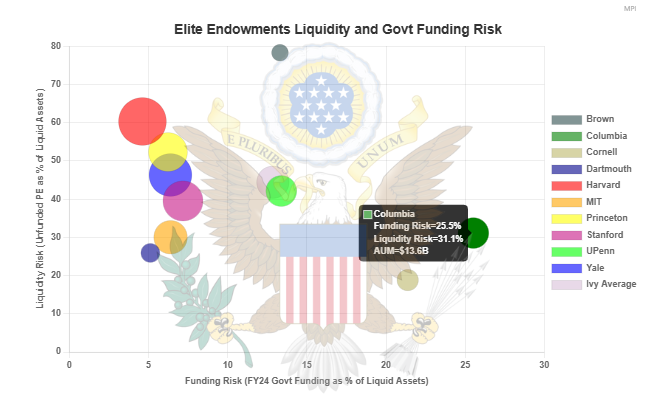

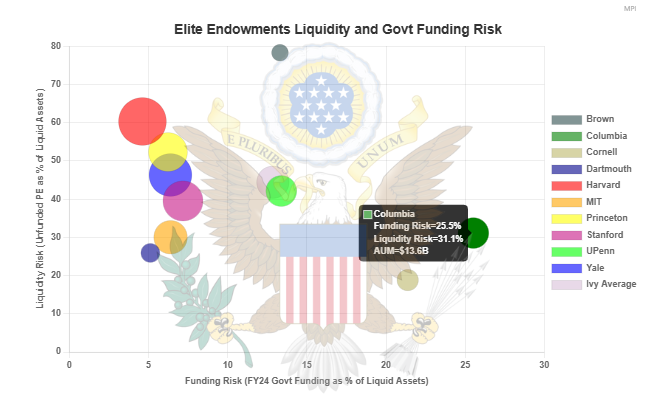

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

Federal funding cuts could impose significant financial strain on elite universities. One key factor in determining a university’s resilience to such funding disruptions is the liquidity of its endowment.

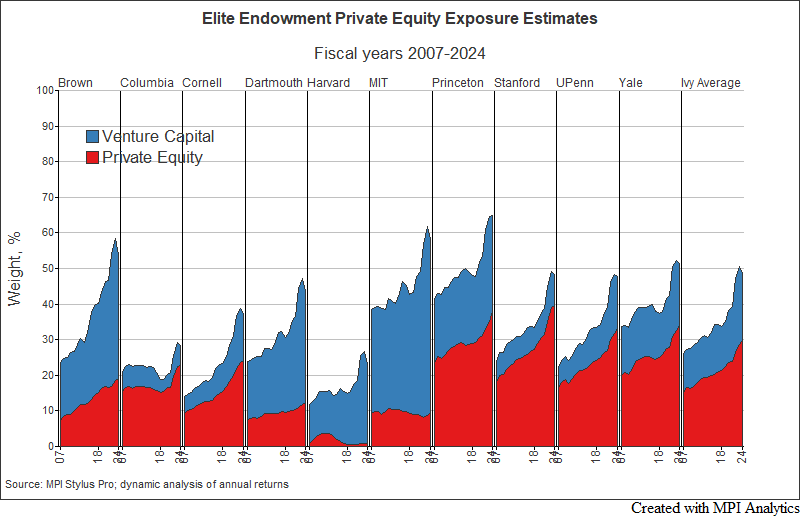

Ivy endowment Fiscal 2024 in review: risks; VC; long-term vs recent years; prospects of Yale Model.

