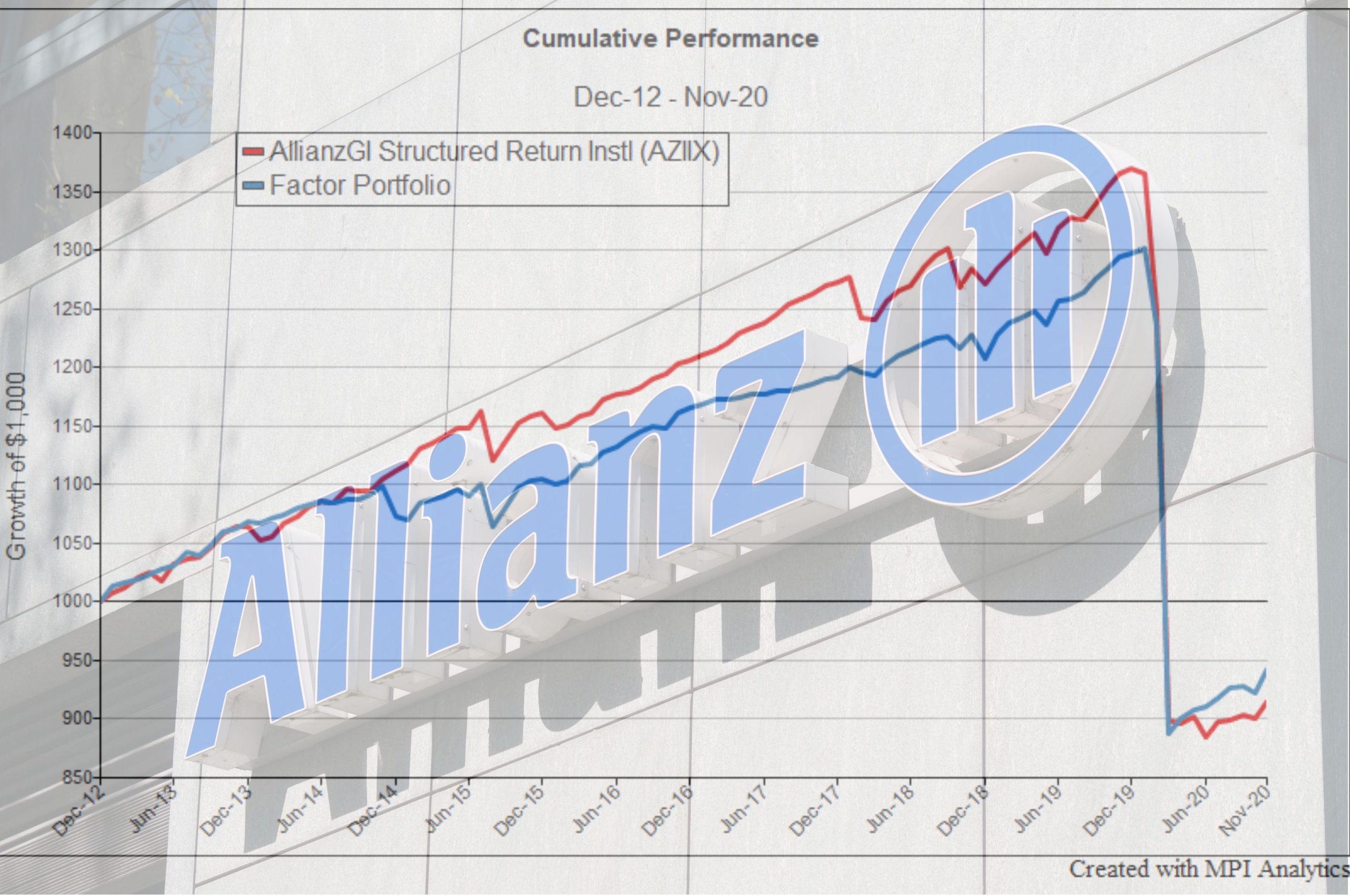

We argue that Sharpe Ratios could be hugely deceiving for derivative strategies – especially if they are in an outlier category as it was the case for the Allianz Structured Alpha funds.

We use Allianz Structured Alpha hedge fund as an illustration to demonstrate how investors could apply quantitative techniques to assess potential risks of complex volatility strategies.