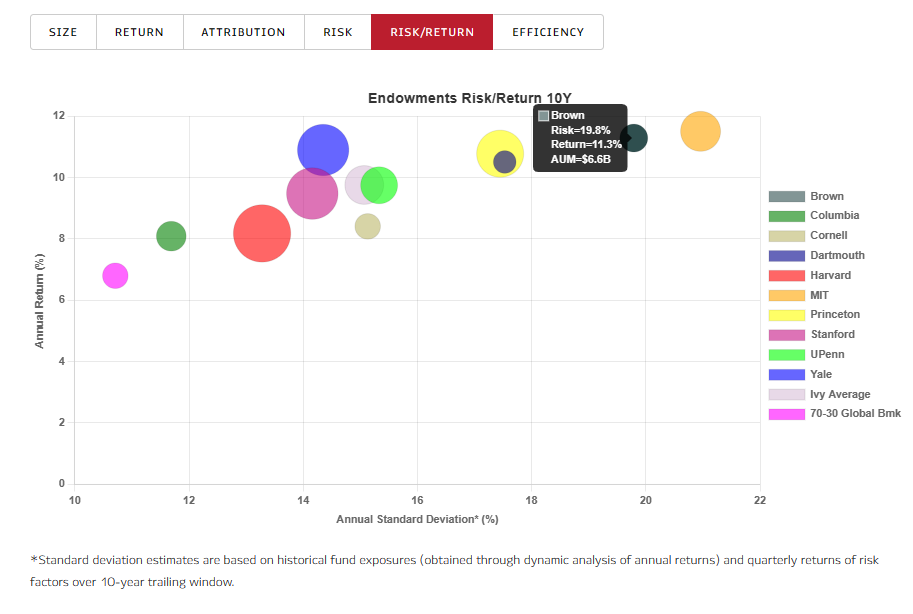

Ivy and elite endowments did poorly in fiscal year 2023, especially relative to a global 70/30 benchmark and smaller, less resourced endowments that invest in less private markets assets/funds than those employing the ‘Yale model’.

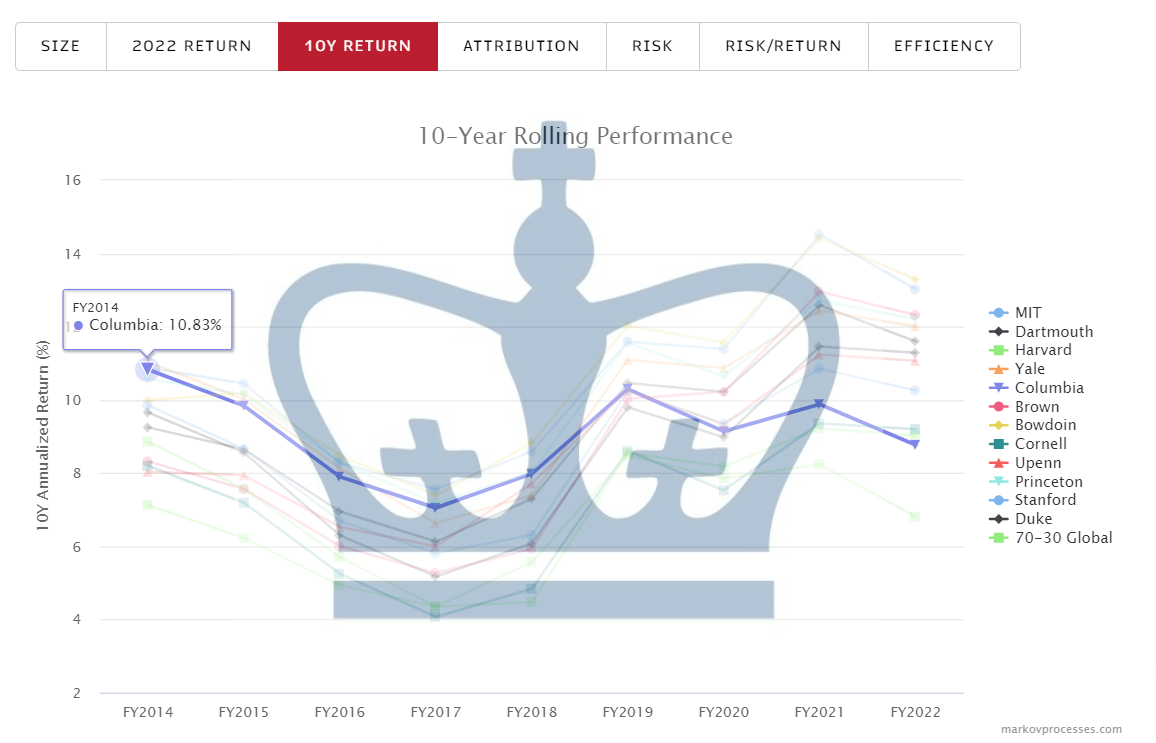

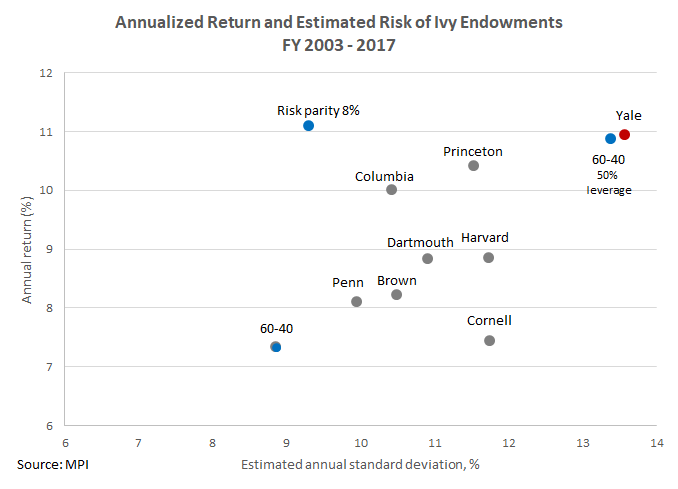

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

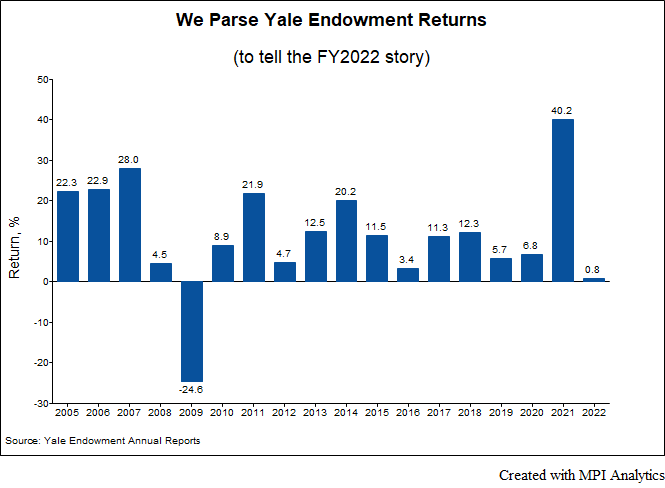

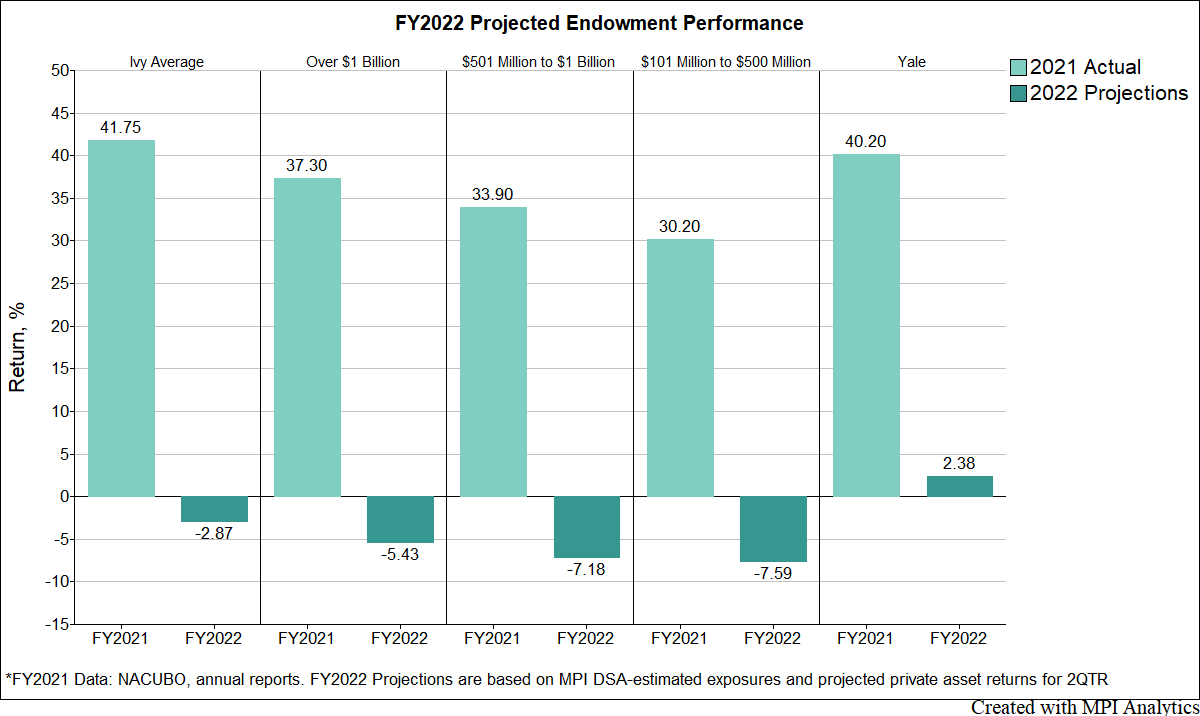

Yale’s been cutting private equity and real estate for years to stay liquid. Did they cut too much, or did they find the right balance for FY2022?

We embarked on a project to estimate 2022 FY performance for Ivies and major US university endowments… weeks before official reports become available.

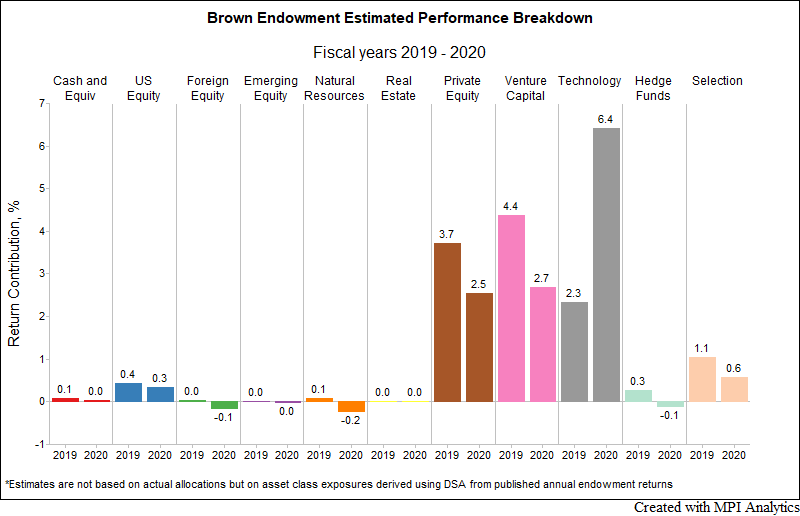

For the second straight year, Brown outperformed all other Ivy endowments by a large margin. Our research team, using MPI Stylus Pro to dissect the endowment annual returns, provides a plausible explanation of the endowment’s spectacular results.

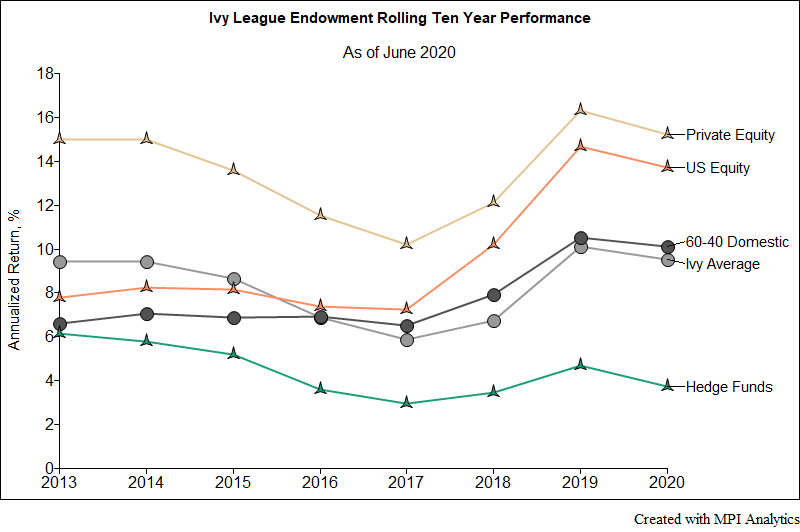

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

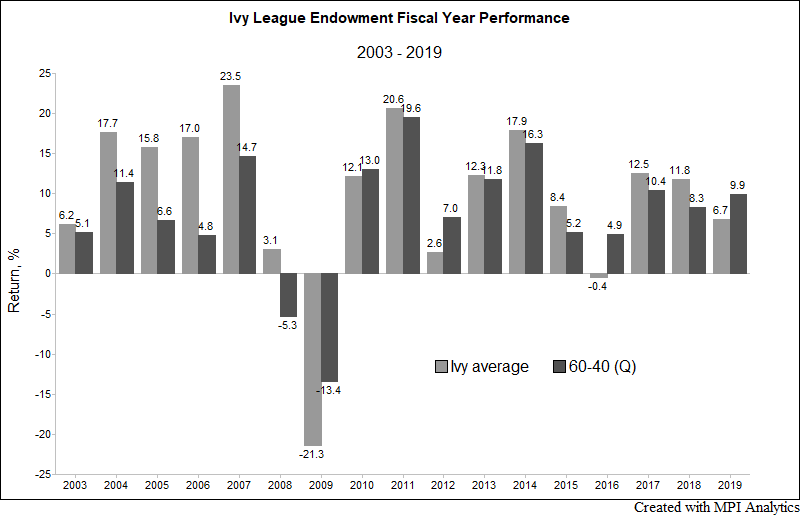

The grades for all the Ivy League endowments are in – and they are rather disappointing. Save for Brown, all Ivies underperformed the 9.9% return of a domestic 60-40 portfolio in fiscal year 2019. The Ivy average in FY 2019 was 6.7%, significantly underperforming the 60-40 and reversing two years in which they outperformed the traditional domestic benchmark.

2017 Yale endowment report rebuts Warren Buffett’s 2016 Berkshire Hathaway investor letter that “financial ‘elites’”, including endowments, are better off investing in low fee index products and not “wasting” money on active managers’ hefty fees. We did our own calculations and here’s what we found…